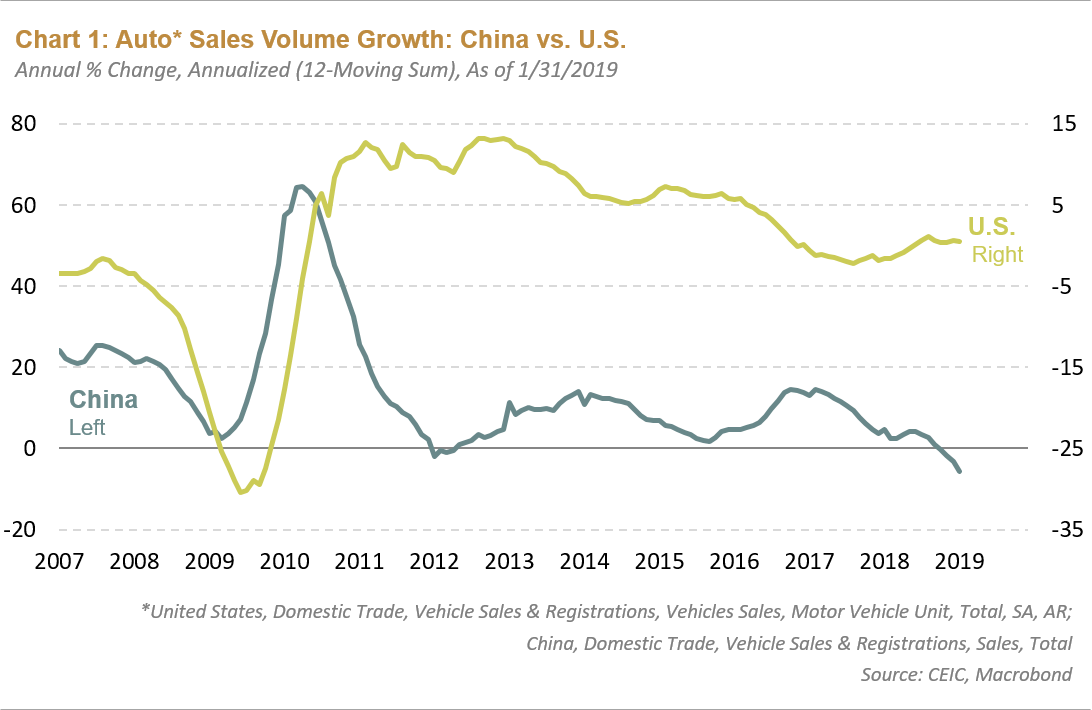

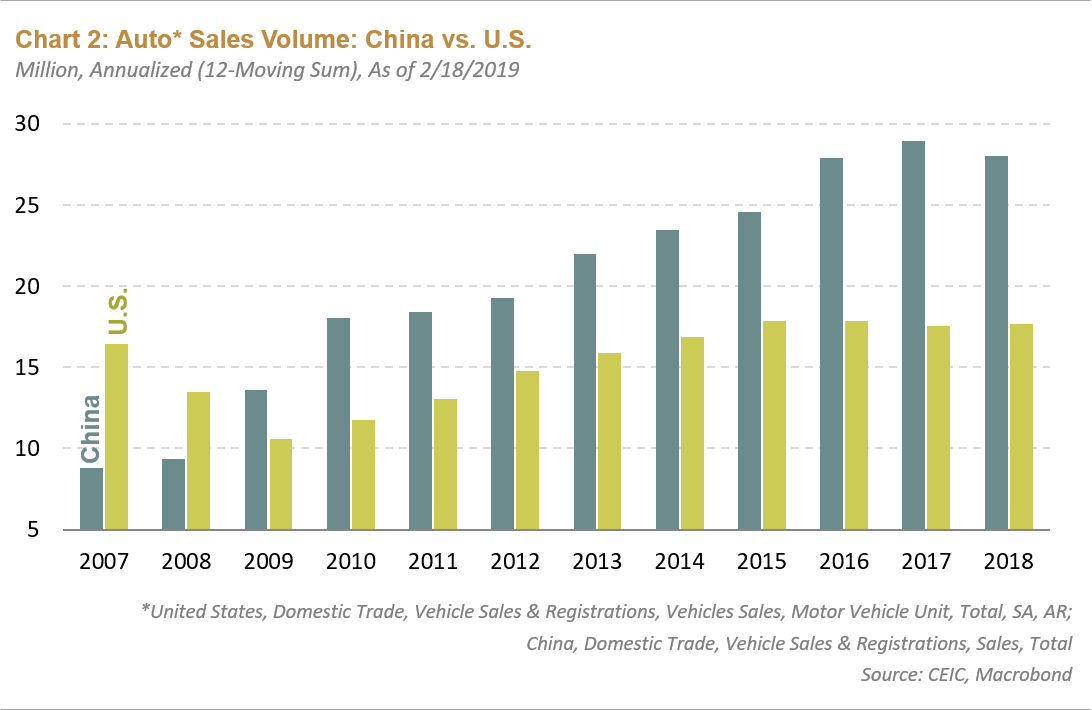

China’s Auto Market Becomes the Largest in the World

In terms of car ownership, China overtook the U.S. to become the largest new car market in 2009, with the largest fleet of 240 million cars in 2018. In terms of market penetration, the U.S. has 910 cars per 1,000 people, whereas China only has 171 cars per 1,000 people, so China is still far from being a saturated market yet.

In terms of production, since 2009, the annual auto production in China has exceeded that of the European Union or the U.S. and Japan combined. In 2018, a third of the world's cars were manufactured in China, totaling 28 million, out of the total global production of 98 million. China is also a huge consumer of passenger cars, with annual sales exceeding that of the U.S.

The Macro Drivers behind the Slowdown

The escalation of the U.S.-China trade tensions has had a strong impact on auto buyer confidence and discretionary spending:

- Tariffs: China announced a reduction of import tariffs for cars and parts in April 2018, which triggered a “wait and see” strategy for potential car buyers as they could buy at a lower price if tariffs were actually cut.

- Local Stock Markets: The equity selloff also created headwind for auto demand in China. The sharp selloff in the A-share market was caused by the intensifying trade war in the second half of 2018. Weakness in the equity market was further compounded by the slowing Chinese economy.

- Housing Markets: Property prices in lower-tier cities rose in 2018 given the increase shantytown developments; however the result was weaker affordability due to lower income levels in lower-tier cities

These factors above are the main engines of much weaker car demand for mainland and mid-to-high brands, though demand for luxury brands is more resilient. Geographically, the weakness in the car market seems more concentrated in lower-tier cities.

Industry-Specific Cyclical Drivers

Property Prices and Taxes

In 2015-17, the major cyclical drivers behind the domestic auto industry were rising property sales and the purchase tax cuts on vehicles with small engines, which brought forward at least 3.2 million units of purchases into 2016-17, and propped up car prices in 2018 (Source: Citigroup). The combined effects of these drivers mostly benefited mainland brands and mid-to-high-end brands. In 2018, the purchase tax was normalized back to 10%, versus 7.5% in 2017, and 5% in 2016 and late 2015. Therefore, the front-loading of demand reversed in 2018. In addition, as the Chinese government tightens the cash reimbursement of shantytown developments in 2018, Citigroup estimated that the cuts in shantytown payouts will potentially remove another 3.5 million units of auto demand from 2017 through the first quarter of this year. Mainland brands and mid-to-high-end brands will split the pay-back. Both negative effects may come to an end in 2Q19.

Widespread Financial Deleveraging

The cooling of auto sales also coincides with financial deleveraging in China, which has led to tighter liquidity and credit tightening, which should squeeze consumer discretionary spending. However, the drag on car sales from credit in China is less severe. According to Goldman Sachs research, only about 40% of annual auto retail sales are financed, a penetration rate that’s still low compared with a global average of 70%. China’s car loans are concentrated in higher-end vehicles. A majority of loans are made by carmakers’ captive finance companies. The delinquency rate was around 0.1%. Chinese auto-financing products tend to have lower loan-to-value ratios and shorter terms than in other mature markets, indicating a lower default probability. Another dampening factor on sales came from a crackdown on peer-to-peer lending, which funded 10% of vehicle purchases in China’s smaller cities. Therefore, auto loans aren’t necessarily a major factor in the health of the overall industry.

Peak Demand for Sport Utility Vehicles (SUVs)

Sales for SUVs are no longer a growth engine in China. Based on JP Morgan data, China’s SUV penetration reached 44% as of December 2018, much higher than the peak level of 37% of other markets such as South Korea, Taiwan, and the U.S. Therefore, SUVs probably have reached the saturation point in China and will no longer grow as fast as sales have in the past several years.

Four Structural Factors within the Auto Industry

These four factors will continue to pose additional headwinds to new demand for internal combustion engine cars in China.

- Used Car Market: The used-car market rapidly increased in size after the government removed regulations that previously banned used cars sold in one city from being driven in another. A decade ago, China’s used-car market barely existed, but today, the ratio of used car sales to new car sales is 1:2. As the Chinese market matures, used cars are becoming an important part of the mix.

- Limited New Car License Plates: There has been growing popularity to limit new car license plates as a way to control traffic jams and air pollution. Beijing started the trend in 2010 with an annual quota of 240,000, which was cut to just 40,000 in 2017. So far seven other cities and one small province have implemented similar controls and more cities are likely to follow.

- New Energy Vehicles (NEVs): China already leads the world in demand for electric vehicles, with its share reaching 4.5% of total sales. The government has been subsidizing NEV manufacturers. Chinese demand for electric cars could eventually become an attractive market for foreign carmakers, but they must first retool their manufacturing process and technology and earn a foothold in the nascent market.

- Ride-Sharing Apps: One of the biggest structural challenges is the growing popularity of transformative technologies like ride-sharing apps. China’s version of Uber—Didi Chuxing—is already significantly larger with 550 million users making 11 billion rides in 2018. The structural decline in vehicle demand will only further accelerate once driverless, autonomous cars arrive around 2030. For automakers, that means declining demand and thinner margins.

Conclusion

Given the above macro, cyclical, and structural drivers behind the auto sales slowdown, we see a risk that the Chinese car market could surprise investors with more prolonged weakness in demand before it picks back up in late 2019. The extended slowdown would be a result of the combined workings of near-term cyclical forces arising from the front-loading sales of 2015-17, and longer-term structural forces of alternative transportation options for consumers, and government policies of favoring clean energies. However, there are certain segments of the auto market that will continue to enjoy high growth, such as NEVs.

Auto sales growth could stabilize in the second half of 2019 with potential stimulus policies like rural auto purchase tax cuts that could temporarily boost auto buyer confidence, better seasonal factors in the fall/winter, and the base effect. We believe a sharp rebound is unlikely though, due to the more mature nature of China’s auto industry and the retooling process of transitioning from internal combustion engines to NEV vehicles.

Therefore, we believe China’s auto market is not likely to be a shock absorber to the challenging global auto market nor will it be a star performer to reverse China’s growth slowdown in the near term. We will be watching this industry and its related drivers closely in 2019.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF