Over the 40 years through 2021, Chief Financial Officers (CFOs) became hyper-focused on rewarding shareholders with stock buybacks, dividends, and mergers and acquisitions, often financed with debt. This period was one of declining interest rates, culminating in near-zero government bond yields during the COVID-19 pandemic. Now, after the Federal Reserve raised the federal funds rate by over five percentage points in 16 months, CFOs are increasingly focused on deleveraging, debt repayment, and bond buybacks. This sea change in capital allocation is a material—and underappreciated—tailwind for corporate credit.

As Borrowing Costs Increase, Leverage Targets Decrease

As borrowing costs increase, CFOs should lower their leverage targets to maintain the same coverage of interest and other fixed obligations. Reconfiguring leverage targets is most pressing for companies that rely on unhedged floating-rate debt or if cash generation is under pressure, which is what we have seen. When the fundamentals of a leveraged company disappoint, CFOs have, in many cases, been directing all free cash flow to debt reduction. They may also sell noncore or even core assets to accelerate debt reduction.

CFOs also can get creative to borrow at lower interest rates. For instance, they can issue secured debt in the high yield or asset-backed markets. Or, if they are willing to give up some equity upside, they can borrow in the convertible market at interest rates similar to the low rates for unsecured bonds in 2020 and 2021.

The high yield market currently has two advantages compared to leveraged loans and private credit. First, high yield bonds are typically fixed-rate obligations, the vast majority of which were issued at low interest rates and extended maturities in 2020 and 2021. In contrast, leveraged loans and private credit are floating-rate obligations, often unhedged, that have already increased by the full 5%+ increase in front-end interest rates.

Second, fixed-rate high yield bonds issued in a lower interest rate environment are trading at low dollar prices even if credit quality has been stable or improving. This phenomenon is also prevalent in the investment grade corporate bond market. CFOs can tender for low dollar price bonds or buy them back in the open market, allowing them to reduce one dollar’s worth of debt for less than one dollar. This opportunity can also result in an upside surprise for the investor. Low dollar price bonds may also be taken out at 100 cents on the dollar or more if the company is acquired. With the high yield market trading below 90 cents on the dollar for the last 15 months or more, there are unusual opportunities for upside surprises in higher-quality bonds.

For companies that issue loans, bonds, and/or equity that are marked-to-market, the financial markets have been ruthless when a leveraged company disappoints on the fundamentals. It is important for active managers to avoid situations where a company cannot generate the cash or asset value to address their holdings. But there are also select opportunities if the markets are too pessimistic about a company that has disappointed on the fundamentals. Again, when CFOs have access to capital, and they are prioritizing bondholders, that is a favorable dynamic for bondholders. Even equity holders will support this dynamic as the equity valuation suffers when the cost of incremental debt is too high.

Supply-Demand Is a Huge Positive in the High Yield Market

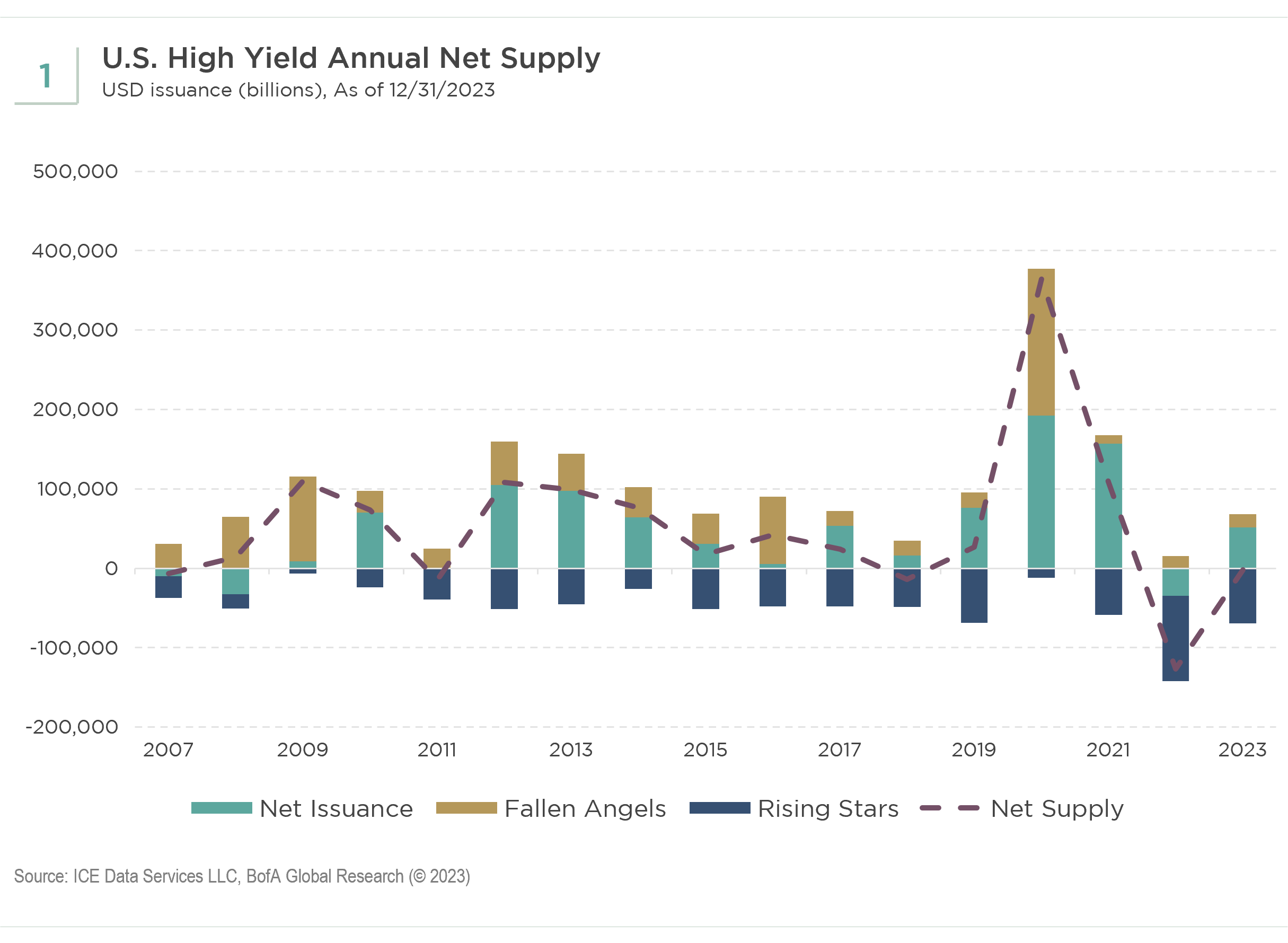

The change in capital allocation priority has resulted in muted debt issuance by more leveraged companies. In turn, this reduced supply has resulted in a very favorable supply-demand dynamic for investors in high yield bonds in particular. Exhibit 1 shows the supply of high yield bonds by year, subtracting refinancings and rising stars, which are bonds that have been upgraded to investment grade, and adding fallen angels, bonds that have been downgraded to high yield. Looking at this data going back to the Global Financial Crisis, we have seen nothing like the two years of negative net supply in 2022-2023.

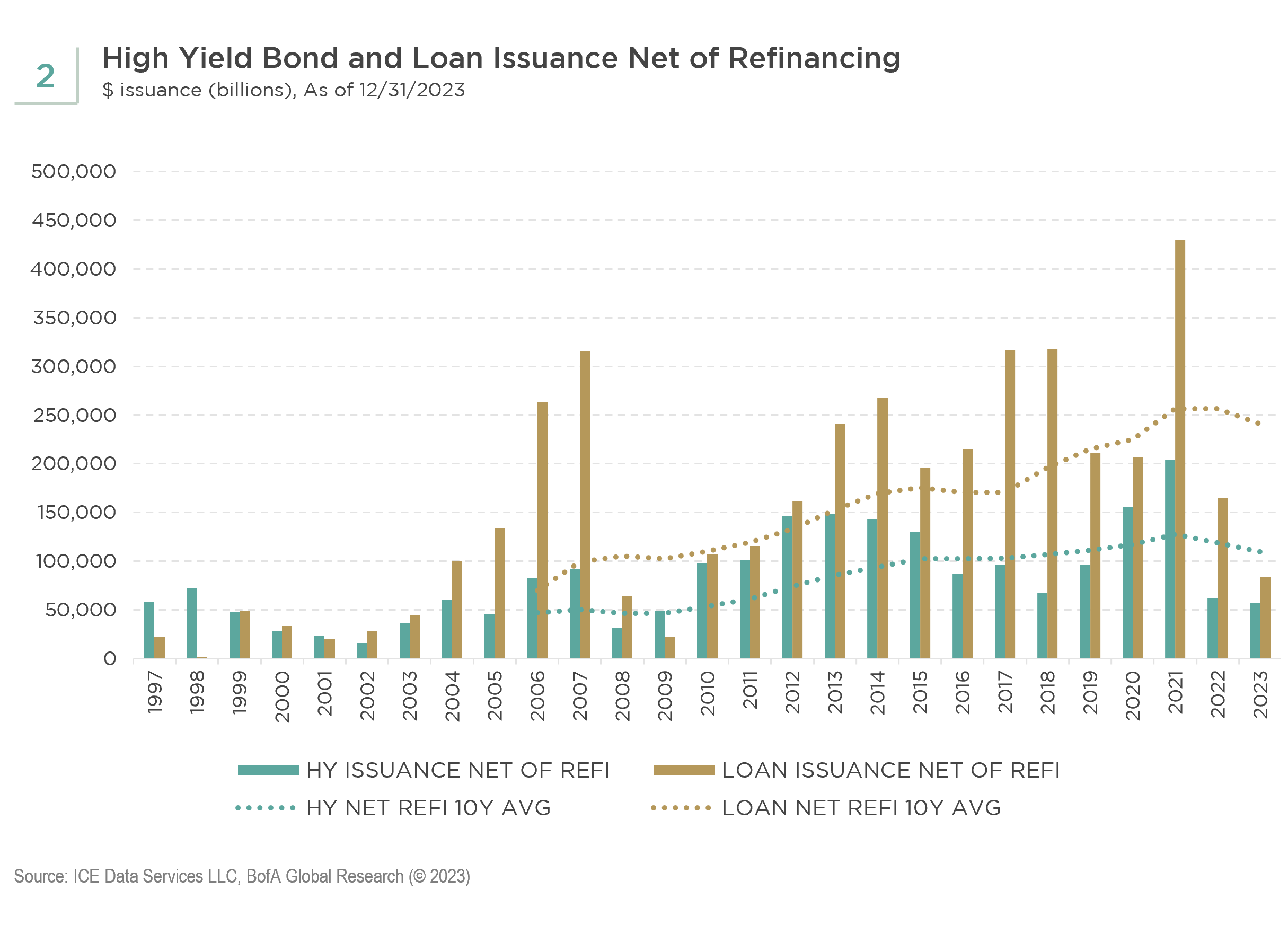

Exhibit 2 shows net issuance by year for leveraged loans and, for comparison, high yield bonds. Although not as extreme as the positive technical for high yield bonds, we also see muted issuance in leveraged loans, especially in 2023.

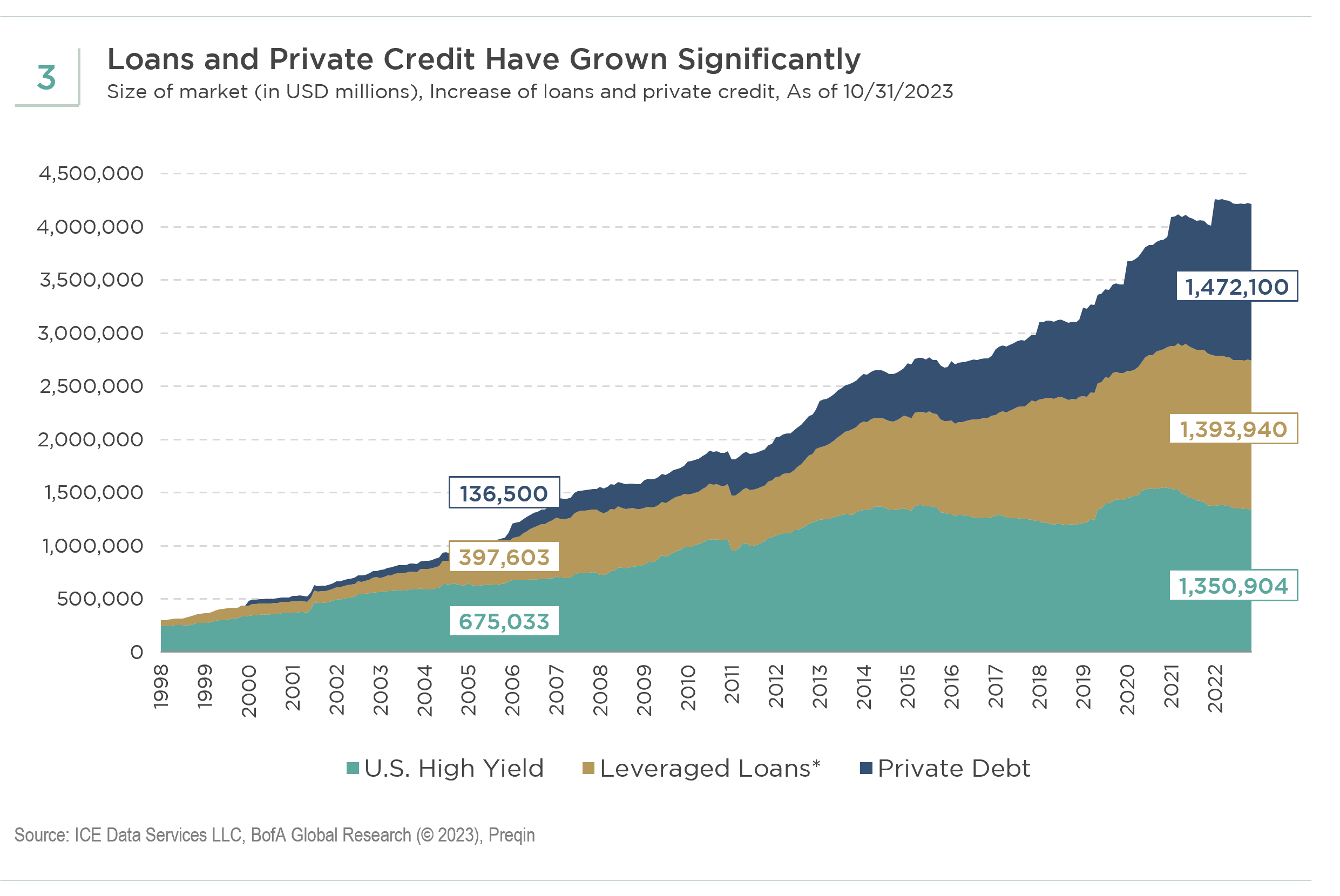

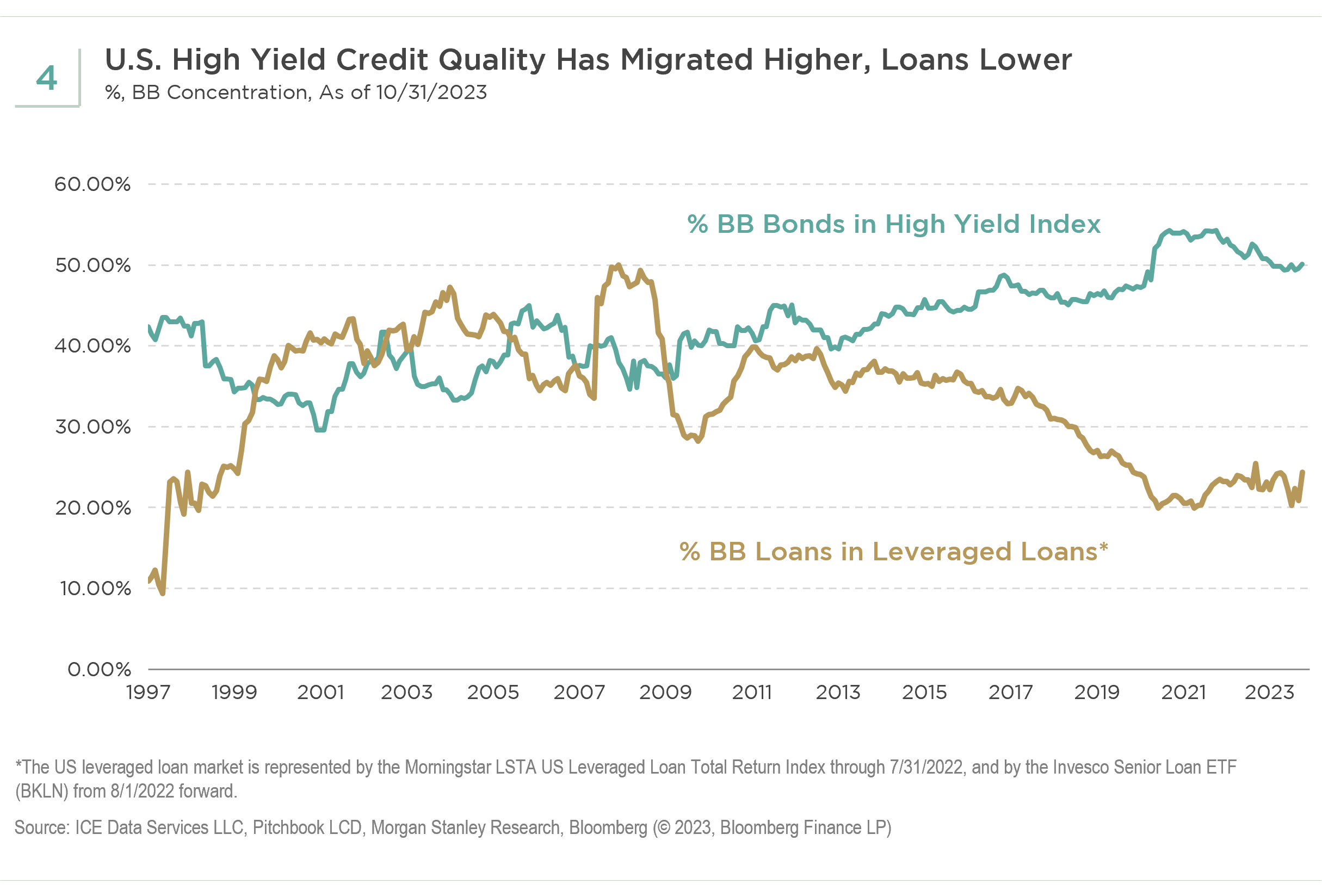

Exhibit 2 also shows the growth of leveraged loans relative to high yield bonds since 2013. Exhibit 3 shows the even more dramatic growth of private credit in recent years. In contrast, the size of the high yield market has been relatively stable over the last decade. This is a technical characteristic of the market that favors the credit quality of the high yield market. As investors committed more capital to leveraged loans and then to private credit, increasingly speculative borrowers materialized to use that capital. Exhibit 4 illustrates that the credit quality of the high yield market has migrated higher over time while the credit quality of the leveraged loan market has migrated lower.

We Choose CFOs over Politicians

The change in capital allocation priority in the CFO suite and the muted supply of leveraged credit stand in stark contrast to the political dysfunction in Washington, D.C. While CFOs have been prudently adapting to higher interest rates for well over one year, we are likely to see irresponsible record Treasury issuance in coming months. Instead, we choose CFOs and the high absolute yields, low dollar prices, and reasonable credit spreads in select high yield and investment grade corporate bonds.

Index Definitions

The ICE BofA US High Yield Index tracks the performance of USD-denominated below investment grade corporate debt publicly issued in the major domestic markets.

The ICE BofA US High Yield BB Index is a subset of the ICE BofA US High Yield Index tracking the performance of US dollar-denominated below investment grade-rated corporate debt publicly issued in the US domestic market. This subset includes all securities with a given investment grade rating BB.

The Morningstar LSTA US Leveraged Loan Total Return Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF