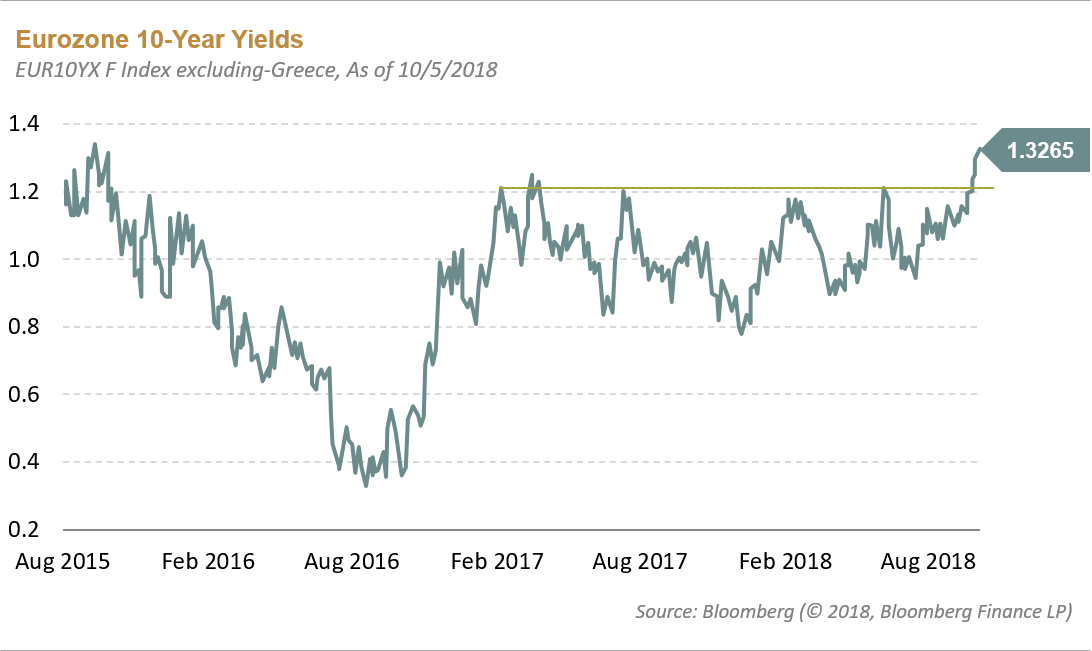

Is the breakout in eurozone 10-year yields sustainable? Although political risks within Europe are driving Italian yields higher and German yields lower, the gross domestic product (GDP)-weighted 10-year eurozone yield seems to be notching higher. The upward pressure on these regional yields could be a result of what’s happening in the U.S. Treasury market, or a credible sign that European bonds are starting to price in the output gap relative to labor market conditions. While growth momentum has weakened in Europe in 2018, the output gap continues to diminish as the overall unemployment rate continues to decline. Core inflation is still subdued near 1.0%, but if history remains a guide, then the tightening of the labor market will lead to a further acceleration in wages, which, in turn, will drive core inflation towards the European Central Bank (ECB) target of 1.5% - 2.0%. If this is the case, then this recent breakout in yields may be more of a long-term trend rather than an anomaly.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF