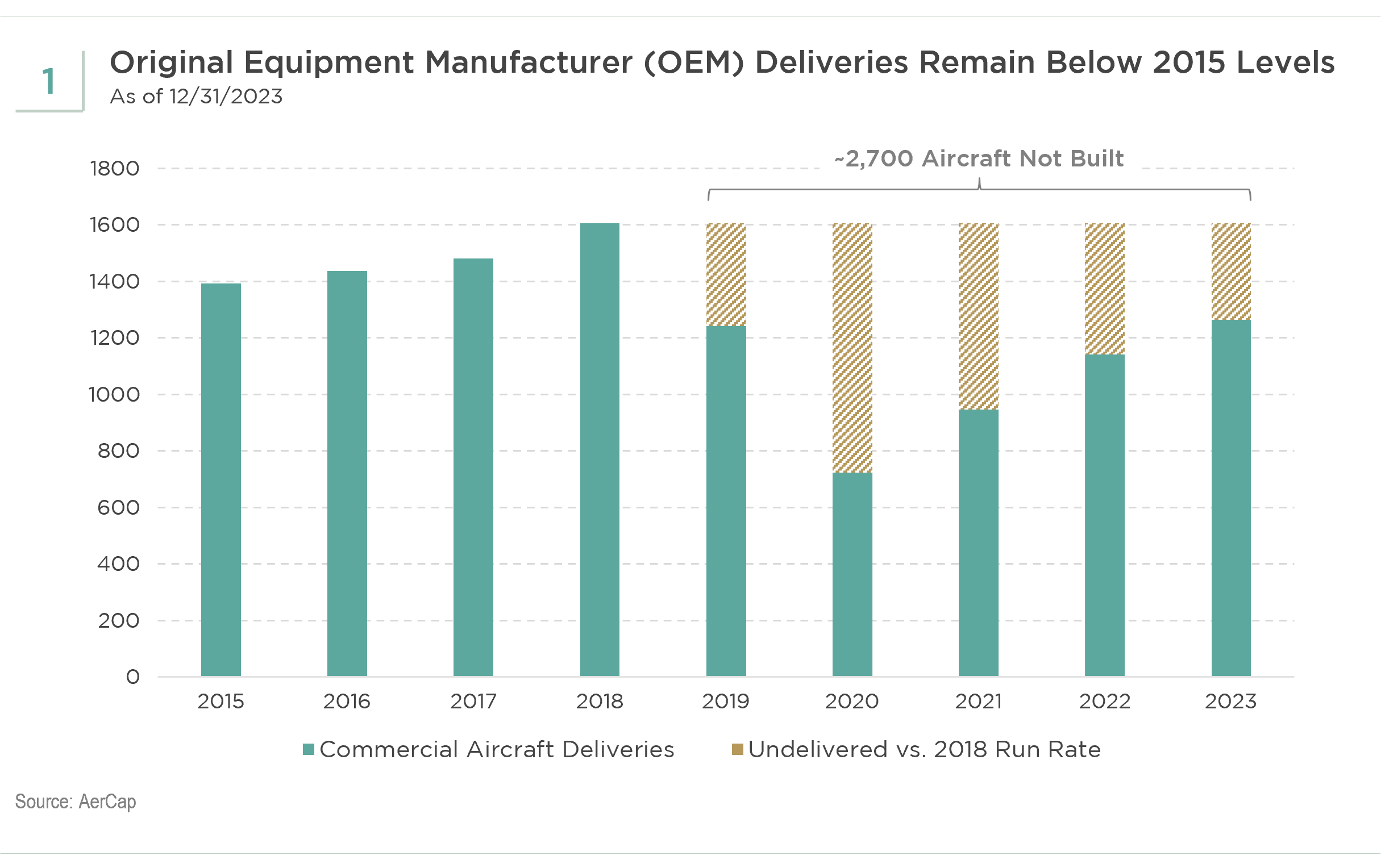

The airline industry is facing a significant challenge that could impact travelers' wallets in the coming years: a shortage of commercial aircraft. Due to manufacturing issues at Boeing, including the grounding of the 737 Max and production slowdowns from COVID-19, approximately 2,700 new planes that were expected to be built over the last five years never materialized (see Exhibit 1). This supply crunch is happening at the same time that demand for flights has largely recovered to pre-pandemic levels in most markets outside of China.1,2

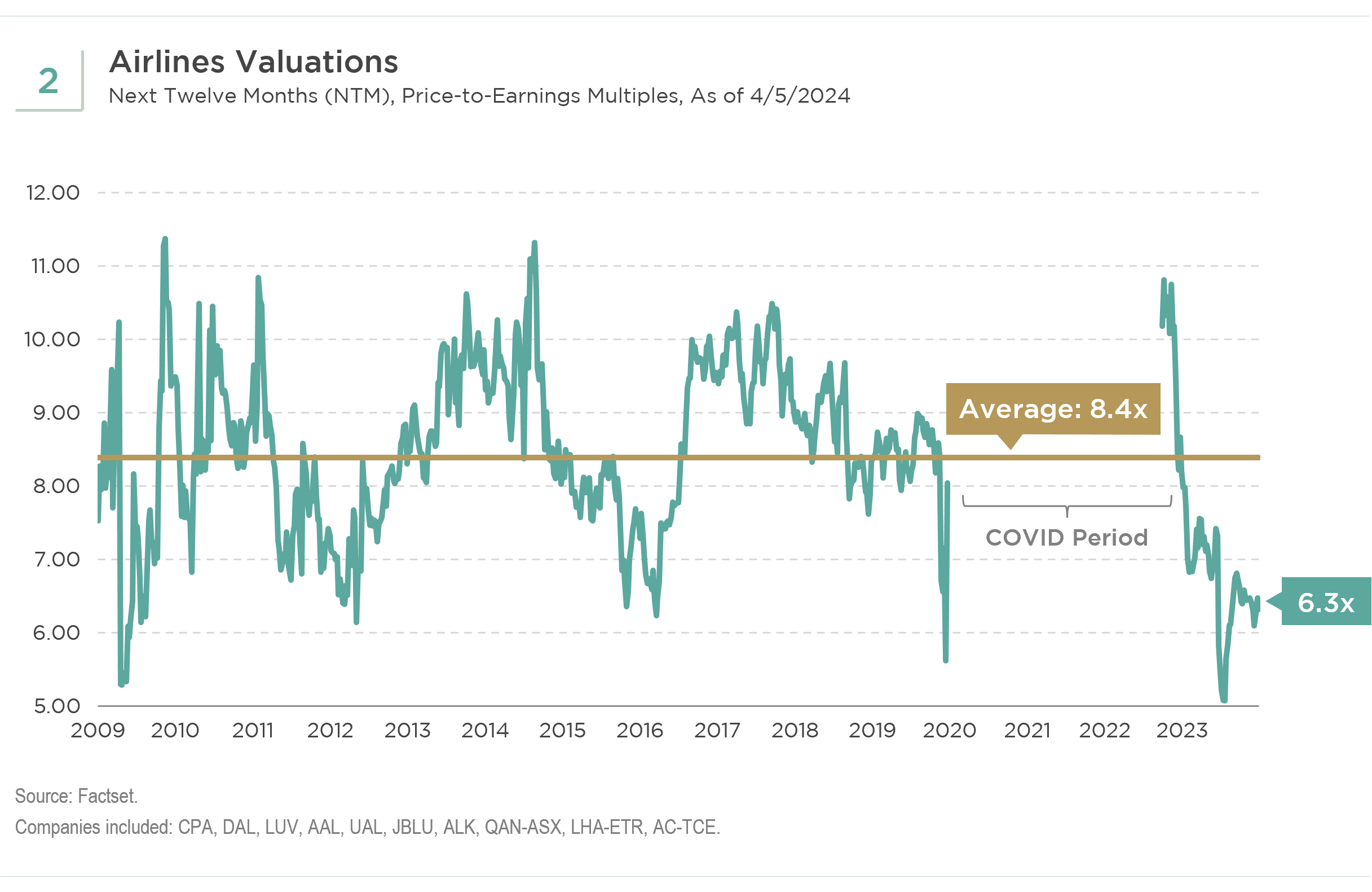

Our investment process, which combines top-down analysis with bottom-up fundamental research, overlays macroeconomic data and trends to identify opportunities across geographies or sectors. As investors, we see opportunity in this imbalance between constrained supply and rebounding demand. Additionally, valuations across the airlines sector are attractive (see Exhibit 2). We have taken positions in several airline stocks that we believe are well positioned, including: Delta, which operates one of the busiest hubs in the U.S.; Qantas, the largest carrier (by capacity) in the Australian market; and Copa Airlines with its strategic Latin American hub in Panama. These airlines are trading at compelling valuations of single-digit price-to-earnings (P/E) ratios. We have also invested in aircraft lessor AerCap, the world's largest owner of aircraft, which trades at only 8x earnings and 1x book value.

In our view, until Boeing and Airbus can ramp up production to meet the growing demand for air travel, prices are likely to rise across the aviation ecosystem. We do not expect Boeing to return to 2018 production levels anytime soon. While bad news for travelers' budgets, it could be good news for investors in aircraft lessors and premier airline franchises that can capitalize on constrained industry supply.

1“Airline CEOs Seek Meeting with Boeing Directors to Address Production Problems,” Wall Street Journal, A. Tangel, S. Terlep, A. Sider, March 21, 2024

https://www.wsj.com/business/airlines/airline-ceos-seek-meeting-with-boeing-directors-to-address-production-problems-cb12e6d4

2AerCap Fourth Quarter 2023 Conference Call, February 23, 2024

https://www.aercap.com/news-media/press-releases/detail/554/aercap-holdings-n-v-to-release-fourth-quarter-2023

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF