Are there still opportunities to earn excess returns in global high yield?

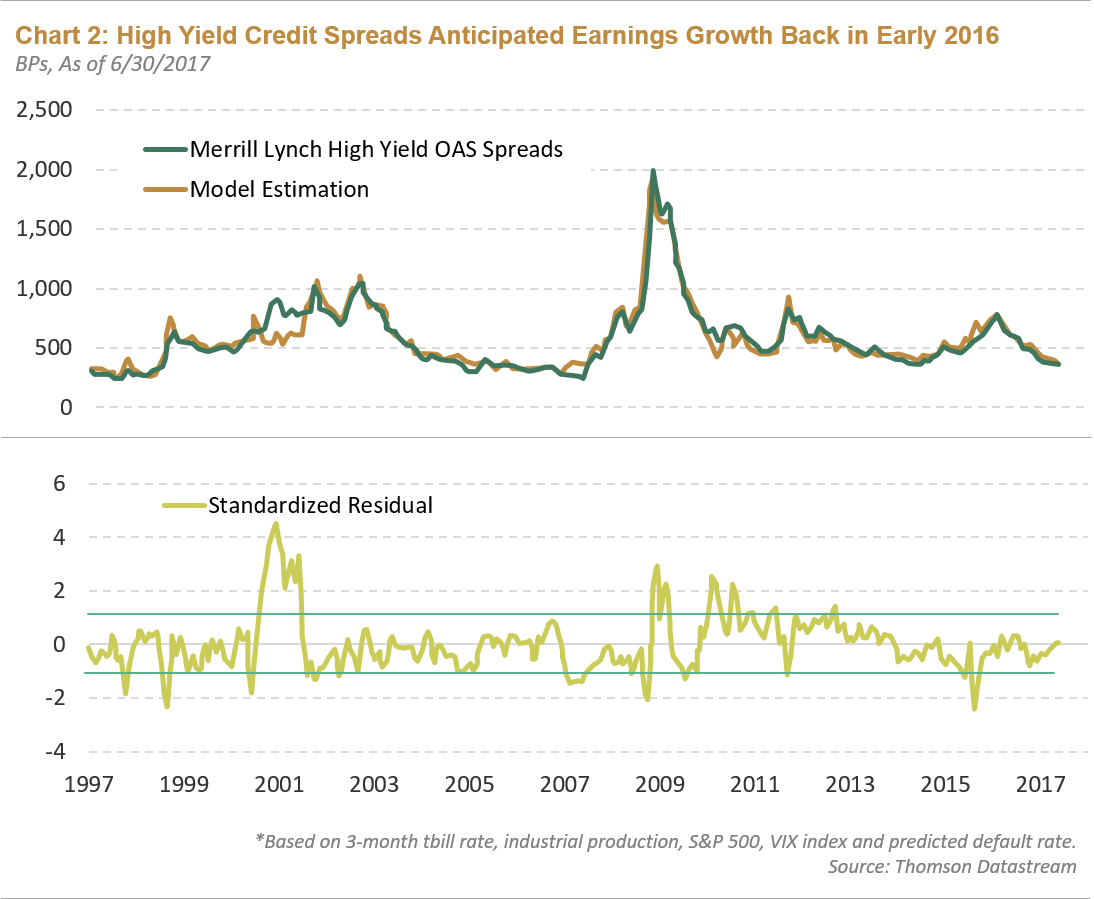

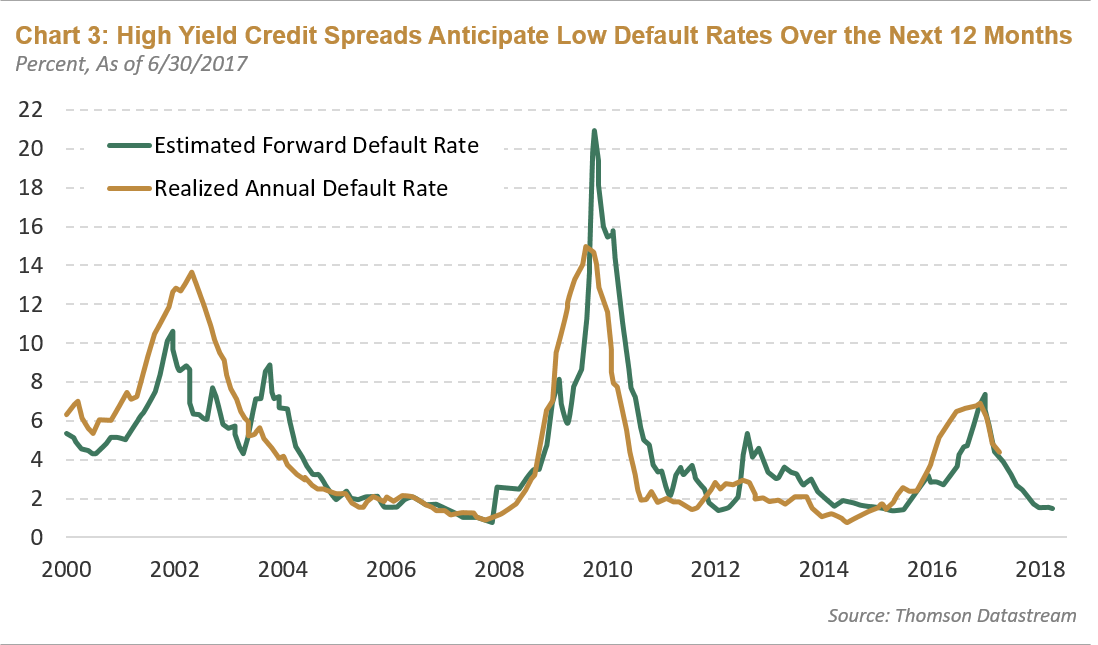

Global leveraged finance markets have priced in this improved earnings growth and better pace of economic activity. In particular, U.S. high yield credit spreads have gradually tightened to 370 basis points (bps) and now anticipate that default rates in the sector will be comfortably below 2% over the next year (see Chart 2 and Chart 3). Our valuation indicators, which incorporate the state of economic growth and asset values, indicate that the U.S. high yield asset class is fairly priced at this point—significantly cheaper on a relative basis than European credit. That is, better economic growth, lower default rates, and more certain asset values are now fairly embedded in the option adjusted spread of the U.S. high yield class. Therefore, we believe investors in the global high yield asset class should move asset allocations to the U.S., focusing particularly on higher quality and lower credit default probability sectors, such as communications and consumer non-cyclicals. We have seen a good amount of merger and acquisition activity within communications as the industry continues to consolidate. We also think the wireless spectrum these companies own translates to solid asset valuations. Communications may be able to better withstand a selloff in risk assets than other high yield sectors. As for consumer non-cyclicals, this has been one of the better performing sectors year to date, and valuations remain attractive.

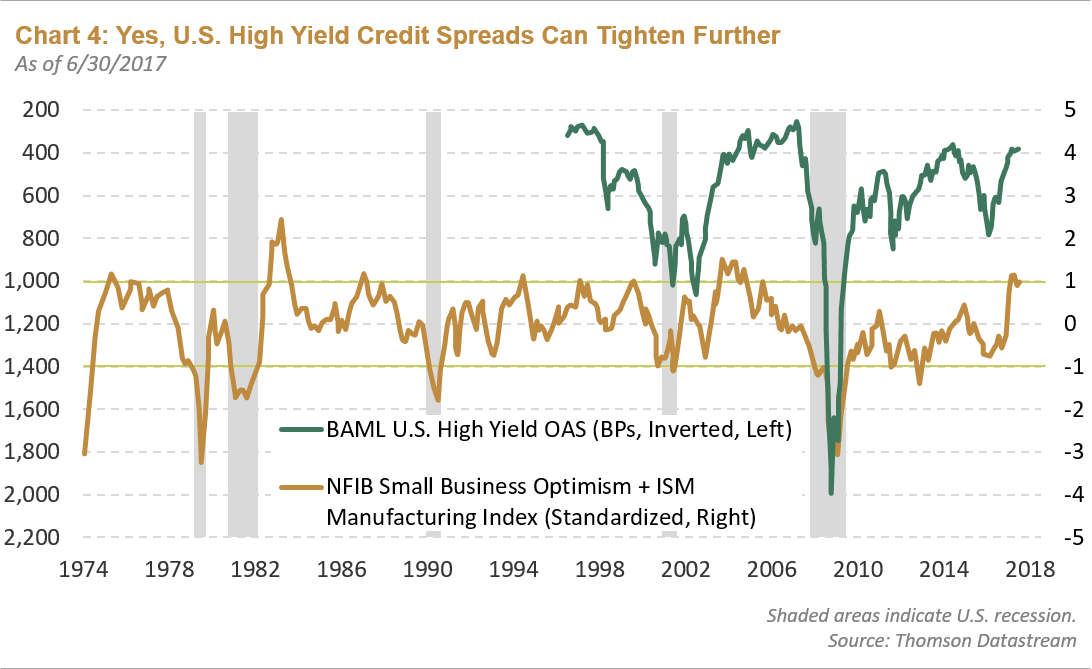

Can U.S. high yield spreads tighten further?

We have been here before. When analyzing business condition surveys, which incorporate small business optimism and manufacturing index data, credit spreads in the U. S. have the potential to tighten further. In fact, based on past historical relationships, credit spreads can tighten an additional 30-70bps from today’s level. Given low nominal sovereign yields in developed market economies, earning 5-year Treasury yields plus another 370bps—roughly 5.50%—with potential for a further 1.5 to 3 points of incremental total return looks compelling given the risks.

Constructive but Careful in U.S. High Yield

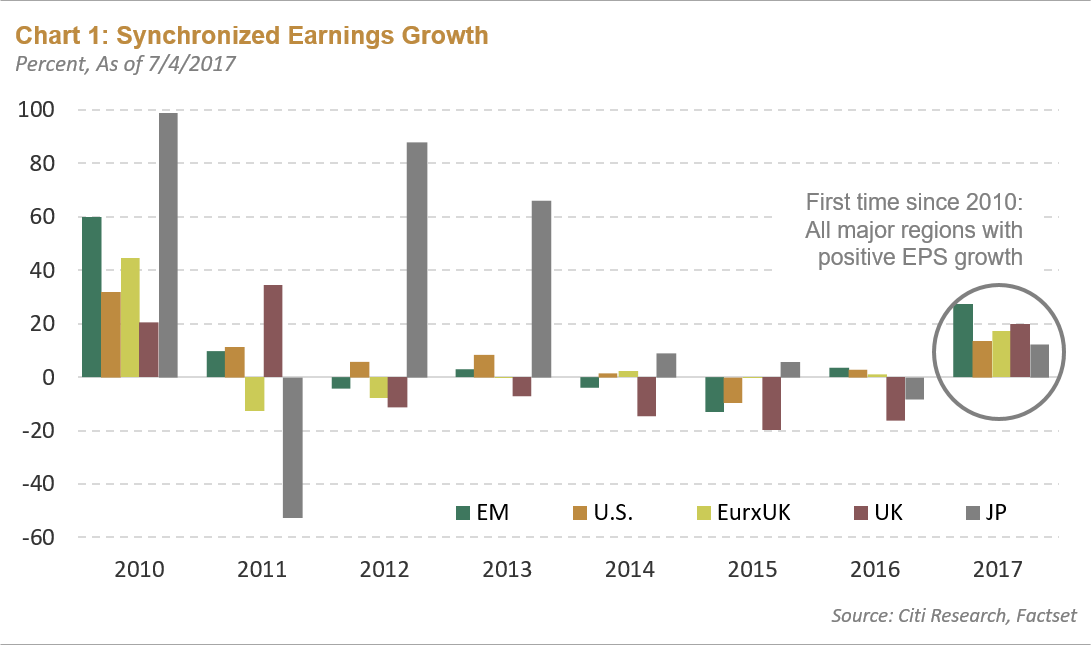

We believe high yield investors must be prudent given current valuations. Credit spreads have recovered since the mid-2014 to early 2016 oil price correction. Broad macroeconomic data is now stronger, while regional earnings show signs of synchronized growth. Yet, developed market central banks wish to change their overly accommodative policy stance, and are hopeful that the proverbial punchbowl—gradually higher short-term interest rates, and eventually a smaller monetary base—can be removed without upsetting continued steady growth in developed market economies. Given the developed market monetary policy risks and global high yield sector potential rewards, we think global high yield investors are best served by keeping allocations focused on the U.S.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF