The broader industry faces both cyclical and structural headwinds, which makes the retail sector a worrying focus for investors, similar to energy in 2014-2015. Will these “problem” credits be the next driver in spiking default rates next year, along with increasing market risk premia?

Distressed Ratios and a Sector Laggard

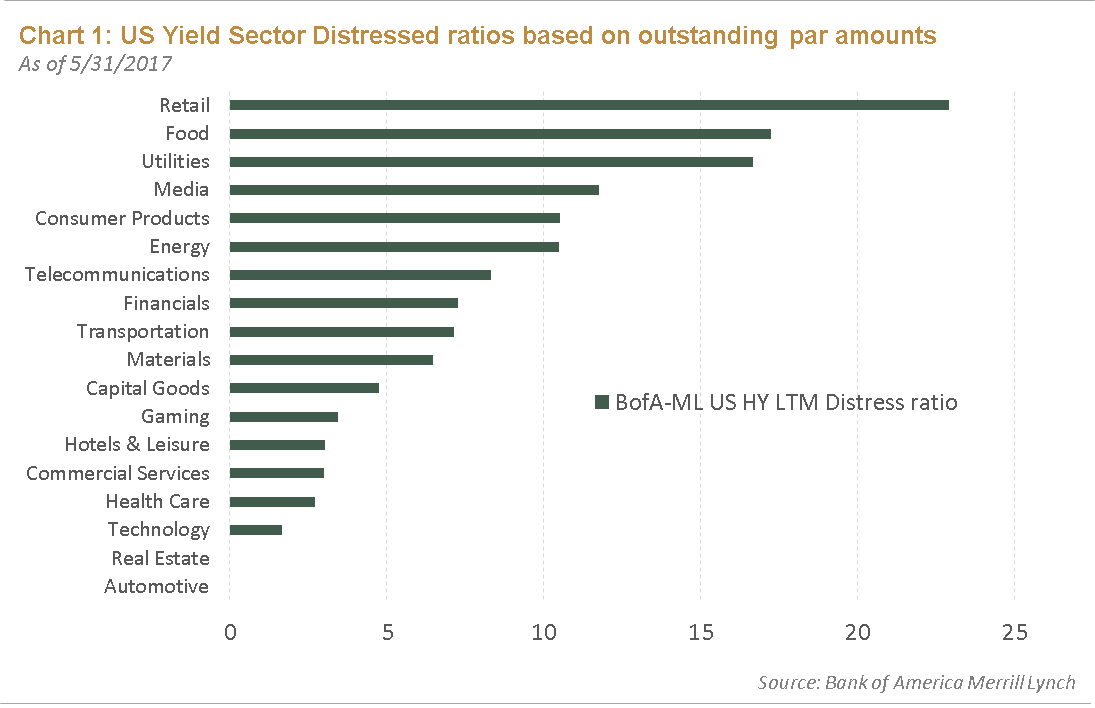

The Bank of America Merrill Lynch retail default rate has come down, although the distressed ratio remains elevated at 16.5% versus the index at 4.6%. The distressed ratio is the percentage of issues with spreads—versus U.S. Treasuries—of 1,000 basis points (bps) or more. The sector currently has the highest distressed ratio in U.S. high yield. The U.S. distressed ratio is typically seen as a precursor to defaults, because most companies that end up defaulting begin the year with their bonds trading at distressed levels. Therefore, the higher the proportion of issues in that category, the higher the percentage of all issues that will default within 12 months. Although the spectre of default isn’t necessarily comforting, senior unsecured recovery rates in the U.S. retail sector have recently jumped to 60%, after an historical average of 20%.

These metrics are potentially telling us that retail can eventually overcome cyclical headwinds, much like the energy industry did over the last few years. For example, we have seen the havoc that LBOs and high leverage ratios wreaked upon the energy industry—TXU ring a bell? Investors speculated about TXU’s default for months—if not years—worried that its default would bring the energy industry and U.S. high yield credit market to its knees. The market ended up taking TXU’s default in stride, although another cyclical headwind, excess inventories and plummeting crude prices, widened energy spreads considerably. The global energy industry has continued to grapple with lower crude prices, but many large producers have adjusted forecasts and business models to account for cheaper oil. Instead of redeploying the cash they’ve been hoarding on their balance sheets toward capital expenditures and exploration and production, these large producers have been able to sort through the detritus left by the MLPs destroyed by cheap oil, and take what they want at fire sale prices. The point here is that the energy industry adapted its forecasting and business models to address cyclical and structural issues. Retailers must do the same.

The Amazon Problem: Disruption and Change in Purchasing Behavior

The reason most retailers miss their earnings estimates is usually because of one of these standard excuses: bad weather, fashion mishap, overaggressive promotional activity, higher input costs, or IT inventory delays. But now, there is the Amazon effect. The e-commerce giant has transformed the way people view, choose, buy and return products and services. Consumers want to compare all options online, and want them delivered to their doorstep almost immediately! Retail is essentially a microcosm of globalization—technology’s proliferation in the flow of goods and capital has revolutionized the industry over time. Today’s retail landscape looks incredibly different than it did a decade ago.

Amazon didn’t initially start out to upend an entire industry, but its growing presence serves as a bellwether for the rest of the industry: change your business model or become obsolete. Remember that at the outset, Amazon was an exchange for new and used textbooks. While Amazon has become an online behemoth, the company recognizes there are significant hurdles that it needs to overcome like delivery and overall supply chain management, and pursue expansionary opportunities in groceries and fresh foods.

Now, Amazon has an aggressive push in both the traditional brick-and-mortar and online channels with the Whole Foods transaction, the roll-out of Prime Wardrobe, and its new arrangement with Nike. Amazon even attempted to foray into the luxury market in 2015, and bid to acquire London-based Net-a-Porter in 2015, whose customers in New York, London, and Hong Kong enjoy free same-day delivery. It seems as though consumers want everything, from groceries to evening gowns, on demand.

The need for instant gratification at the click of a button has indeed vexed the industry. Traditional retail chains are struggling to meet the competitive challenge of online retail. Also, there is greater technological penetration due to the increasing household presence of artificial intelligence (AI) like Amazon’s Alexa. Forget the button, now consumers can simply ask AI to do the shopping on their behalf.

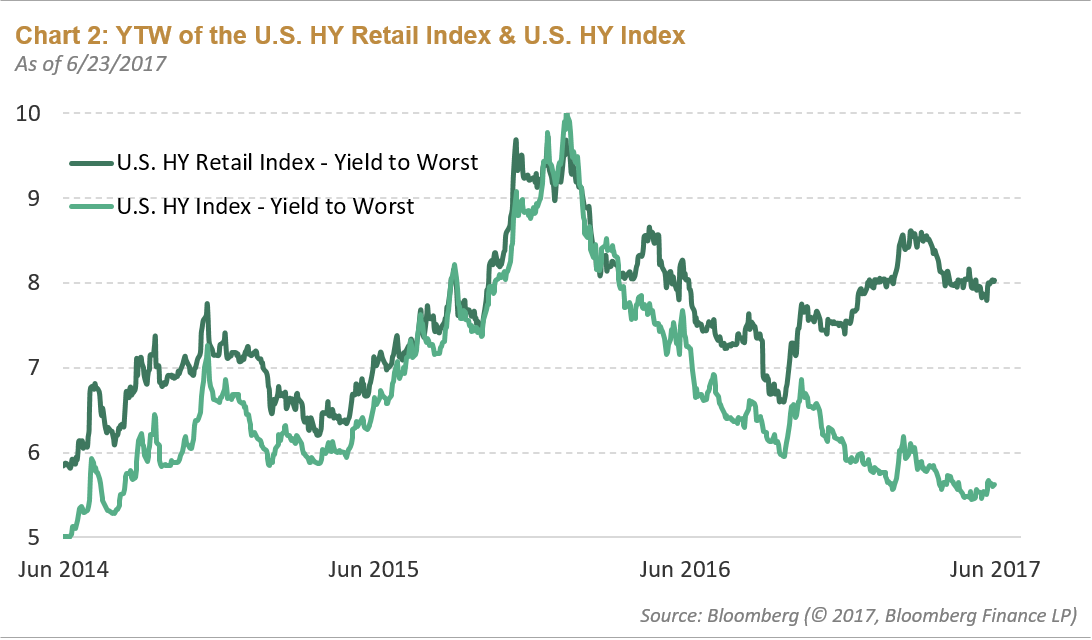

With fundamental investor concerns about declining earnings, large debt burdens, as well as structural changes affecting purchasing behavior and distribution, retail bonds have underperformed the rest of the market the past year. The average yield of U.S. retail high yield bonds is close to 8%, diverging from the broad-based rally seen in the rest of market since the end of 2015.

Opportunity or Stay Clear?

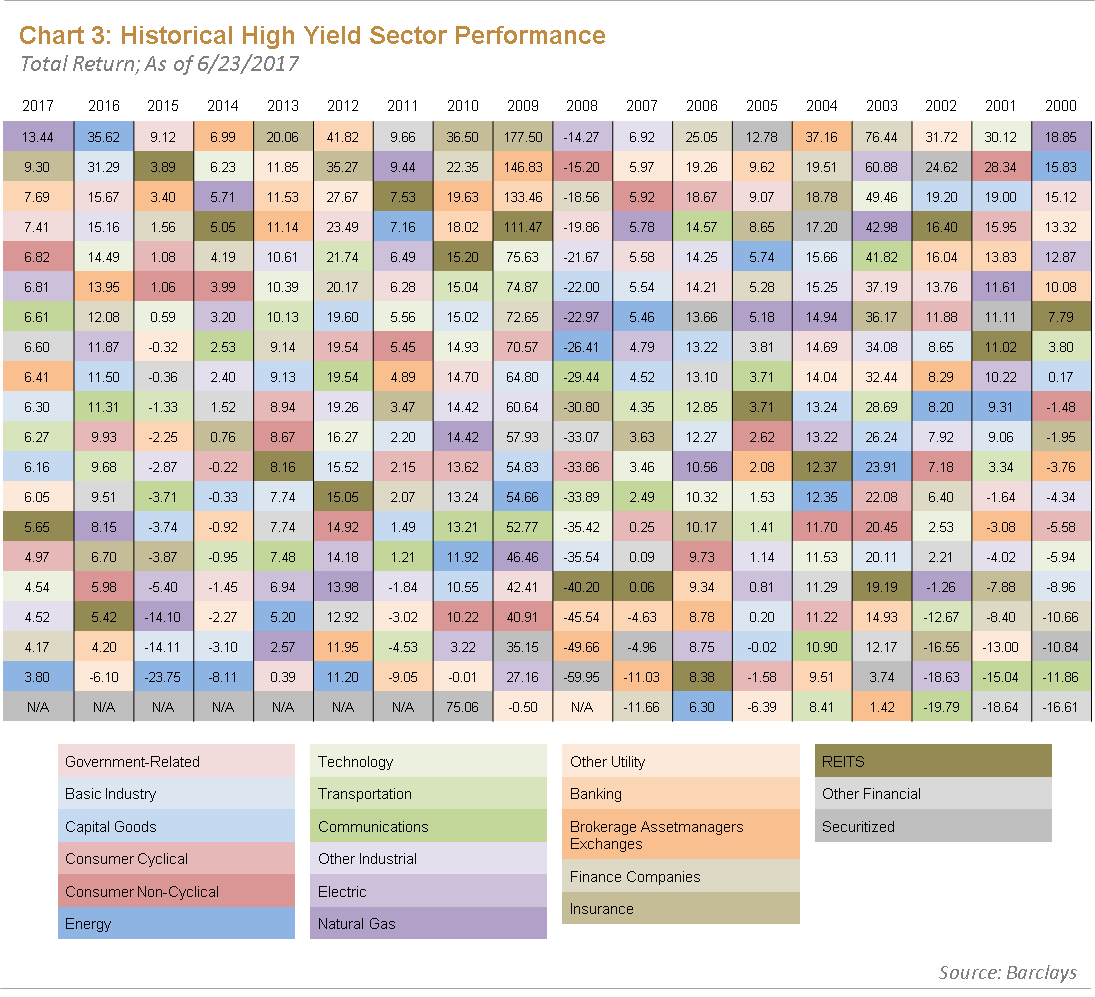

Retail has quickly become the new troubled sector driven by poor earnings and growing concerns around unsustainable capital structures and weakening competitive trends. This is a sector we have stayed clear of across our credit strategies, given our fundamental concerns and rapidly changing industry dynamics. Retail is a year-to-date laggard in 2017—barely positive at 0.38% (as of June 28, 2017), compared to the rest of the U.S. high yield market return of 4.8%. Based on historical returns, many of the worst performing sectors of a given period tend to revert to better performance after the default and restructuring process plays out, and also as valuation metrics overshoot to being oversold to more normalized levels. We see this adjustment in the below chart. As you can see both energy and basic industry were the worst performing sectors in 2014-2015, but reversed the trend in 2016.

Even at rising distressed levels, we believe retail is a sector that deserves continued caution through the year due to declining fundamentals, increasingly disruptive and competitive trends, and fewer bond-holder friendly developments such as weak covenant packages that limit recovery values. We are even seeing investment grade public companies rethinking their capital structure, with Nordstrom’s potential re-privatization and headlines around a Staples LBO. Similar to what occurred in some of the oil and gas high yield credits, companies are coming up with creative ways to shore up liquidity through different financing sources and extend maturities. In some cases, companies are transferring value away from bondholders, and other restrictive groups/subsidiaries in order to raise cash.

In order for retailers to succeed in the long-term, we believe they will need some combination of an online and a brick-and-mortar presence, the ability to control their own supply chains, and adapt to profound changes in consumer behavior. In short, we believe retailers can overcome cyclical headwinds but they must implement structural changes to survive in a rapidly changing industry. We realize consumer habits have drastically shifted in a short amount of time, but generally retailers have not recognized the importance and permanence of these changes—they are not trends but an actual paradigm shift. The pervasive sale signs in storefronts or emails flooding our inboxes not only signal an ailing industry, but highlight the disconnect between retailers and the consumer. Discounts and promotions are not a panacea for the larger problem at hand: reconciling consumer behavior with unsustainable levels of corporate debt and flagging and even negative earnings.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF