The strong rally of U.S. Treasury bonds and European sovereign debt abruptly paused on August 16, upon news of potential plans for German fiscal stimulus and U.S. Treasury issuance of 50- to 100-year bonds. Of the two, the future direction of Treasury yields will be a function of global growth—with China as a significant driver—and the progress of the trade talks, though the path of Federal Reserve (Fed) rate cuts and market supply and demand technicals are also important variables. The rally in safe-haven bonds could end as a result of the continued stimulus that China is leveling, and if U.S.-China trade tensions come to an end. Should these events occur, then risk-seeking investor behavior should resurface and direct investments away from safe-haven assets.

So are we out of the woods on China's growth slowdown and the ongoing trade war? In order to answer these two questions, let's assess the recent trade negotiations and look at some of China's recent growth indicators, the banking sector, and new measures for additional easing.

Trade

The power dynamics have changed since President Trump delayed the September 10% tariff on over half of the $300 billion imports from China. Although the U.S. decision to extended Huawei's licenses for another 90 days was briefly a constructive sign, the trade war has escalated over the last week. China has continued to take countermeasures:

- Increasing its tariffs on $75 billion of U.S. imports starting in September.

- Resuming the 25% tariff on U.S. autos/parts imports on December 15—a decision that was previously shelved in 2018.

- Abstaining from discussing Hong Kong matters.

The U.S. has also continued to respond, with President Trump quickly asserting that:

- The U.S. will raise the 25% existing tariff on $250 billion Chinese imports to 30% starting October 1; we find it significant that 25% is no longer the upper limit for tariffs.

- The proposed 10% tariff on $300 billion of goods will be raised to 15% in two batches on September 1 and December 15.

- American companies should immediately start looking for an alternative to China. On Twitter, Trump has mentioned the International Emergency Economic Powers Act of 1977 (IEEPA) and may potentially use the presidential power granted by the IEEPA to sanction a country by banning transactions in foreign exchanges, bank transfers of credit, or payments.

Furthermore, we will be closely watching to see whether:

- The extension of the Huawei licenses is simply a tactic to give U.S. firms more time to find alternative buyers while Huawei and 118 of its affiliated businesses will be added to the export blacklist.

- Trump goes through with the planned $8 billion fighter jet sale to Taiwan, which China has vowed to countermeasure by perhaps sanctioning U.S. firms that sell jets or arms to Taiwan.

- China expands the Unreliable Entity List, restricts Chinese tourism and studying in the U.S., or increases cooperation with Russia, North Korea and Iran.

A year ago, the market firmly believed that the U.S. could win this trade war. However, some of these remaining risks could make this negotiation more complex and even harder to reach a deal. For example, markets did not expect this round of escalation during the G7 summit weekend, and pricing in this type of uncertainty will be extremely difficult and volatile. With China buying more time and Trump's reelection clock ticking, the power dynamics may shift to China's benefit as it has a longer timeframe for negotiation while enduring slower growth, higher inflation, and higher unemployment—if needed.

Recent Economic Data from China

China's July activity disappointed markets due to weak domestic demand and no immediate signs of stimulus working:

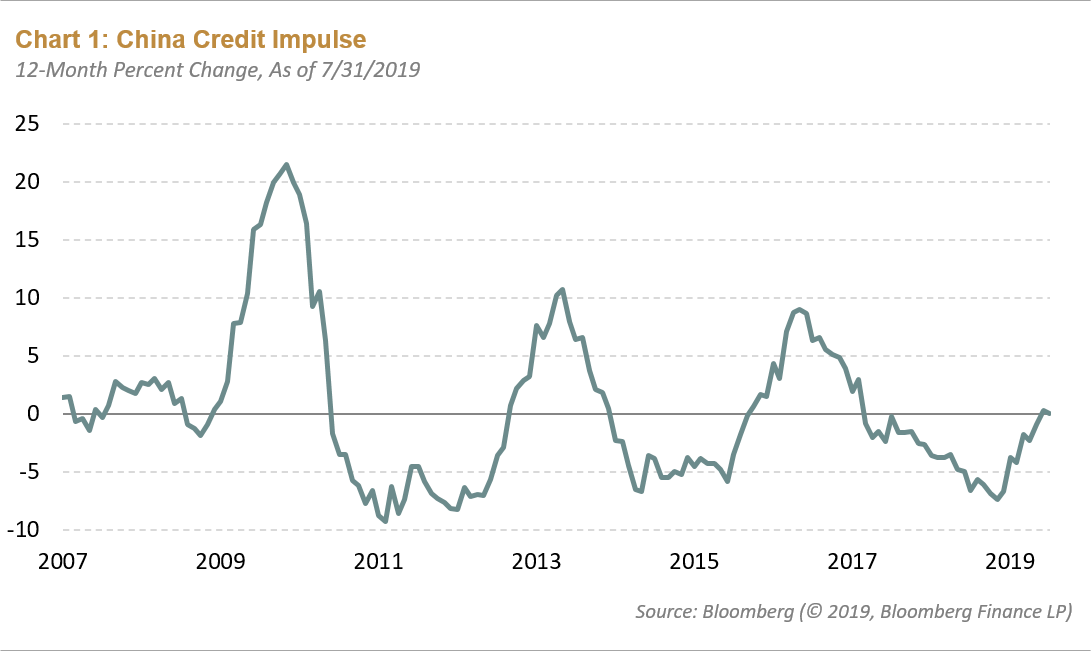

- Weak credit data were driven by softer new loan growth and continuous shadow banking shrinkage, both of which resulted from tightening property developer financing, prohibiting the use of consumption loans for home purchases, and strengthening asset management rules for shadow banking (see Chart 1).

- Producer price index data fell into negative territory, signaling the resumption of deflation and further challenges to industrial profits.

- Infrastructure investment weakened moderately despite the fact that local government special bond issuance used up 80% of the quota.

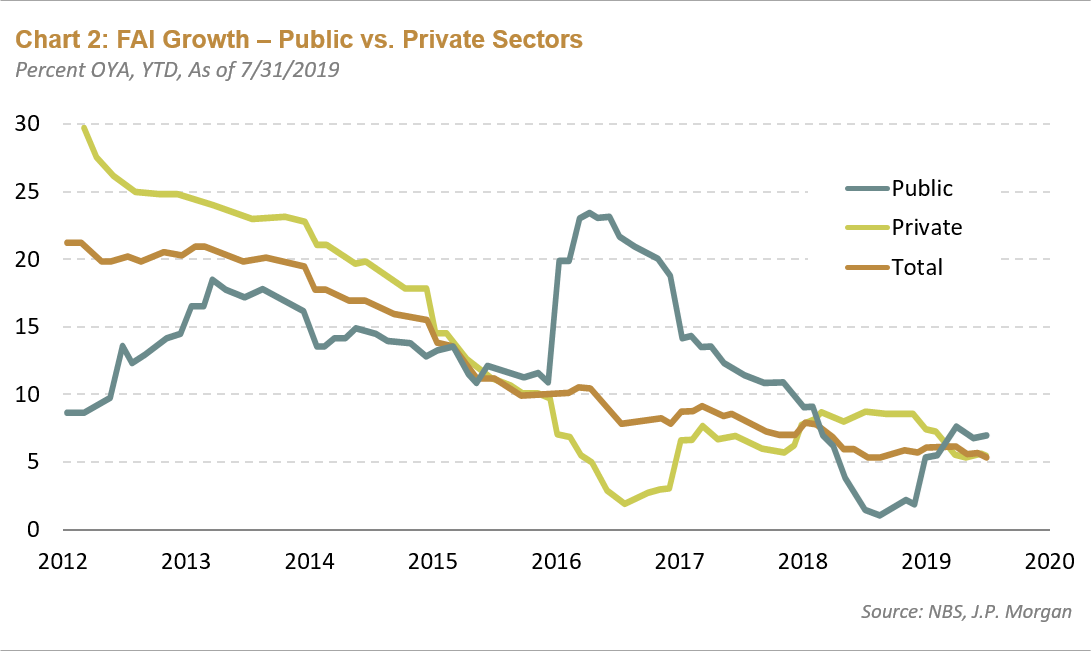

- Private investment turned weaker than public investment, as shown in Chart 2 below:

- Retail growth continued to be dragged down by auto and home-related sales.

China's Banking Sector

Chinese policymakers have emphasized the need to delicately balance deleveraging, maintaining a higher tolerance for the failure of weak financial institutions, and coordinating measures to avoid spillover to a systemic crisis. The bailout of three banks within three months and the prospect of risk for a serious debt crisis highlights this delicate balance. However, we don't see this bailout as a systemic risk, particularly when compared to 1998, when China's non-performing loan crisis was triggered by the big four banks. According to JP Morgan research, the market share of the big four banks has declined to 37% of total bank assets, therefore making small- and mid-sized banks key players in the financial market. Currently, the big four banks are healthy whereas the smaller banks are more vulnerable. Given this shift in the composition of the banking sector, we expect these major trends should unfold to address existing conditions:

- Capital injections to banks, though this measure would also cause a lag in credit growth and constrain monetary policy.

- Strengthening shareholder structure to distribute risk.

- Acquisitions and industry consolidation in lieu of bankruptcies.

Additional Stimulus Efforts

Markets have been generally underwhelmed by China's stimulus efforts. However, China recently announced in mid-August more "defensive" easing measures as below:

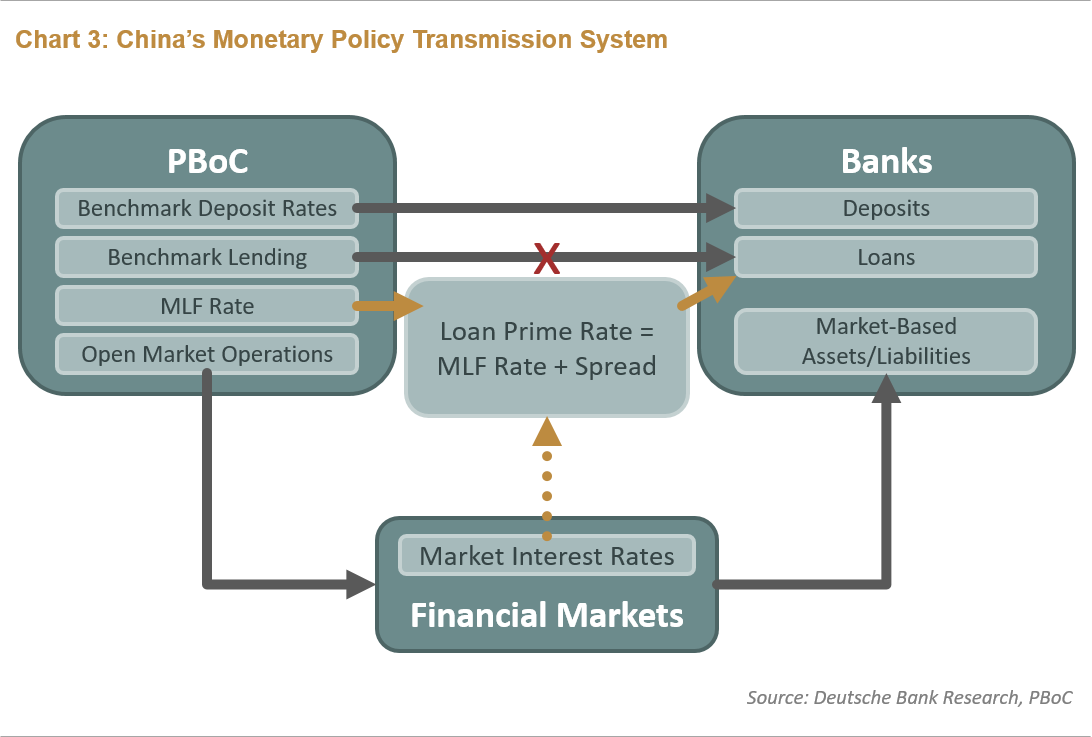

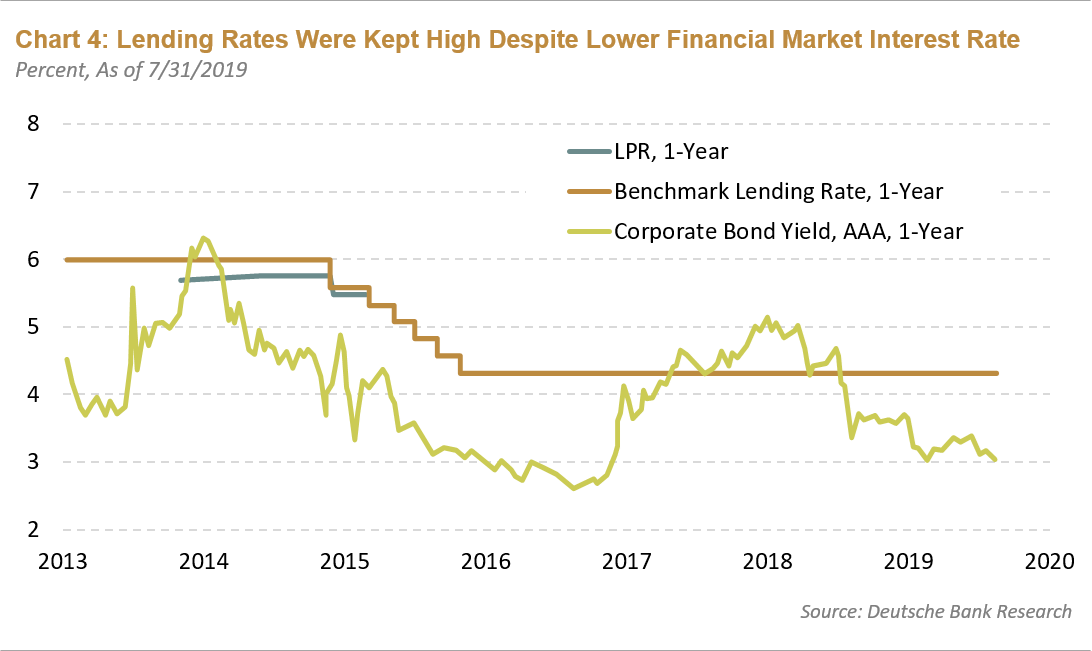

- Monetary Policy: The People's Bank of China (PBoC) announced a Loan Prime Rate (LPR) reform on August 17, which symbolizes an additional step toward interest-rate liberalization and the gradual integration of the existing "dual-track" rate system, where we see the benchmark lending rate deviate from the real financial market rates. Charts 3 and 4 show the rate transmission mechanism between the PBoC, financial markets, and banks.

As a result, average lending rates were kept at a high level, despite much lower financial market rates. We think this is why easier monetary policy has not been getting traction in boosting money supply growth. We anticipate that the immediate impact of this "baby step" alternative rate cut should be moderate as it doesn't affect existing loans until they refinance. However, average lending rates should come down further in their monthly reset if policymakers cut the medium-term lending facility rates going forward.

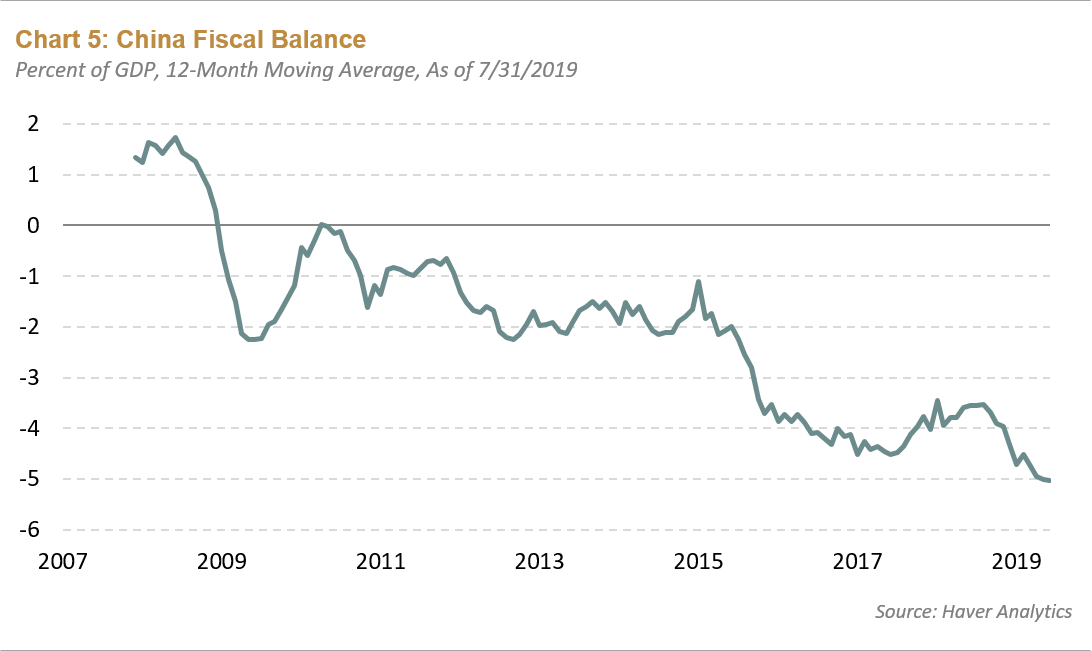

As a result, average lending rates were kept at a high level, despite much lower financial market rates. We think this is why easier monetary policy has not been getting traction in boosting money supply growth. We anticipate that the immediate impact of this "baby step" alternative rate cut should be moderate as it doesn't affect existing loans until they refinance. However, average lending rates should come down further in their monthly reset if policymakers cut the medium-term lending facility rates going forward. - Fiscal Policy: In July, the fiscal deficit was around 5% of gross domestic product (GDP)—the highest level since 2007; it has mostly been comprised of central government spending. However, as land transaction prices weakened, seven out of 28 provinces saw negative revenue growth due to tax cuts. Therefore, China is considering lifting the annual quota for local-government special bonds from ¥2.15 trillion currently to boost infrastructure investment. This existing quota is set to be used up by end-September and should increase local-government spending.

- Disposable Income: China will roll out a plan to boost disposable income and spur private consumption. It will urge local authorities to adopt measures to quickly stimulate consumption, with particular focus on:

- Stabilizing employment and stepping up reform in Hukou and rural areas

- Rolling out consumption stimulus at the central and local levels and minimize administrative interference in the market

- Digitalizing consumer rights protection program

- Unemployment: New job creation is 8.67 million year to date. The target is 11 million for the full year while labor supply is at 15 million—putting pressure on the job market. The nationwide urban unemployment rate rose to 5.3%. As a result, Premier Li announced measures to support unemployment:

- Deploy ¥100 billion to support job skill training and re-employment.

- Increase the scale of 2,000 vocational schools to address a structural mismatch in the labor market, where jobs should complement the upgrading of the value chain.

- Continue to support the corporate sector with tax cuts, etc.

The above measures are incremental easing as economy slows. However, they are defensive in nature and may not fully offset the growth drags amid trade uncertainties.

Conclusion

While markets focus on trade, lackluster data, and the need for more stimulus, we will also be watching two other factors closely: the yuan and the scope and pace Fed rate cuts. As trade tensions re-escalate quickly and more tariffs are potentially introduced, the yuan could flirt again with that 7.30-7.40 "threshold" by the end of 2019. Since China has already been labeled as a currency manipulator, policymakers have more flexibility to allow the yuan to continue depreciating. The CNY-USD cross is no longer constrained by the interest-rate differential—a reason why the trade war has escalated into a currency war. The Trump Administration could pursue policies to weaken the dollar as well and potentially remove one headwind impeding global growth.

President Trump will also likely remain focused on U.S. equity market performance. Year to date, the stock markets of both countries are still up by about 14%, leaving room for risk assets to withstand more volatility from now through the end of the year. Therefore, we expect the Fed will continue to come under pressure to cut rates. The Fed is at risk of falling behind the curve with an insufficient number of rate cuts to ameliorates tightened dollar liquidity and bolster global growth.

China needs to more aggressively pursue additional stimulus, bank consolidation, and a lower-rate environment in order to stabilize its economy as trade tensions escalate. Therefore, China isn't out of the woods quite yet. If the trade war continues to escalate from here, safe havens should periodically rally. While safe haven yields should over- or under-shoot based on market technicals, given how much they have rallied so far, we expect them to trade sideways in the near future.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF