The rapid growth of private equity and credit has been a persistent theme over the past two decades. Within private credit, the rise of Business Development Companies (BDCs) in number, scale, and prominence has created an entire sector’s worth of investment vehicles for public market equity and debt investors. In our view, BDCs currently offer compelling investment grade alternatives to the otherwise low-yielding U.S. dollar-denominated high-grade credit universe.

The Rise of BDCs

BDC growth accelerated after the Global Financial Crisis as middle market bank lending was constrained by subsequent legislative and regulatory responses to that event. Some of the largest listed BDCs are profiled in Figure 1:

BDCs were created to provide credit to domestic middle market businesses, with specific requirements on reporting, portfolio composition, and diversification. Features of BDCs include:

- BDCs provide secured loans and, to a lesser extent, junior or hybrid capital to middle market companies. This financing is usually through direct origination teams but may include participation in private and public club or syndicated deals.

- Most BDCs sit within a larger asset management business.

- Generally, these organizations operate as Registered Investment Companies, with high levels of income paid as dividends, providing an equity income investment not dissimilar to listed real estate investment trusts (REITs).

- Every quarter via 10Q and 10K filings, BDCs disclose their assets, i.e., their loan books, with line-item details such as borrower, maturity, seniority, term, performance, and price.

- A statutory minimum 150% asset coverage ratio to remain a BDC inherently limits leverage.

Assets are the loans included in the loan book, typically secured and with maturities of 2-6 years. BDCs earn income from their loan books, mark-to-market gains, and origination and early repayment fees. Conversely, unrealized losses from mark-to-market changes in loan values and realized loan losses detract. Liabilities are chosen for cost effectiveness and flexibility, generally comprised of a mix of CLOs, credit facilities, and unsecured debt. Many public BDC bond issuers adopt a laddered maturity structure, and for most approximately half of their debt funding is from unsecured sources.

Current Opportunities in BDCs

Within the universe of generally low-yielding U.S. dollar-denominated investment grade bonds, we view unsecured BDC debt as an attractive place for credit holdings at the front end of the curve. Advantages of unsecured BDC bonds include:

- Investment grade ratings: A majority of BDCs are rated BBB-.

- Institutional scale:Top-tier BDCs typically issue new notes of $400-1000mm in size; there are numerous bonds of this size outstanding.

- Favorable coverage cushion: While most BDCs have shareholder approval to operate at 150% minimum asset coverage ratio, many are committed to the 200% framework that was previously required, thereby keeping leverage (debt/equity) in the 0.9-1.3x range. The rating agencies view the 200% level as consistent with investment grade. This coverage ratio creates a favorable cushion for creditors of BDCs.

- Attractive growth: In contrast to languid commercial and industrial (C&I) loan growth at banks, the middle market space continues to grow and attract institutional players and capital.

- Transparency in assets and underlying performance: During the COVID-19-induced recession, investors had transparency on loans on nonaccrual; management teams provided more detail on non-accruing loans than they had historically. While some BDC equities traded at 20-30% discounts to book value, the actual changes to asset values were typically much less, and the vast majority quickly recovered in the second half of 2020 with relatively minor actual losses.

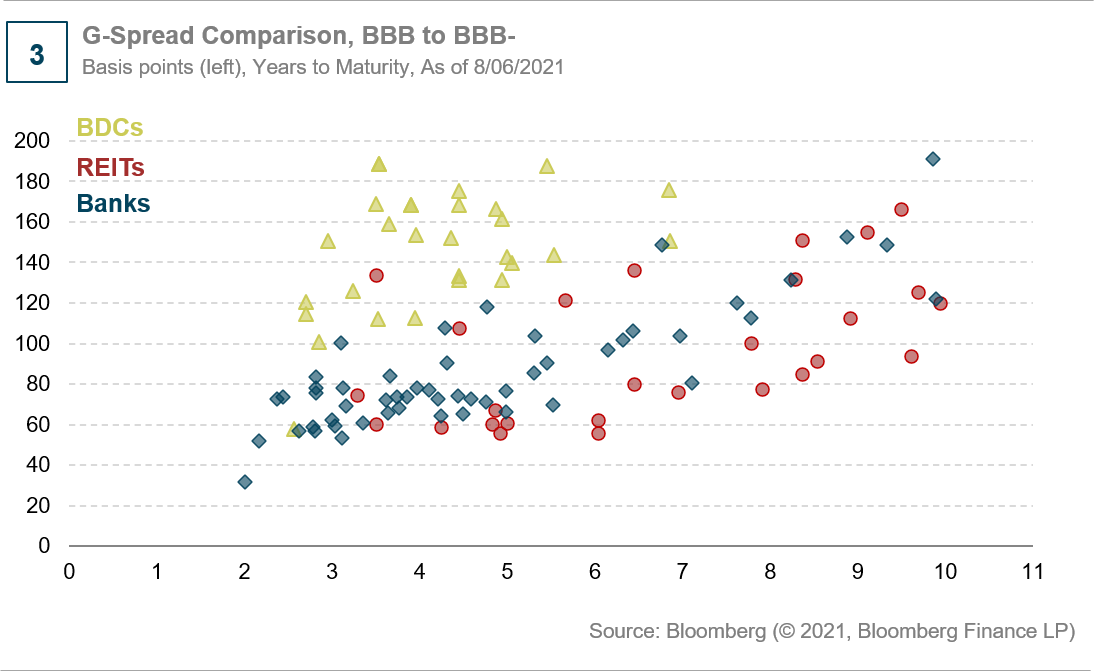

- Spread pick-up potential relative to other BBB/BBB- financial sectors with relatively low incremental risk: Comparing spreads over U.S. Treasuries, or “g-spreads”, to bonds of comparable maturities in the BBB to BBB- financials segment, BDCs offer excess spread for approximately similar risk. At the same time, these bonds typically have shorter maturities. G-spreads for BDCs, banks, and REITs in the BBB to BBB- sector are shown in Figure 3.

While attractive as a group, not all BDCs are created equal. As with any fixed income investment, BDCs are not immune to the traditional risks of interest rates and credit; and, as a nascent sector, illiquidity and transparency are still potential risks. Thorough credit research, a look through history, and engagement with management are essential to understanding risk and return in this space. We prefer the direct origination model; ownership by and support from a larger asset management group; a straightforward underwriting process; and candor from management. The BDC space continues to present interesting debt—and equity—investment options for those interested in digging into the details.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF