In light of the market's weak performance, these are the most common questions we have been asked:

- Is there still opportunity in the high yield market?

- What are our default expectations?

- What are the main market risks for the new year?

While the global high yield market looks relatively cheap, we believe investors need to answer the questions above in order to find pockets of opportunity in this market that may offer value, strong fundamentals, and the potential for risk-adjusted returns.

Is There Still Opportunity in the High Yield Market?

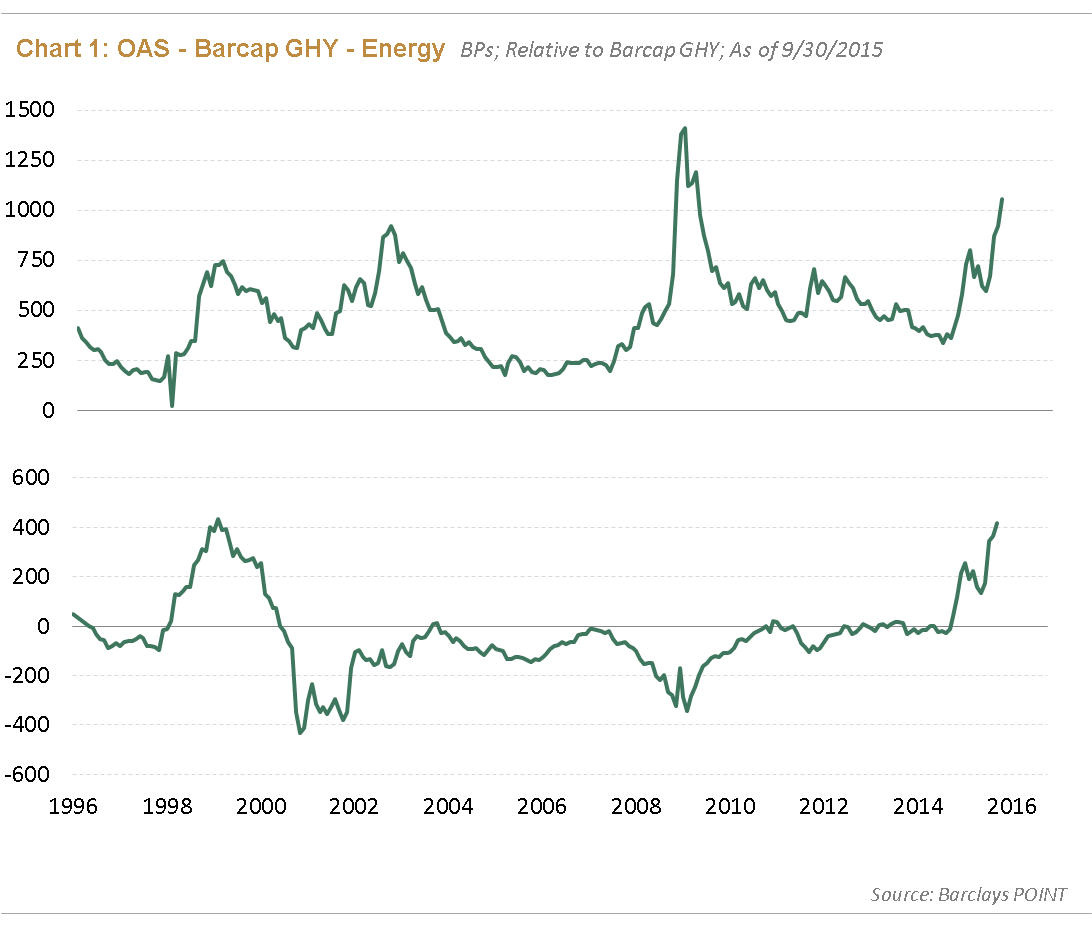

September was a very challenging period for risk assets as it marked the fourth consecutive month of negative returns for the global high yield market. Much of the pain was centered around cyclical and commodity sectors. For example, spread widening in the energy sector accelerated during the quarter (see Chart 1) due to investor fear of an additional slowdown in global growth, uncertainty over central bank actions, and concerns of solvency among levered issuers—particularly if commodity prices remain at these lower levels.

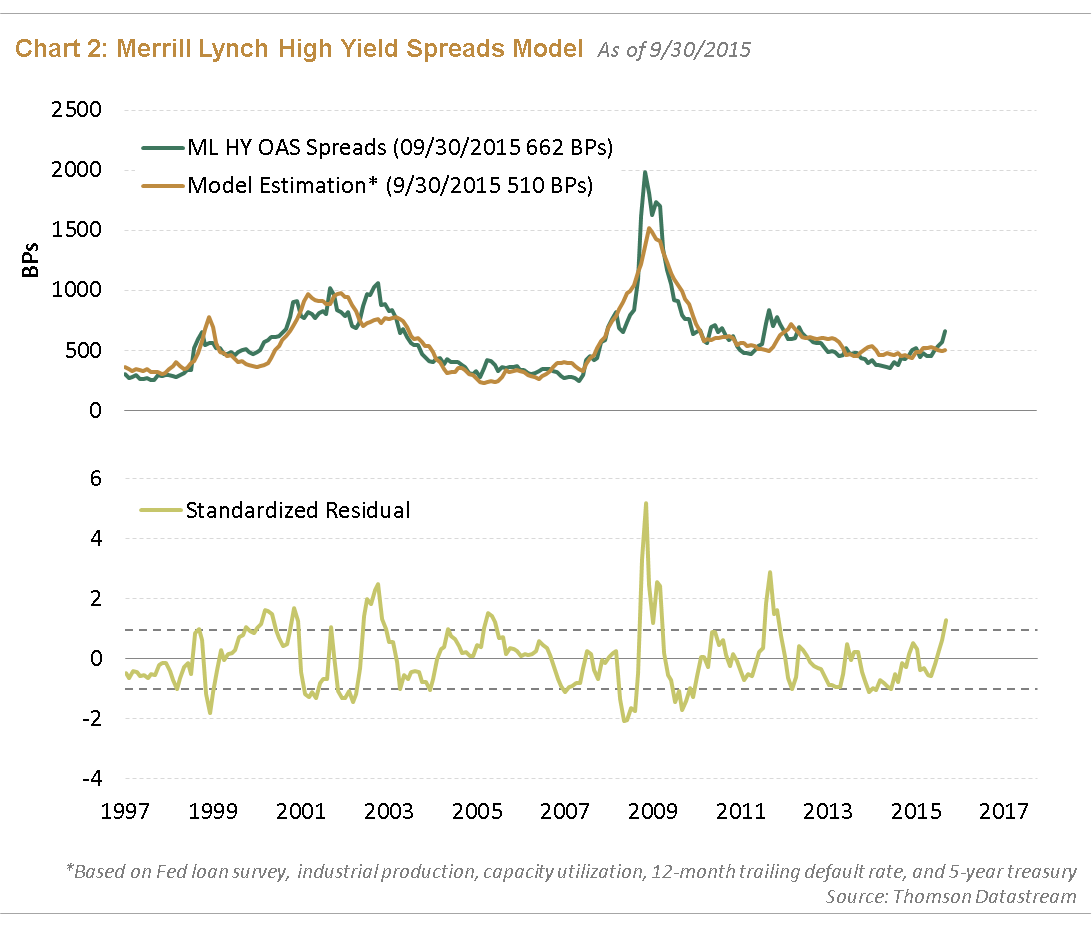

The U.S. high yield market has relatively more exposure to the energy sector than other global high yield markets given the surge in U.S. upstream production and the related services and infrastructure needed to support the boom. Given the U.S. market's exposure to energy and relative maturity in the credit cycle, the U.S. high yield market looks to be one standard deviation from fair value based on our internal valuation models, as shown in Chart 2.

We are starting to see repricing occur across many sectors globally, and believe that single B and BB-rated European issuers and select U.S. non-cyclical credits may offer pockets of opportunity in this environment. We believe that European issuers offer value given the European Central Bank's (ECB's) expansionary monetary policy which supports the euro-zone economy and also acts as a back stop for the banking sector. The credit cycle in Europe also lags the U.S. by several years, with earnings trends and credit ratios still improving. With more idiosyncratic global credit events occurring and an increasing number of fallen angels—issuers that were once rated investment grade and have since received a credit-rating downgrade—investors should continue to do their credit work and be very selective going forward.

What are our default expectations?

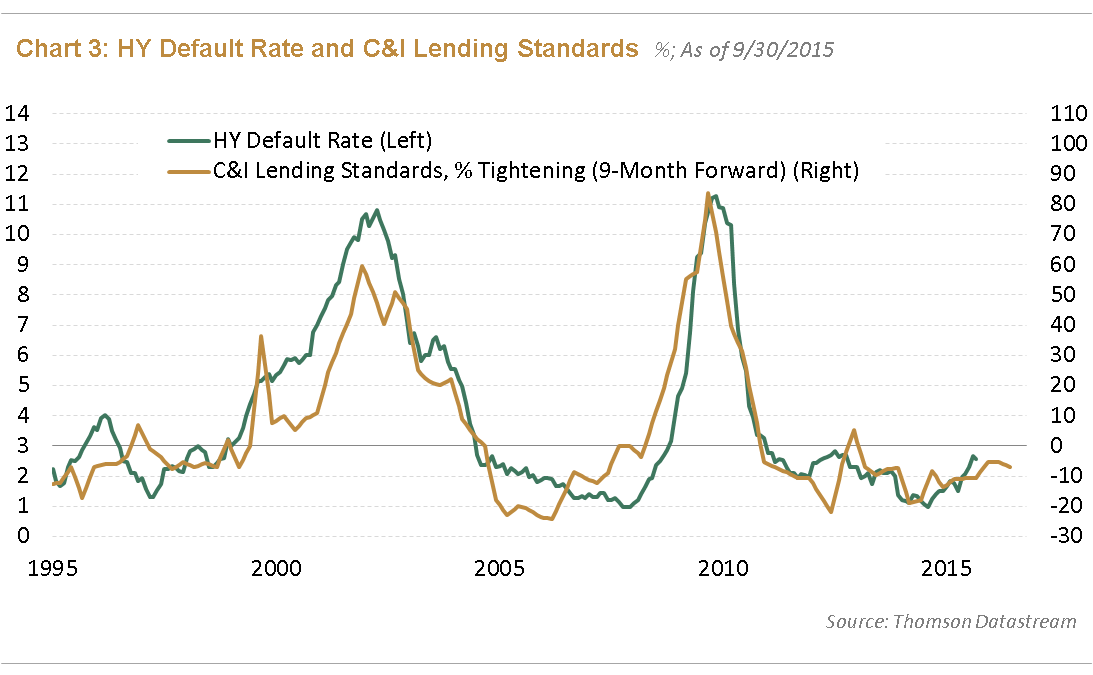

One of the biggest historical drivers of high yield risk premia and default rates is the lending conditions for small-to-medium sized enterprises. Chart 3 shows the 9-months forward U.S. commercial and industrial standard lending conditions and the U.S. high yield default rates for the past 20 years. In our opinion, the tightening of lending standards has been a good leading indicator of default rates.

Default rates on average should still remain at the lower-bound historical ranges through next year, with U.S. lending conditions still relatively accomodative and policymakers across Europe and emerging markets endeavoring to improve lending conditions to small- and midsize- enterprises. However, there will be certain sectors with higher default rates such as energy and metals and mining.

What are the main market risks for the new year?

Volatility has increased this past year and macroeconomic concerns have put a dent in global investor confidence. These are the main concerns we believe may continue to weigh on spreads:

- Potential policy mistakes from both developed- and emerging-market central banks.

- Much of the uncertainty has been focused on the divergence in central bank policy actions. The Federal Reserve (Fed) and Bank of England have been heading toward renormalization while their decisions remain "data dependent." The concern here is whether these central banks will tighten too quickly. On the other hand, the ECB, Bank of Japan, and the People's Bank of China are increasing their reflationary efforts to combat lower inflation expectations and slower global growth. President Draghi and the ECB have shown their willingness to act, however, concerns lie ahead as to whether the ECB and other central banks facing low inflation and growth may not act aggressively enough when necessary.

- A worse-than-expected growth slowdown in China and the rest of emerging markets.

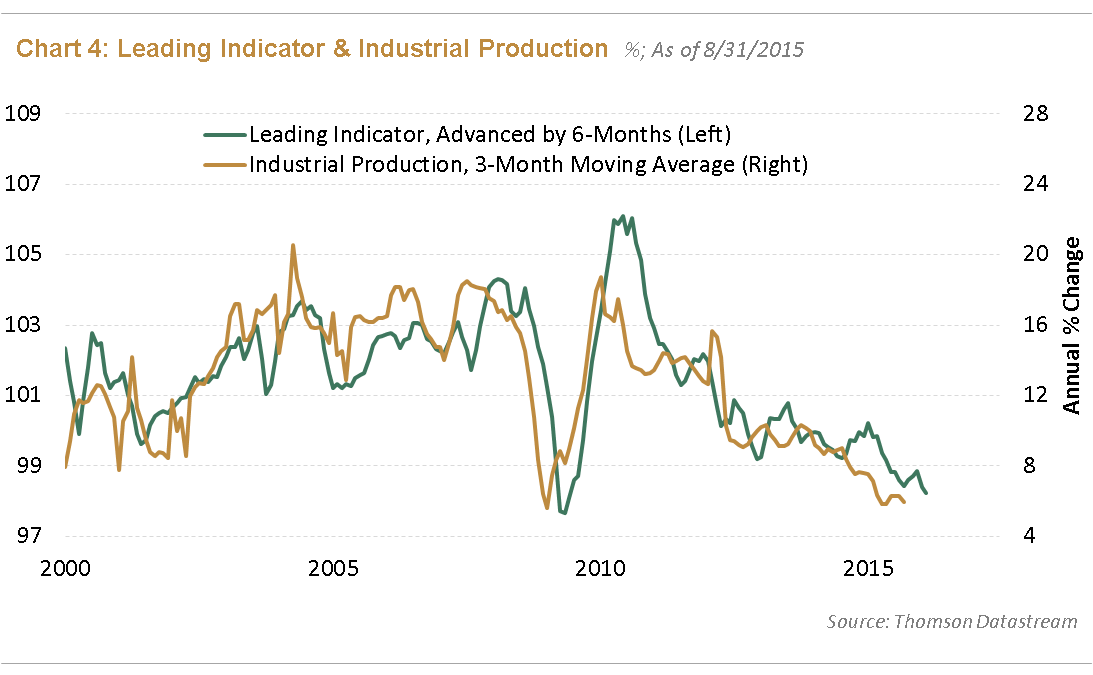

- China is undergoing a structural change from a manufacturing, capital-intensive economy to a more balanced, consumer-driven open economy (read our blog post related to this topic), a transition that will take many, many years. The combination of an overvalued currency and persistently high real-lending rates over the last five years have had a very strong tightening effect on the overall economy. Chinese officials still have a number of tools available to implement this transition. The manufacturing picture is challenging while the consumer data remains quite resilient. This transition will be a long road ahead so investors need to buckle up for some bumps along the way (see Chart 4).

- Is a U.S. recession closer than we think?

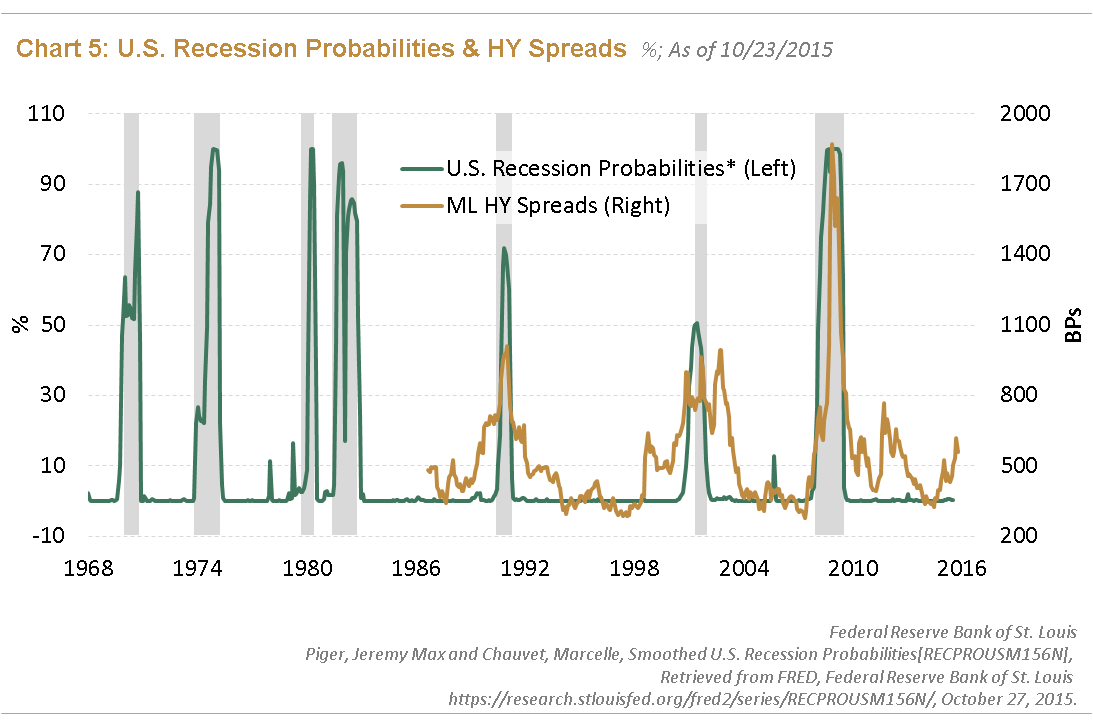

- While the U.S. economy has come a long way since the Global Financial Crisis, corporate profits over the past three years have been trending downward. The widening of both BBB and high yield spreads since the summer of 2014 point to some worrying signals ahead (see Chart 5).

- Both the strong U.S. dollar and external deflationary factors have affected the domestic economy. The U.S. credit cycle is comparatively more advanced, with corporate leverage continually rising and the share of issuance being used for purposes other than refinancing also rising.

Based on U.S. lending conditions, the latest corporate earnings, and the relative stability of consumer indicators, widening U.S credit spreads over the past year are more reflective of lax credit standards and an uptick in defaults; however, lending conditions still remain accommodative and remain the primary driver of high yield risk premia. As stated earlier, we believe the advanced stages of the U.S. credit cycle, along with prolonged weakness in the energy and metals and mining sectors, will make it difficult for investors to uncover opportunites that offer value and that are also supported by strong underlying fundamentals. Therefore, regions that are in earlier phases of the credit cycle and also exhibit signs of economy recovery—such as Europe—may offer pockets of opportunity looking ahead to 2016.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF