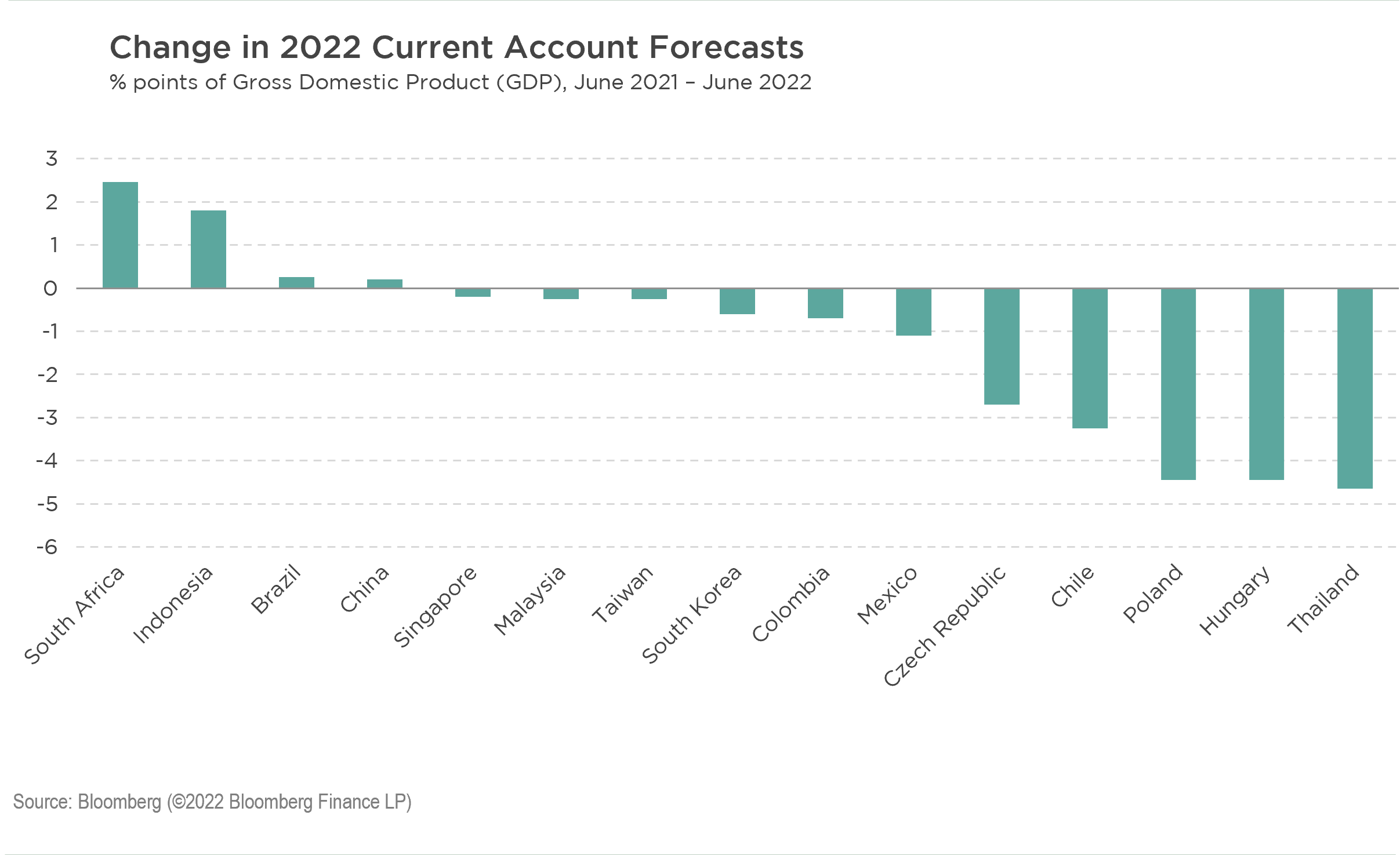

In our recent podcast, Senior Research Analyst Alberto Boquin and Senior Vice President – Investment Specialist Katie Klingensmith discuss the differentiated impact that rising commodity prices and supply scarcities have had on emerging markets. As this chart shows, there have been winners and losers. Some net commodity exporters, like Brazil and South Africa, have seen current accounts improve as commodity prices and revenues have surged. However, for many emerging markets, food security is a growing concern, and net importers are particularly at risk. Furthermore, developing countries also tend to have less competitive market structures, allowing supermarkets and farmers to pass on price increases faster. Many emerging markets must import most of their fuel as well. Therefore, one issue that virtually all emerging markets are facing is inflation, and unchecked inflationary pressures run the risk of negating even the most positive fiscal balance or current account balance improvement.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF