Many instances exist in the past when the Fed’s focus on domestic policy has conflicted with the dollar’s role in the international financial system. Usually, any conflict becomes obvious after several interest-rate increases that boil over into some kind of crisis. In 1994, the Tequila crisis put Fed rate hikes on ice. In 1998, the Asian crisis and subsequent bankruptcy of Long-Term Capital Management actually led to a reversal of policy rates in the U.S.—if only temporarily.

This time there has been no rate increase. However, in a zero-bound world of weak demand and deflationary pressure, dollar strength represents an endogenous form of policy tightening—a development that the Fed has not acknowledged so far. So it remains for the economic data to tell us if this form of tightening has reached some sort of choke point and whether forces are beginning to gravitate toward the next crisis.

Consider the following:

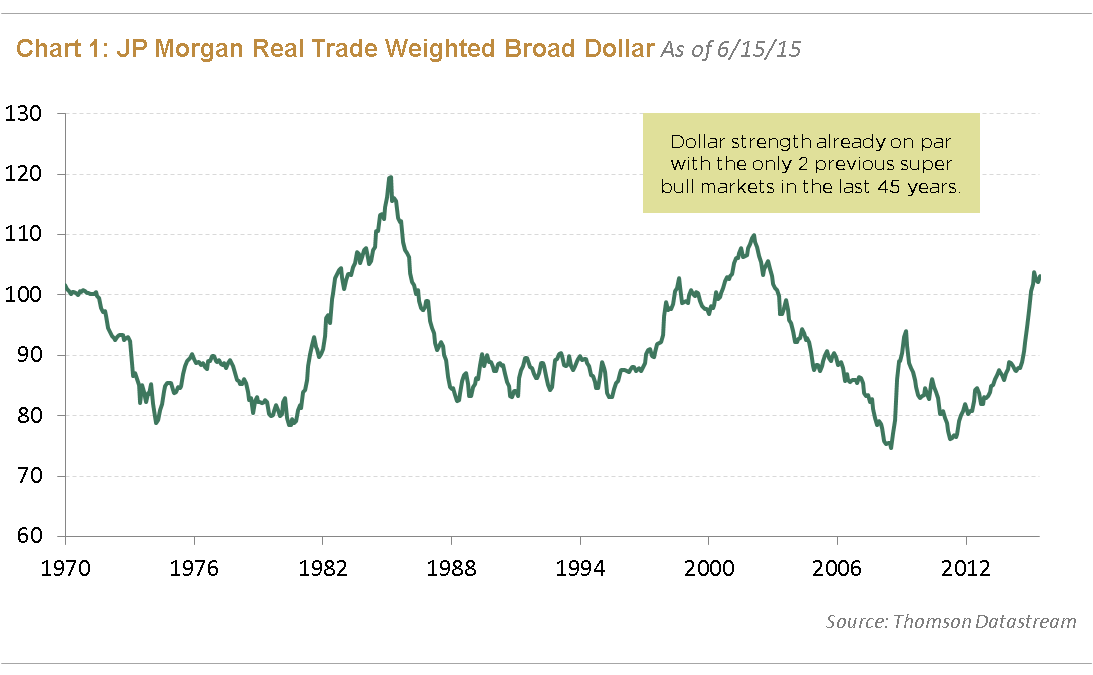

- According to JP Morgan’s real trade-weighted dollar basket, the U.S. dollar has risen to a level seen only twice before in the last 45 years: during the Reagan-Volcker years and during the tech boom (Chart 1). Both earlier instances were marked by entrepreneurial revival, enthusiasm, and economic strength—which has not been the case during this bull market. Instead, the current period of dollar strength is more about economic weakness in the rest of the world.

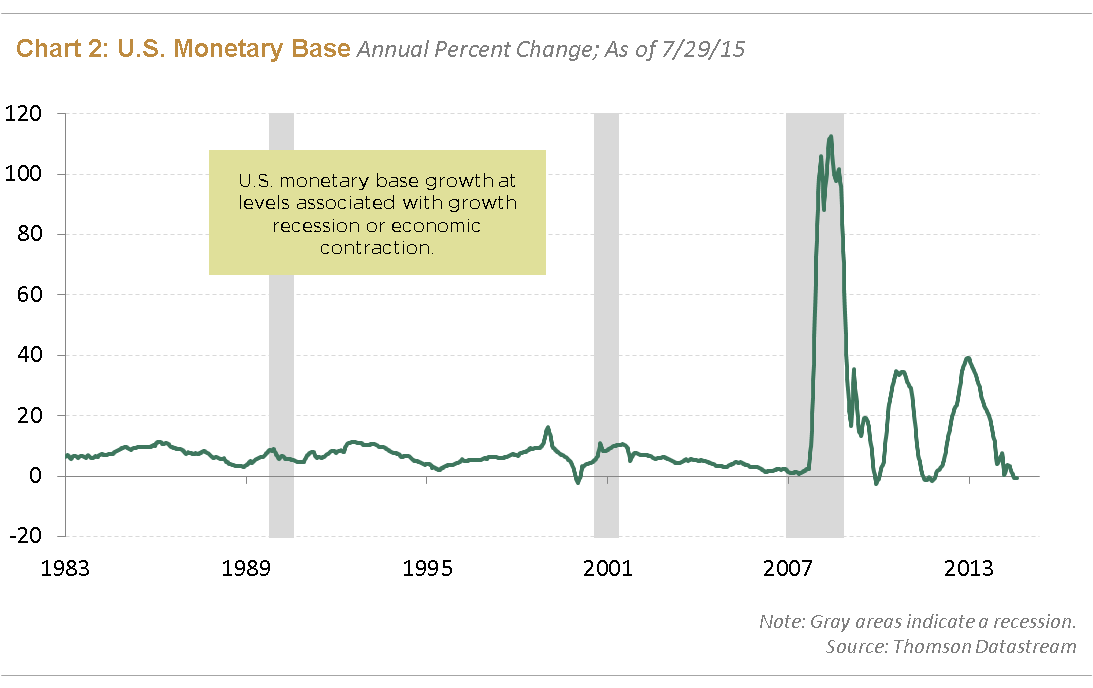

- U.S. monetary base growth has fallen to a level normally associated with recession (Chart 2). Similarly, growth in the non-gold stock of international reserves, plus the Fed’s holdings of U.S. Treasurys and Agencies (a measure of global liquidity), has dropped below zero. These various measures of high-powered money along with dollar strength correlate with the steady deterioration in global trade and the bear market in commodities (Chart 3).

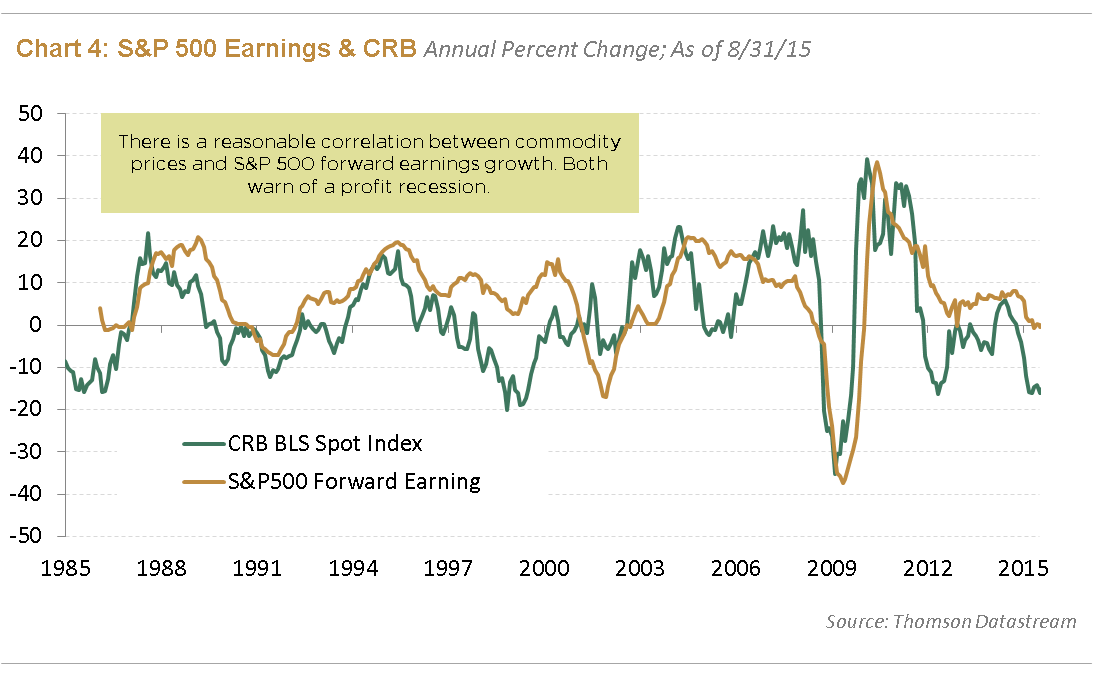

- In turn, growth in the CRB Raw Industrials Commodity spot price Index is closely correlated with the growth rate in S&P500 forward earnings (Chart 4). Both have fallen to levels that have coincided in the past with episodes of Fed easing, not tightening.

- Dollar strength obviously translates into foreign currency weakness. The effect has been generally reflationary for developed countries with credible monetary policy. But the story is different for developing countries, which currently represent nearly 60% of global gross domestic product. Brazil and Russia are the extreme cases. Both have taken a huge negative hit from deteriorating terms of trade. Yet central banks in both countries have been forced into defensive/tight monetary policy to protect against import inflation related to weak currencies. The combination is a recipe for stagflation and a vicious cycle of currency weakness and central bank restraint. Reserve Bank of India Governor Rajan has been the most prominent critic of the Fed’s renormalization policy in terms of its impact on the global economy.

- China’s de facto peg to the dollar has been particularly deflationary. Until last week, Chinese policymakers clung to the rising dollar despite growing overvaluation, a recession in industrial profits, sliding economic growth, shrinking foreign-exchange reserves, and nearly four years of falling producer prices. The currency move from the week of August 10 may have let the genie out of the bottle. Either way, China will export considerably more deflation in the months ahead, as well as push the trade-weighted dollar ever higher.

Collectively these data suggest that American corporate profitability is beginning to erode from diminished pricing power, due in part to deflationary pressure from abroad. Fed Vice Chairman Fischer went as far as saying in a Bloomberg interview from August 10 that policy arguably would be easier if the Fed’s only mandate was inflation. Yet, it is the gains in employment—the other component of the Fed’s dual mandate—and the potential for rising-wage inflation that has tilted the Federal Reserve Board of Governors toward anticipating rate renormalization.

At the end of the day, any conflict derived from the Fed’s inward goals and the global impact of U.S. monetary policy should be revealed in the domestic inflation rate and pace of activity. So far the Fed dismisses the low levels of inflation as transitory. But market action suggests that it is not transitory. Corporate spreads have widened, breakeven inflation rates are sinking, profit growth has flattened out, and stock market breadth has retreated. A rate hike would represent a major regime change and the beginning of a new trend. The Fed should do it only if fully supported by the data which—for the moment—is not the case.

As for a crisis, the weighted dollar price of emerging-market equities has weakened to levels that have provided support for the past four years. A breach of these levels on the back of Fed renormalization would be very negative for global growth.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF