A case in point is the U.S. Its economic recovery so far has been propelled by both growth in labor input and wages, as well as the ensuing consumption growth. Now, as the U.S. is reaching full employment status, wage growth will also reach its limit. Whether the economic recovery can transition from being driven by labor, wages, and consumption to one that is investment and productivity driven will determine the U.S.’s future gross domestic product (GDP) growth potential and ultimately the Federal Reserve’s (Fed’s) equilibrium rate as well.

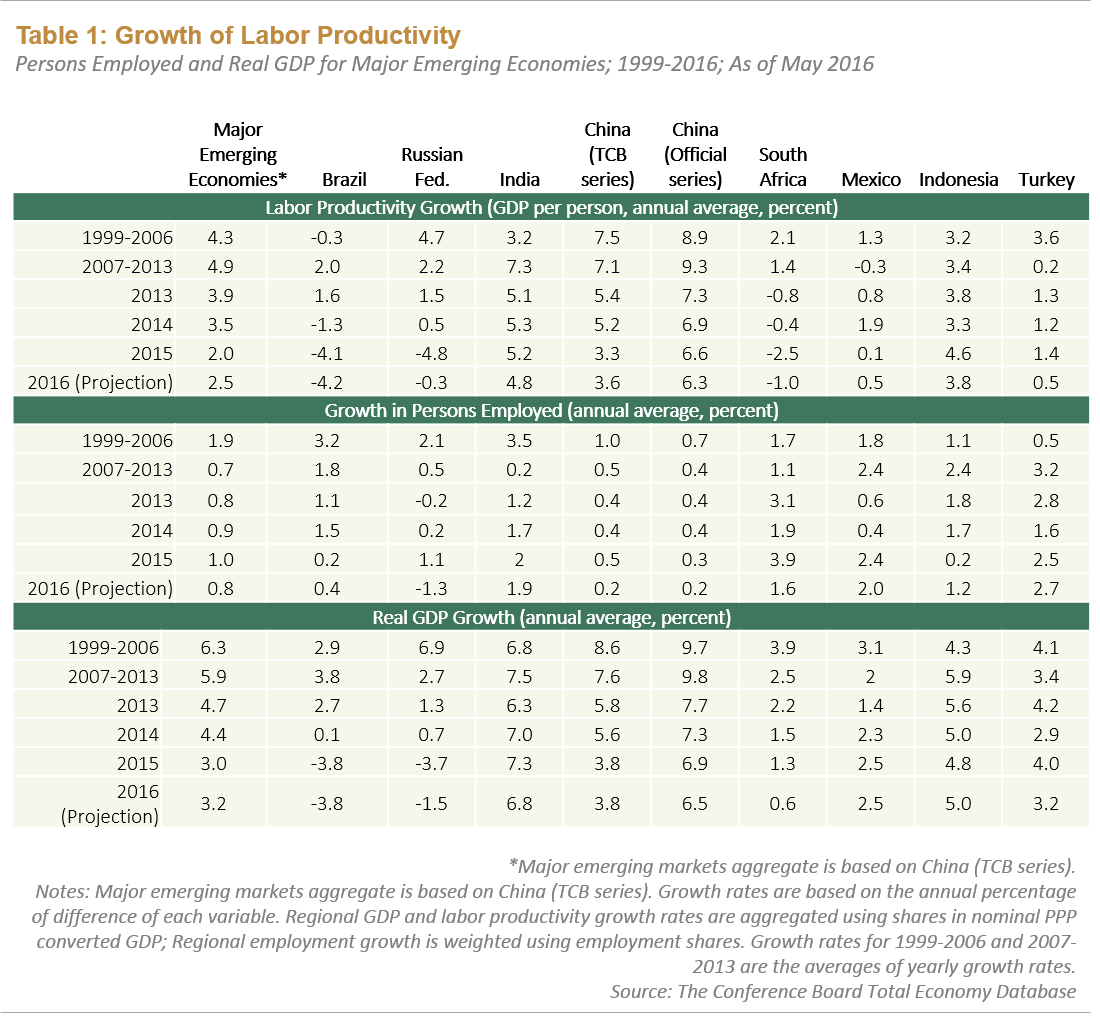

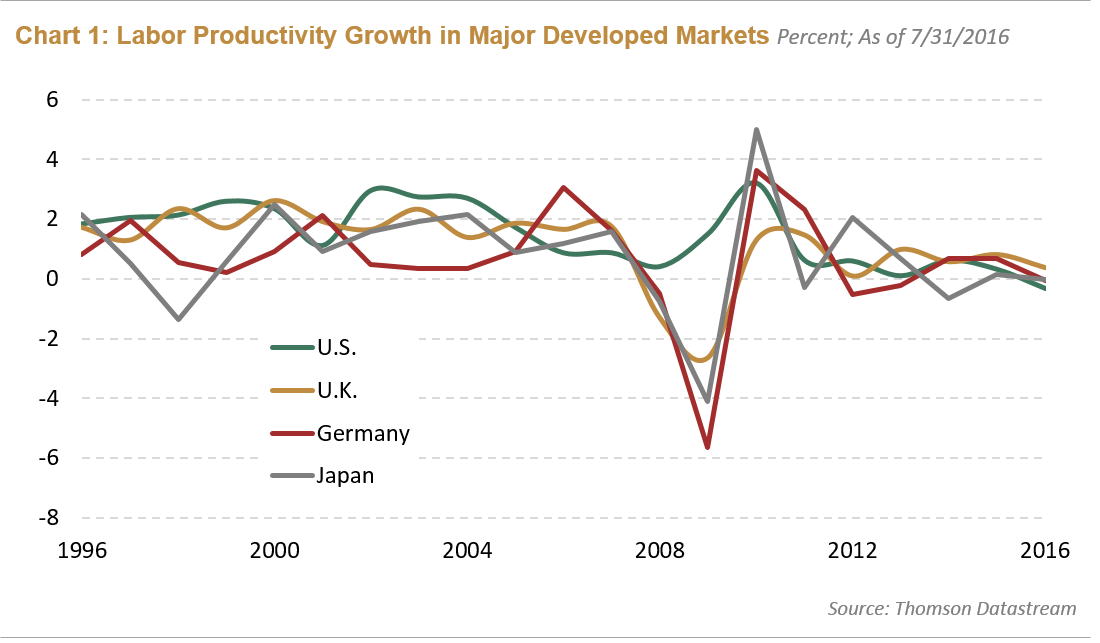

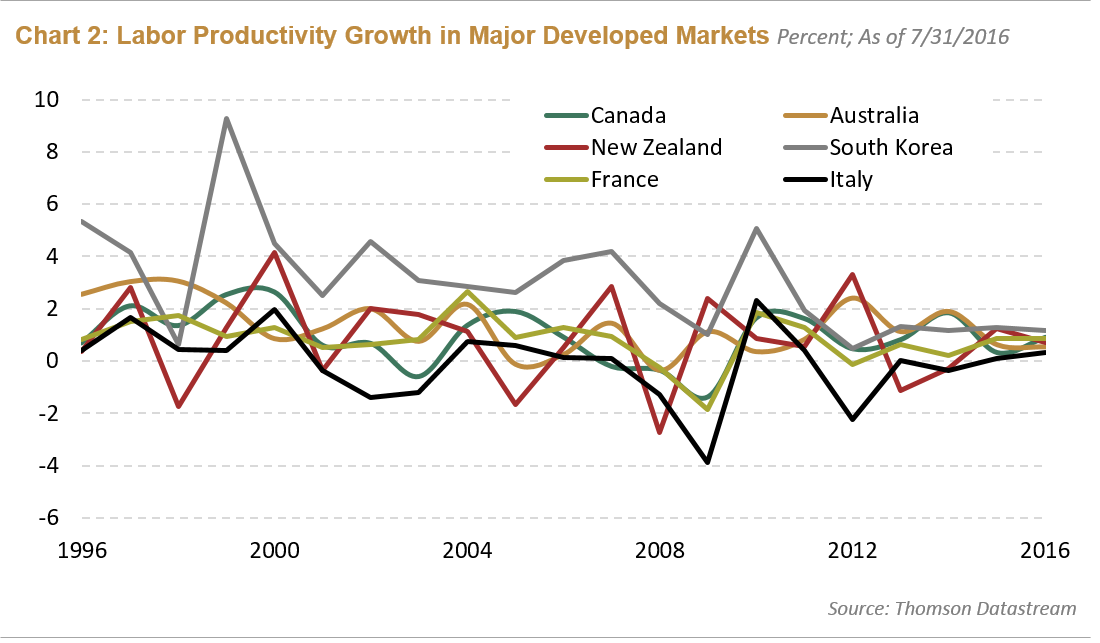

A look at trending labor productivity data paints a clearer picture of this productivity malaise across both major EM countries (see Table 1) and developed market (DM) countries (see Chart 1 and Chart 2). Our major observations are:

- Labor productivity growth has slowed in both EM and DM countries over the past several years. In EM countries, productivity growth has declined from 5% in 2007-2013 to 2% on average in 2015. In developed countries, productivity growth has slowed from 1%-2% in 2007-2013 on average to below 0.5% in 2015.

- In EM, there is more dispersion among countries. Brazil, Russia, South Africa, Mexico, and Turkey have seen the greatest drop-offs in productivity, whereas India, China, Indonesia have been relatively stable.

- Within developed nations, data is more consistent, hovering around 0.5% growth or below. Surprisingly, productivity growth has been slowest in Germany, France, and Italy.

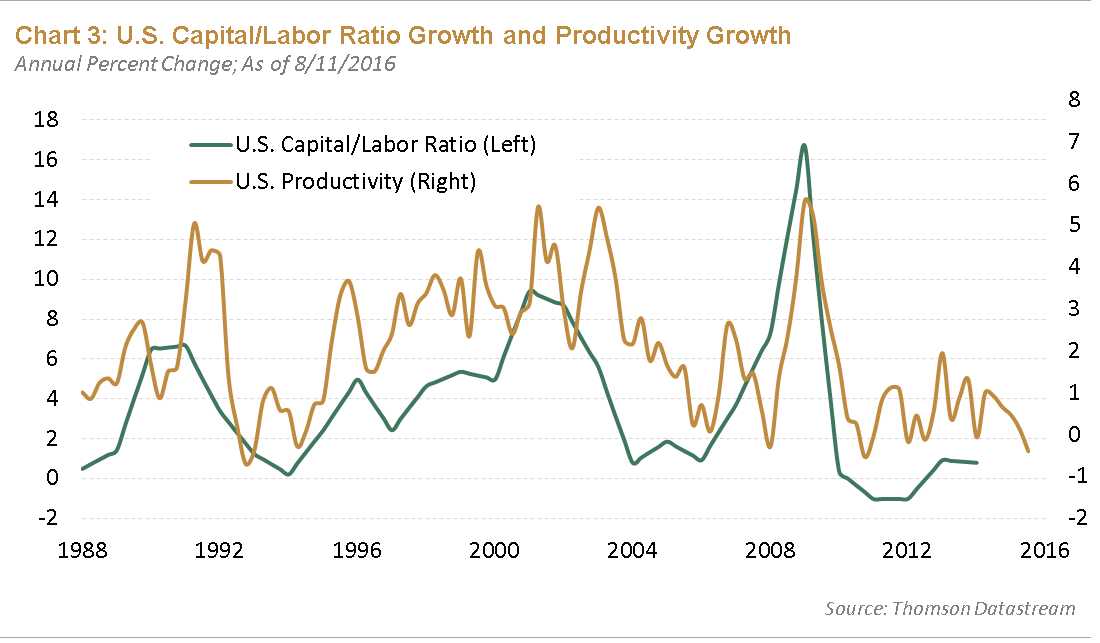

Examining this malaise to determine the investment implications and potential cures, we will use the U.S. economy again as an example. We believe the correlation between the capital/labor ratio versus productivity is the crux of the productivity slowdown issue (see Chart 3). If we label the first leg of the economic recovery since the Global Financial Crisis as between 2009 to now, we see that it has mostly been driven by recovery of labor input rather than capital input. However, the capital/labor ratio seems to be forming a bottoming pattern since 2012, and stalling a little after that. If this ratio picks up again, we believe productivity also should pick up if this relationship holds. However, given that the U.S. presidential election is drawing near in November, businesses may see too much uncertainty to commit more capital investments.

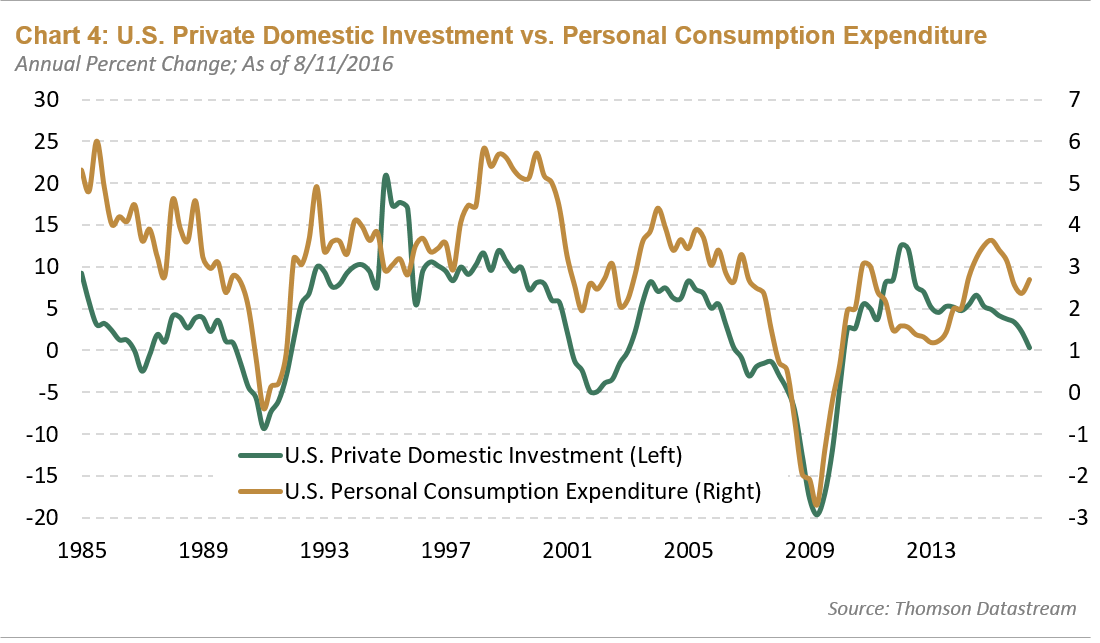

Private domestic investment growth has slowed dramatically from 10% in 2012 to 0% currently, while personal consumption spending has remained relatively more robust at 2.5% (see Chart 4). This trend also echoes the theme of the declining capital/labor ratio. As the labor market recovers, wage growth picks up, which in turn leads to personal consumption growth. In contrast, private investment has slowed, leading to a drop in capital input.

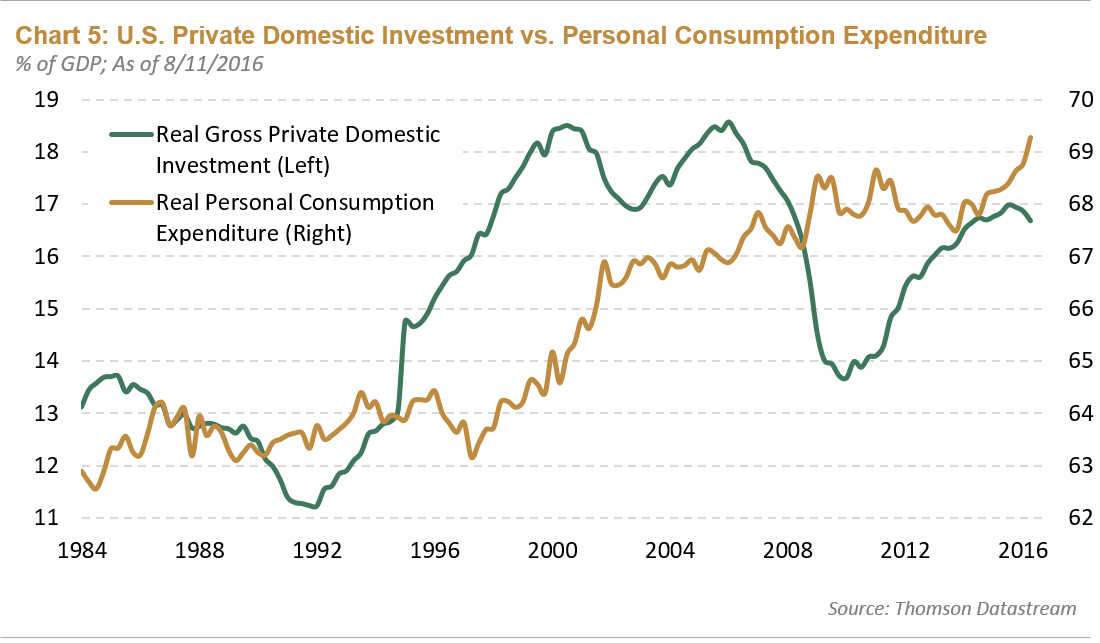

The U.S. economy is relying increasingly on consumption as a driver of GDP (see Chart 5). Personal consumption’s share of GDP is at a historical peak of 69%. Meanwhile, the share of investment, while recovered from its trough of 14% during the Global Financial Crisis, still struggles at around 16%, failing to surpass its 2000 and 2006 peaks of over 18%.

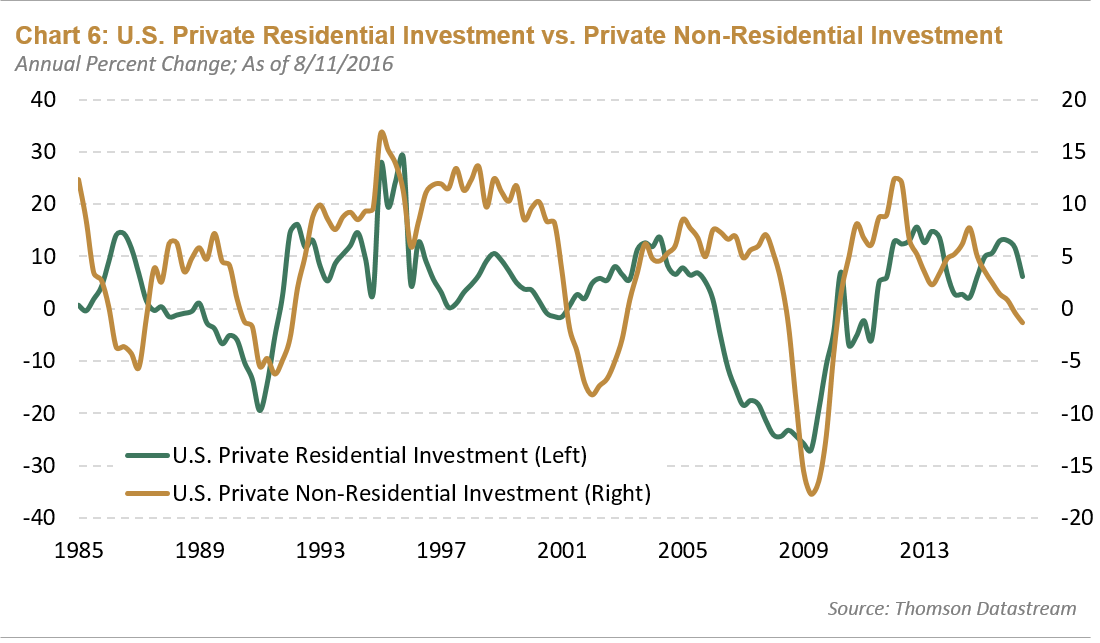

Most interestingly, non-residential private investment growth has declined more drastically to almost -1.5%, whereas residential investment growth is just over 6% (see Chart 6).

Conclusion

We believe the anemic global economic recovery has been driven by labor input and wage growth. As a result, personal consumption has picked up. However, the global economy is plagued by a slowdown in productivity growth, both in EM and developed countries, largely due to a lack of private investments. If the capital/labor ratio bottoms from here and begins to recover, productivity should also pick up, in our view. The cure for the productivity malaise would be an increase in investment spending. However, one risk to the recovery is the fact that this is a presidential election year. Businesses may be unlikely to commit to investment amid the heightened uncertainty. Given that the U.S. is nearing full employment, labor input and wage growth may reach their limits and fail to propel GDP growth further. As a result, U.S. GDP growth potential will be determined by productivity growth. If the latter cannot pick up, we contend that the economy will be stuck in this slow GDP growth environment. Subsequently, interest rates will stay lower for longer.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF