Unwinding the Great Policy Experiment

After years of unconventional monetary policy, most developed market central banks are starting to signal they may be ready to normalize, to some degree thereof. Federal Reserve (Fed) policy normalization has been underway, first by raising the fed funds rate—though we haven’t actually seen the Fed achieve its projected dot plots to date. Next, the Fed also pledged to reduce its monthly asset purchases and ultimately shrink its balance sheet, which could happen as early as this fall. Rather than rehash the “when and how” the Fed will address its balance sheet and policy rate (Spoiler Alert: it’ll go slow on both fronts), I want to highlight the Fed’s unique position. In a way, the Fed was a key first responder to the global financial crisis (GFC). And now, it’s going to be the first major central bank to pursue quantitative tightening (QT), the more uncertain leg of its great “monetary policy experiment.”

Taking Cues from the Fed

First and foremost, the Fed needs to make sure the global financial markets will be okay with QT. Remember, its third policy goal—granted it’s implicit—is financial market stability. Sort of along the lines of the maxim primum non nocere, or first, do no harm. Why is this important? First, the Fed has been mindful of asset price inflation and the positive wealth effect it has had in the U.S. It’s been part of the Fed’s stated policy tool. However, the risk is that the wealth effect isn’t always one way; it can tighten financial conditions as well. You can watch my video on the topic here if you want to know more.

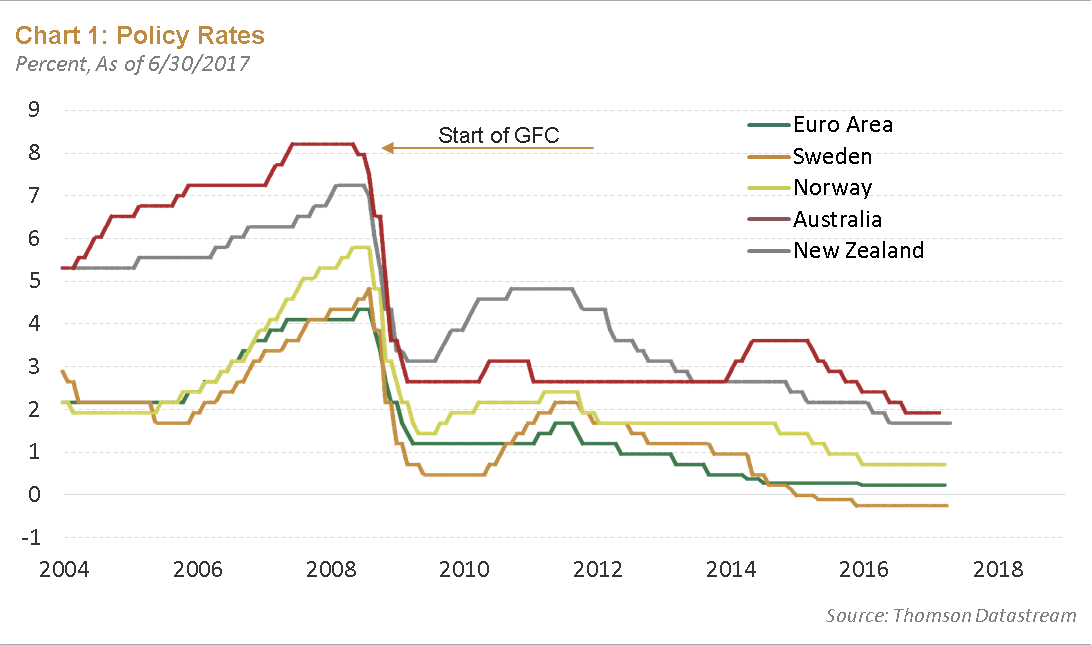

Second, and equally important to the Fed, is maintaining its credibility. Other central banks can get away with implementing a quick shift in monetary policy—which is what we witnessed post GFC—during 2009-2010 (see Chart below) when central banks tightened policy, thinking they had done enough in response to the GFC.

However, they underestimated the lasting disinflationary drag on their respective economies and were forced to start cutting policy rates during the 2011-14 time period. The Fed quickly reversing course would take a chunk out of its credibility, and that wouldn’t be good for risk assets in general. It may remind markets that the Fed’s collective wisdom and models aren’t any better than the private sector’s. I think a Yellen-led Fed understands this dynamic. It’s the reason why the Federal Open Market Committee (FOMC) put policy rate moves on hold until they get a better understanding of how markets will react to balance sheet reduction. Another discussion around the Fed is whether Chair Yellen will remain as chairperson, but we’ll assume if she won’t be guiding the Fed in 2018, someone with dovish tendencies will be at the helm.

While my colleague Dorothee Rainis suggested the Fed may no longer be, “the undisputed “central banker of the world” the FOMC’s collective thoughts remain embedded in every other major central bank’s rhetoric and policymaking, by linking currency markets via U.S. dollar exchange rates. We’re coming off a 10-year period where currencies have influenced monetary policy decisions to an unprecedented degree. When an economy is fighting disinflation, a strong currency isn’t part of the solution—the opposite is. The U.S. dollar is still by far the most important global currency, so other central banks watch its moves closely. Just as many major central banks took their cues from the Fed following the financial crisis, we are starting to see that trend reemerge.

The Path to Normalization

The Bank of Canada surprised markets in July by raising its policy rate, with Governor Poloz going so far as to say the prior rate cuts served their purpose. We’ve also seen the European Central Bank (ECB) and a collection of other European central banks grow less dovish—I think growing hawkish is too strong of a term right now. But, there is one lone dissenter: Sweden’s Riksbank. I’m surprised by the Riksbank’s hesitation. Unlike almost every other major economy, Sweden is actually generating inflationary growth, albeit its inflation target is now a moving one. Just a few months ago, the Riksbank decided to abandon the longstanding 2% inflation target in favor of a variation band of +/- 1% of that rate. Despite the new metric, the Swedish economy seems to be reflating, which should satisfy the Riksbank’s sole mandate to manage inflation. And yet the central bank announced that it would remain accommodative despite evidence of sustainable inflationary pressures.

What’s different this time around? For the first time in a long time, “everyone” seems to be okay in terms of economic stability. We’re not expecting global economic growth to skyrocket, but it is slow and steady. Every region seems to be participating in this uptick in economic growth. We’re starting to see a couple of positive knock-on effects. Global trade has improved—emerging markets should also benefit from an increase in global trade and the subsequent stability in commodity prices; they also seem to be in generally better shape than they were in 2013, or 2010 for that matter. Emerging market inflation has turned over and their central banks are ready to keep easing. Ultimately, we think capital will flow into emerging markets and create a positive feedback cycle for their respective currencies. Bottom line, we’re not looking for another taper tantrum in emerging markets, or within broader global financial markets. The global economy is in much better shape today than it has been over the past 10 years; it is better able to withstand the incremental removal of some emergency level stimulus by developed market central banks.

Conclusion

We are talking about monetary policy in black and white terms when it’s about to enter unchartered territory. We’ve seen several FOMC members tone down their hawkishness, especially as inflationary pressures fail to build in the U.S. economy. The last thing the global economy needs is for the Fed to tighten too quickly or too much. All the G10 central bankers get this. At the very least, we think these central banks should wind down financial-crisis stimulus—which is very different than actually tightening monetary conditions.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF