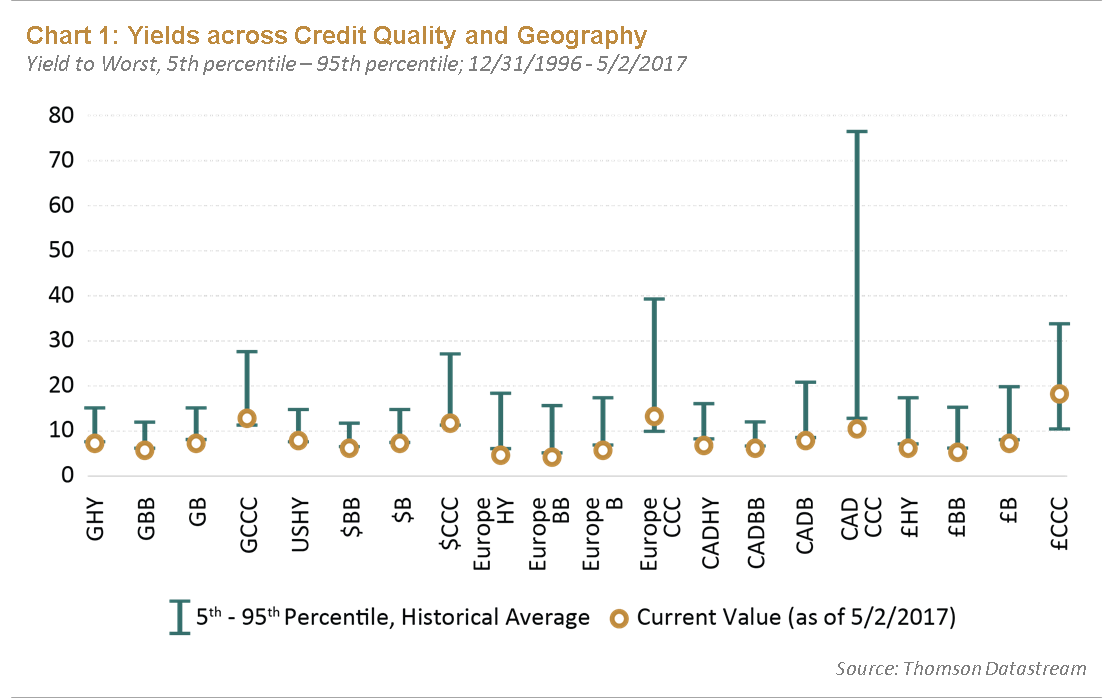

Current conditions should raise questions for investors. The U.S. economic recovery has now extended nine years without a recession. The Federal Reserve is embarking on a path toward tightening through interest rate hikes and balance sheet contraction. Inflationary pressures have increased over the last six months but more recently have moderated. Meanwhile, unemployment levels continue to trend lower. In addition, yields across credit quality and geography are at or near historical lows, reducing the cushion generated from the running yield of corporate credit that has generally been provided to fixed income investors during a default cycle (see Chart 1). More recently, default rates have begun to moderate as defaults among energy and basic material corporate credit have abated.

Before one can assess whether the current environment could exacerbate the default rate, one must first understand the different factors that trigger a default. Analyzing the credit market through the lens of a default, one would determine that a default is technically caused by:

- A breach of covenant

- A missed coupon payment

- The inability to meet the principal payment at maturity

The first potential default-triggering event—breach of covenant—is less consequential as it may be addressed via a waiver by the bond holders for a consent payment. The remaining two events are economic defaults that are more difficult to overcome. It is important to look at current conditions to gauge the probability and potential frequency of each of these types of default events.

State of the Economy Model and Predicted Default Rates

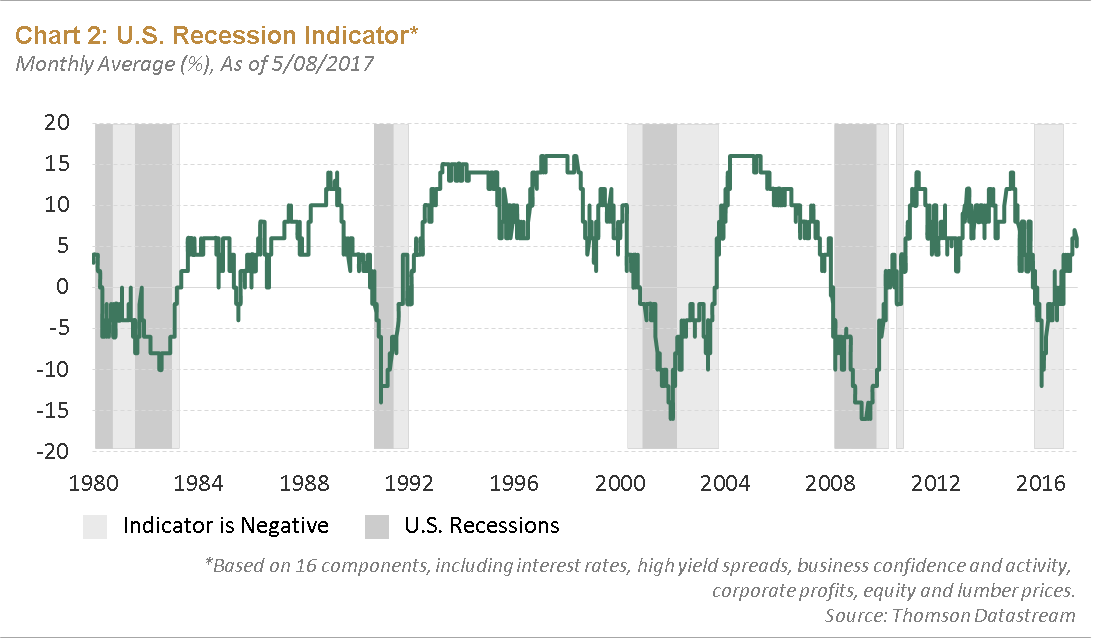

Global gross domestic product (GDP) remains supportive for risk assets as commodity prices have recently stabilized, European elections have not surprised the markets, and China continues to adjust excesses within its economy. Brandywine Global’s State of the Economy model shows a fairly benign environment after experiencing a more tumultuous 2015 (see Chart 2). Given the current macroeconomic backdrop, investor expectations for a significant increase in defaults should be tempered.

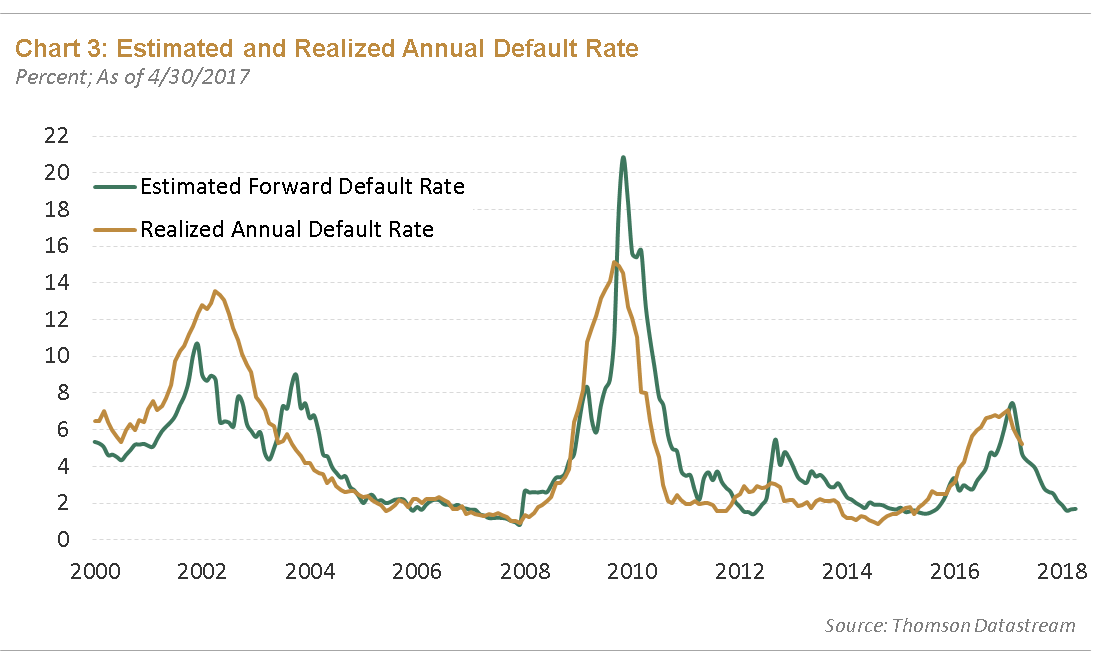

Our proprietary default model is predicting a drop in defaults for the calendar years 2017 and 2018 (see Chart 3). It is currently lower than both the consensus on Wall Street and that of the rating agency models that have been published. (Note: Our propriety default model did not adjust for coercive debt exchanges in 2009.)

Wall of Maturities

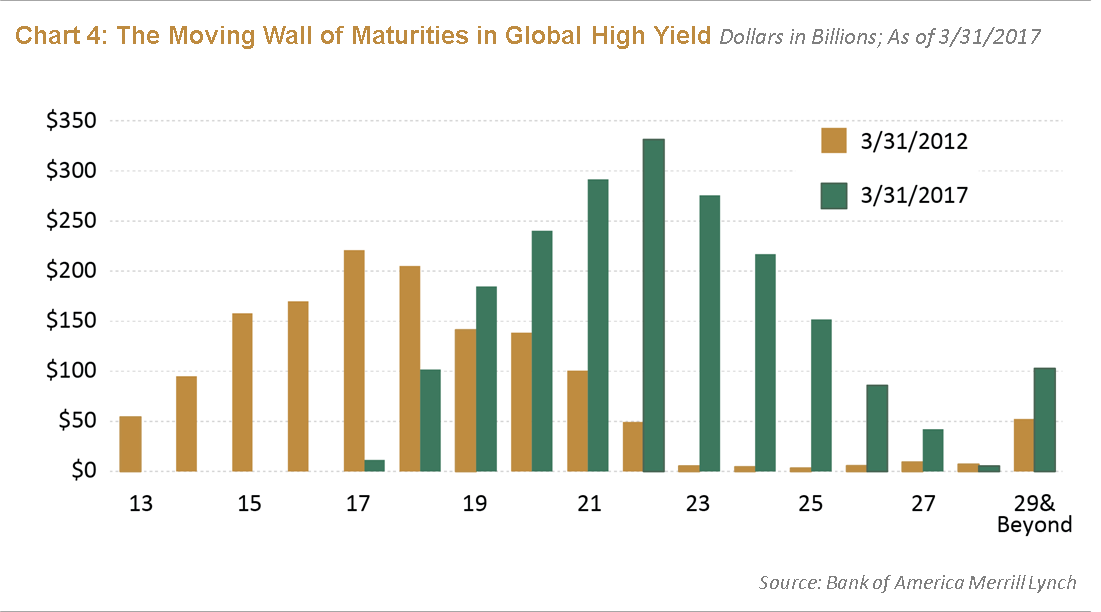

Discussions across the financial press have been focused on the “wall of maturities” that is coming due in the near future. The wall of maturities is extremely important to monitor as maturities are one of the three ways to default, as discussed above. To avoid an inability to meet the principal payment at maturity, prudent and sophisticated corporate management teams will address their capital structures when the market is open for refinancing.

The chart below highlights both the current wall of maturities and what that wall of maturities looked like in 2012 (see Chart 4). Examining the chart closely, there is very little corporate credit debt on which to default due to maturity in both 2017 and 2018. At the same time, there is an acceleration of maturities in 2019 and 2020. Based on market conditions and the level of debt maturing in the next two years, it is our belief that there is not a significant probability of a substantial increase in the default rate over this period. The salient issue is whether corporate management teams take the opportunity to refinance their capital structures over the next two years when markets are open. If this wave of refinancing occurs, it will effectively push this maturity wall from 2020-2025 out to 2026 and beyond.

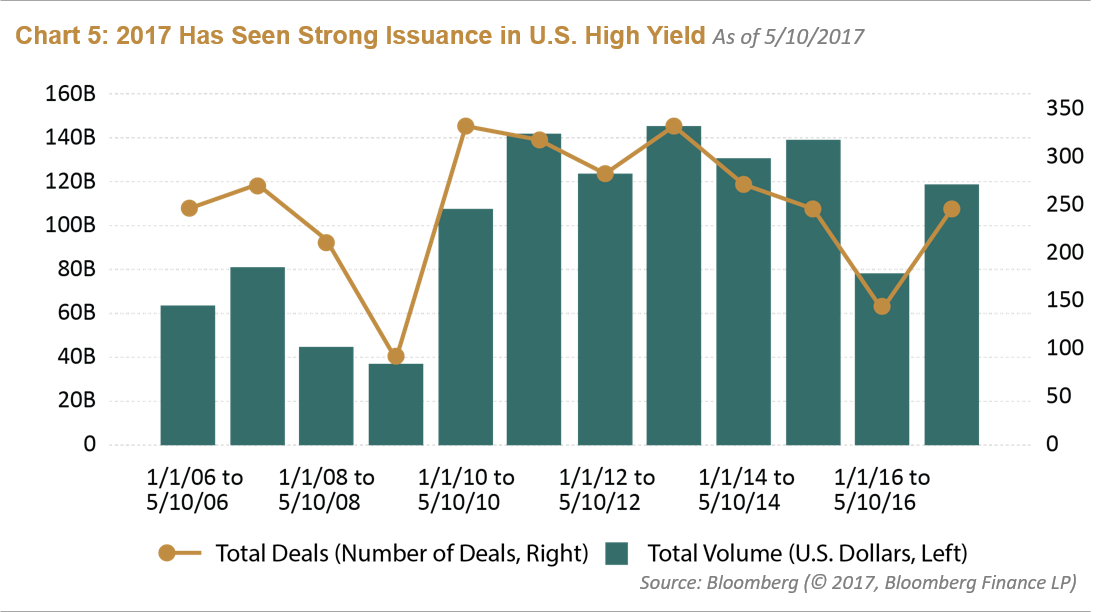

In just over the first four months of 2017, issuance has been robust (see Chart 5). It will be critical to continue to watch this metric to see if the market can push out the wall of maturities as it did in 2011 and 2012.

Conclusion

Our expectations are that the default cycle will remain benign for the balance of 2017 into 2018 and that investors potentially can earn an attractive return with prudent credit management. However, we still believe in the existence of the business cycle, which in turn means we believe there will be a default cycle—if not today, then perhaps tomorrow.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF