- In this two-part series, we outline how political risk is priced into sovereign bond yields and how long that risk premium could last.

- We then review a few typical indicators to determine whether they serve a dual purpose for economic and political analyses.

- Ultimately, we suggest evaluating economic data in conjunction with more qualitative factors such as income inequality and governance to identify significant shifts in political sentiment that may yield policy implications.

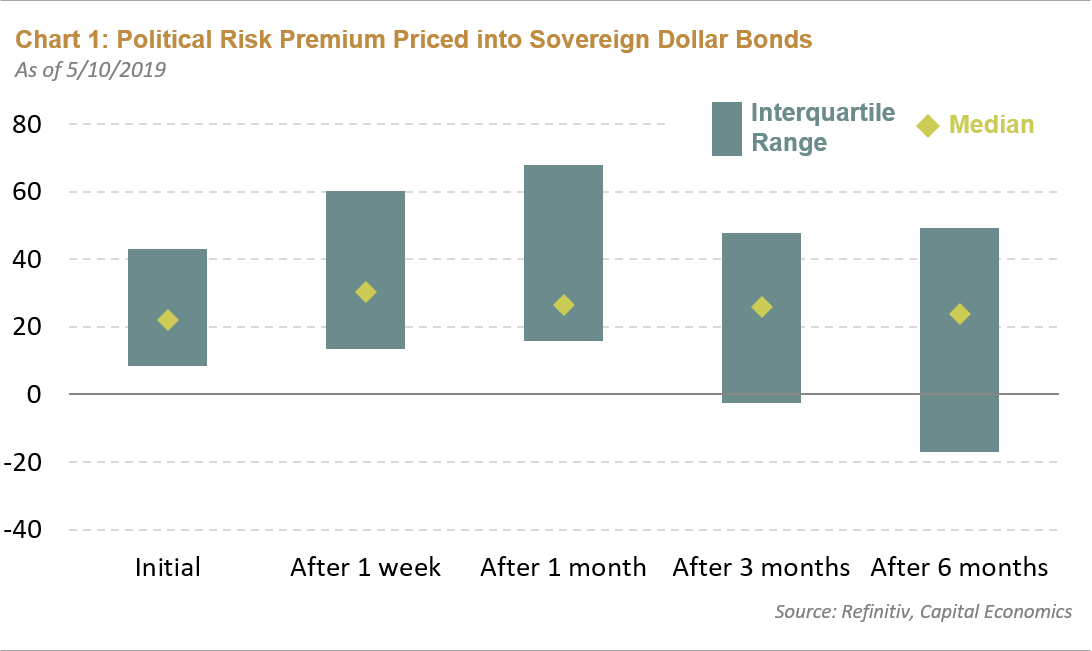

As global bond investors, analyzing economic indicators is like second nature to us. However, political risk has become a prevalent factor in both local- and hard-currency sovereign bond valuations over the last several years. Since we already evaluate price and information risk, there could be merit in reviewing traditionally quantitative factors through a qualitative lens, at least when it comes to political risk. We’ve read some compelling research about the effect political risk has on asset prices. For instance, Capital Economics evaluated the amount of risk premia priced into spreads following a political shock and how long that particular risk remains priced into a country’s sovereign bonds.

Similarly, J.P. Morgan outlined that it typically takes bond and equity markets about three months to retrace their losses following a geopolitical shock. Reviewing historical data is certainly helpful when trying to understand the financial and economic impact of politics, but is there a way for investors to contemporaneously evaluate risk factors to better understand—or even prepare for—these watershed events? We think there are certain economic indicators that investors can also evaluate within the context of politics, so these events become less of a shock and more of an opportunity to make tactical decisions.

Populism Poses the Biggest Political Risk

It used to be the case that major geopolitical events occurred about twice a decade; however, that changed after the 2016 U.S. presidential election. Since then, significant geopolitical events have materialized more frequently. These types of events have become more commonplace as a result of the global shift toward populism—a form of political risk that has the highest and stickiest risk premia according to Capital Economics. Chart 1 illustrates how the market provides an excess 20 basis points for political risk in dollar-denominated sovereign bonds, and the trailing effects of political events, which could last anywhere from one day to about six months.

Markets appear to provide excess spreads for bearing political risk—a topic we previously covered in a blog about Environmental, Social, and Governance factors. However, the risks associated with a rise in populism appear to persist for about six months or longer; an astute political analyst could potentially capture the excess spread over time and also capitalize on significant price appreciation should the risk be analyzed correctly.

Since populism is a global phenomenon, let’s review economic data in conjunction with sentiment factors in emerging market countries like Brazil, India, Mexico, and South Africa to see whether their election results match up with external and internal conditions.

Economic Indicators

A country’s external balances play a paramount role in our macro analysis and exogenous factors like the implementation of developed market unorthodox monetary policies in response to the Global Financial Crisis (GFC) have challenged emerging market economies. The impact of external events on these particular economies has been large given their varying stages of development, institutional structures, and generally more challenged aggregate balance sheets and current account balances. Markets are already quick to price in these weaker economic profiles, yet these weaknesses have manifested themselves in greater political risk. How beholden are emerging market economies to external influences? Let’s first review some typical external liabilities for South Africa, India, Brazil, and Mexico over the post-GFC period. Then, we can begin to understand political risk within the context of the economic backdrop.

Foreign Direct Investment (FDI) Flows

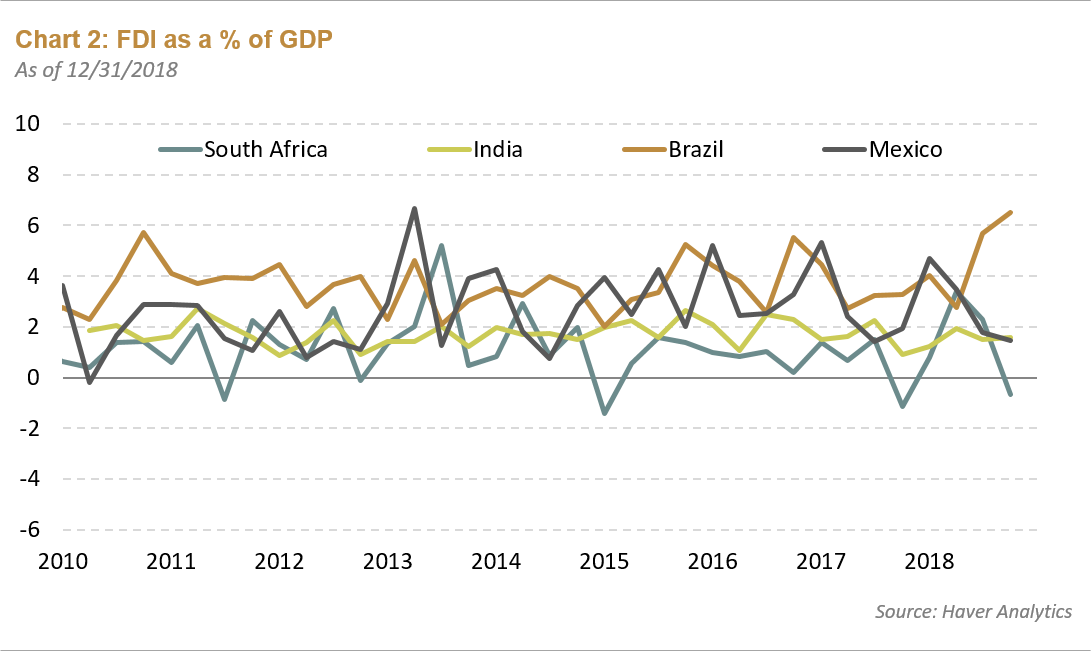

We’ve always been particularly interested in whether domestic policymaking can attract foreign capital. Chart 2 below shows FDI flows for the four countries of interest:

We can then align these flows with the political undercurrent within these countries. Foreign capital fled South Africa at the end of 2018 as business confidence remained suppressed and market sentiment turned increasingly skeptical regarding President Cyril Ramaphosa’s ability to implement reform. Similarly, FDI into Mexico declined as the Andrés Manuel López Obrador (AMLO) Administration began to limit foreign participation in the country’s energy auctions. Conversely, FDI began to flood Brazil around the time that President Jair Bolsonaro was inaugurated. The curious case here is India, which has been notoriously skeptical of foreign investment. After all, this was a closed economy up until the 1990s.

GDP Growth

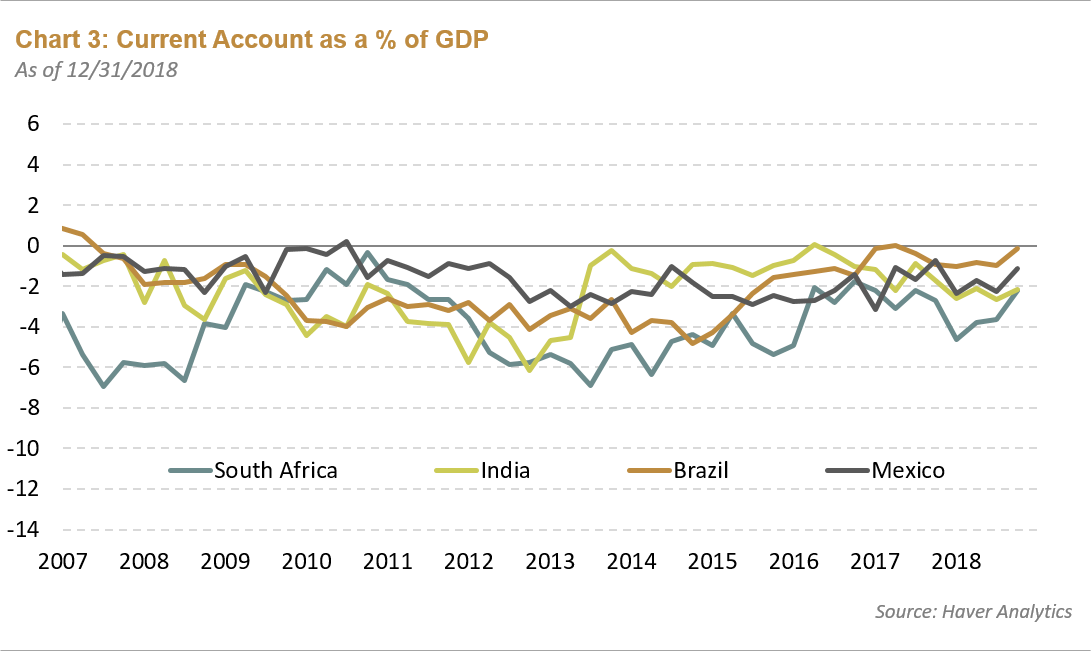

When Prime Minister Narendra Modi was elected in 2014—upending the political establishment—he also sought to further liberalize India’s notoriously nationalist economy. Yet, FDI has continued to hover around 2% of GDP as shown in Chart 2 above. While investors would expect a steady increase in FDI under the Modi Administration, does the populace really care about the level of foreign investment? India, along with the other three countries we’re evaluating, have seen their overall balance of payments improve as their current account deficits shrink. To varying degrees, foreign investment has been used to finance their current account deficits, which have improved over time as illustrated in Chart 3 below:

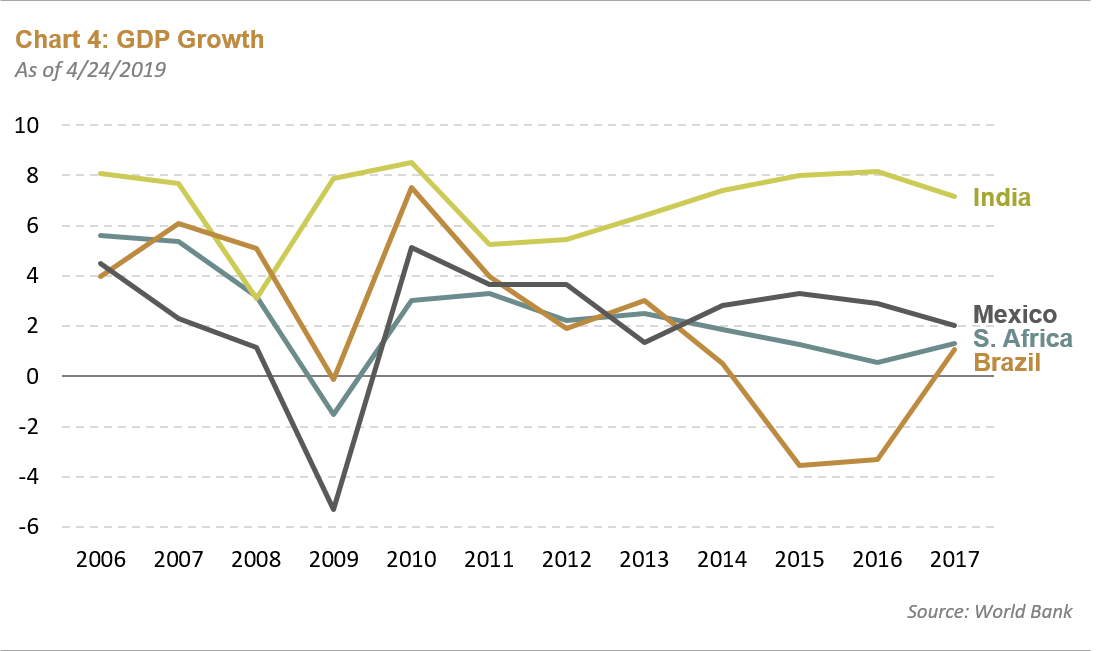

While current account deficits matter to investors, do average voters even care about balances of payments or attracting foreign capital? What likely resonates more with the population—particularly during an election cycle—are less abstract principles, like economic growth. Chart 4 outlines historic GDP levels:

When overlaying GDP growth with key political events, we can make some deductions. For example, let’s track Brazilian GDP, which began to contract in 2010 as the term ended for the country’s immensely popular former president—Luiz Inácio “Lula” da Silva. His successors, Dilma Rousseff and Michel Temer, were mired in scandals as the economy fell into recession. This example highlights why it’s important to look at political and economic conditions together. In Brazil, the simultaneous decline in economic growth and effective governance may have precipitated a profound ideological shift within the population. Therefore, it makes sense that voters rejected the Workers’ Party in favor of a fringe candidate like Bolsonaro.

However, GDP doesn’t neatly explain AMLO’s victory in Mexico, Modi’s ascendancy in India, or Ramaphosa’s nomination and recent reelection in South Africa. Sure, Mexican and South African GDP growth tapered off over time—South Africa even fell into technical recession; however, Indian GDP growth modestly improved during former prime minister Manmohan Singh’s second term. Yet Modi and the Bharatiya Janata Party (BJP) swept the 2014 elections.

In part two, we’ll highlight the role of the consumer in changing the composition of GDP growth within these economies and how factors like income inequality and perceptions of corruption present another facet in evaluating indicators like unemployment and wage growth.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF