The Tale of the Tape

The risk coming into the election was always a hung Parliament and that raised the spectre of a Labour-led government. Yet, the Conservative mantra ("Get Brexit Done") largely won over a Brexit-weary public. Johnson's Conservative Party made sizeable gains in traditional Labour strongholds, especially in the North and the Midlands. These were constituencies that had voted Leave on June 23, 2016. Overall, Johnson's majority was the largest Tory win since Margaret Thatcher's due to those Labour switchers. As the press noted, even former Labour Prime Minister Tony Blair's Sedgefield seat fell to the Tories. So sweeping was Johnson's victory that pundits openly speculated whether or not he has forged a new voting coalition a la Donald Trump in the US. This remains to be determined.

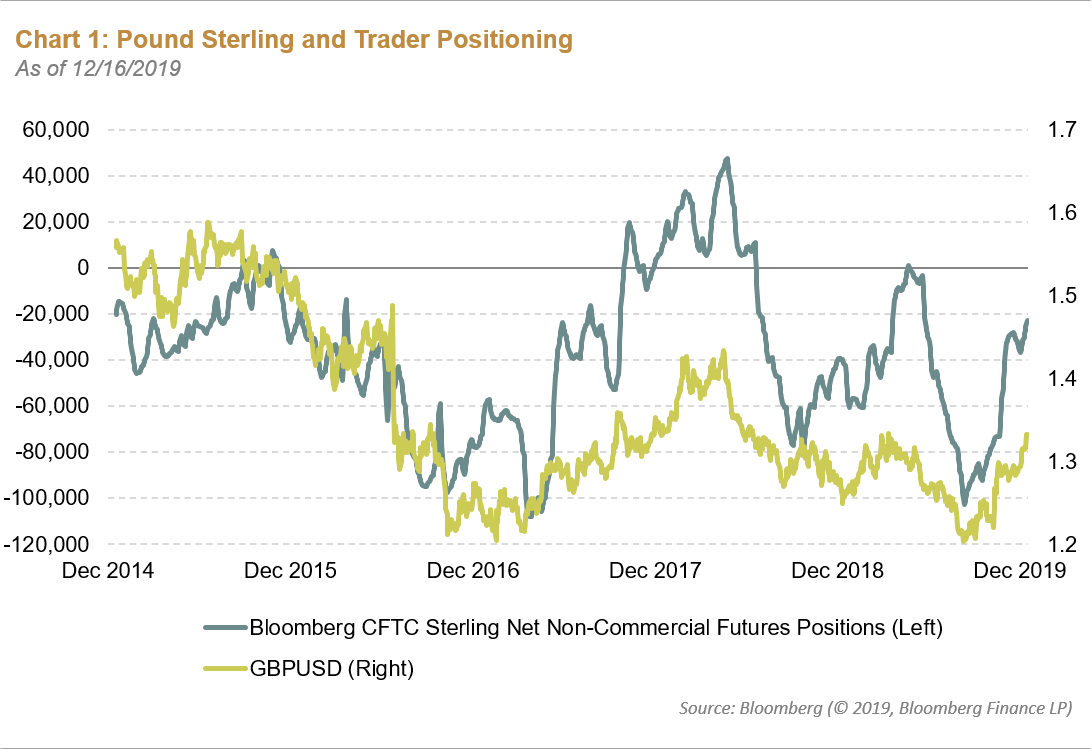

Financial markets had been "forecasting" a Tory victory, as investors increasingly gained confidence of a Johnson victory and with it the prospect of reduced economic uncertainty. The sterling-sensitive FTSE 100 is 17% higher from its late summer low, in spite of an appreciating pound. Likewise, the FTSE 250, an index compromised of domestic companies, posted a 17% gain in local currency with many of these companies benefitting from the rejection of the Labour Party's nationalization agenda. Utility stocks, for example, surged, as did water companies, each Labour Party targets. Not surprisingly gilt yields are moving higher, as risk aversion ebbs. Traders have been covering pound short positions, giving sterling a boost. Positive election day exit polls briefly pushed sterling to $1.35. Some period of price consolidation should be expected in these markets, as investors ponder what's next.

Pound Sterling and Trader Positioning

- What's next? The Queen's speech will open the Parliament this week. Members will vote on the Prime Minister's withdrawal bill, which is expected to take place by January 31, 2020. That gives the government 1 year to negotiate the UK's future trading relationship with the European Union (EU). The agreement allows for a 1-or 2-year extension of the deadline, something that Boris Johnson campaigned against. The PM is said to be striving for a Canada-type trade deal, achieved by the end of 2020. Conveniently overlooked is the Canada trade deal took 7 years! Negotiations with the EU should begin late in the first quarter of 2020;

- The sweeping victory could also produce some political headaches. The Scottish National Party (SNP) was also a big election day winner. The SNP picked up 13 seats, giving it a total of 48 seats. This win will raise the volume of SNP party head and First Minister of Scotland Nicola Sturgeon's call for a new Scottish independence referendum. Another referendum, however, will need Parliamentary approval, an unlikely outcome. Additionally, the nationalist parties in Northern Ireland gained seats. These parties support uniting Northern Ireland with the Republic of Ireland. Both Scotland and Northern Ireland voted to remain in the EU in the Brexit referendum; and,

- What about the economy? Clearly, after 3 years, the elections have reduced, but not eliminated, risk and uncertainty. Nonetheless, the Tory election and the expected approval of the withdrawal bill should allow businesses and consumers to breath a sign of relief. As part of the Conservative Party manifesto some additional government spending has been proposed, following years of Tory-driven fiscal restraint to reduce a bulging budget deficit following the Great Financial Crisis (GFC). This spending will focus on healthcare, education, taxes, and a higher minimum wage, marking a shift away from Margaret Thatcher's brand of conservatism.

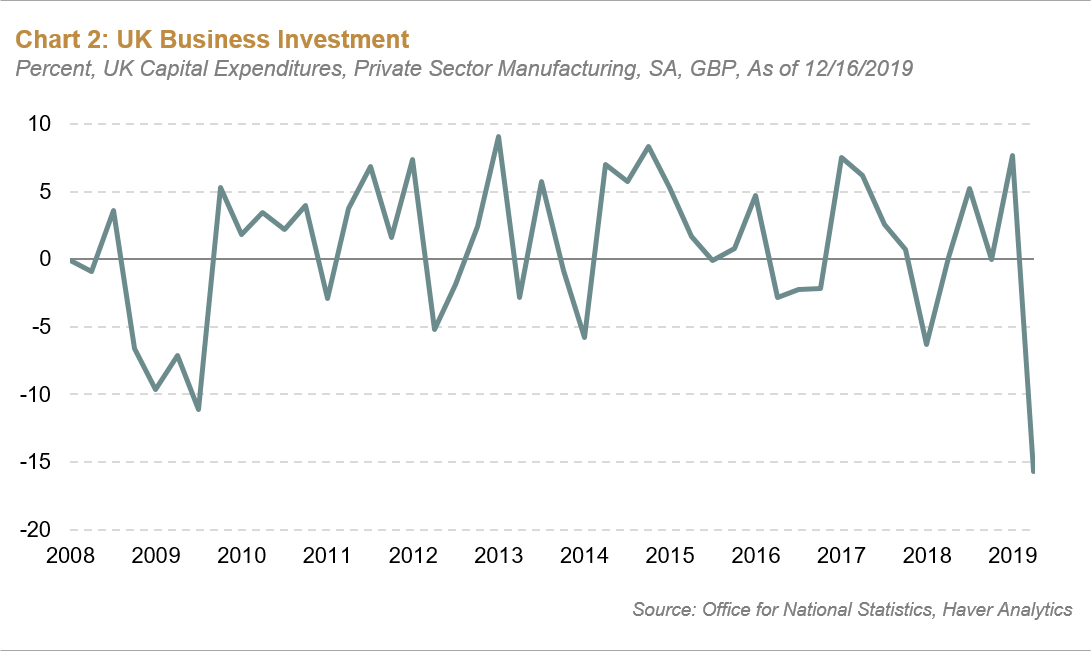

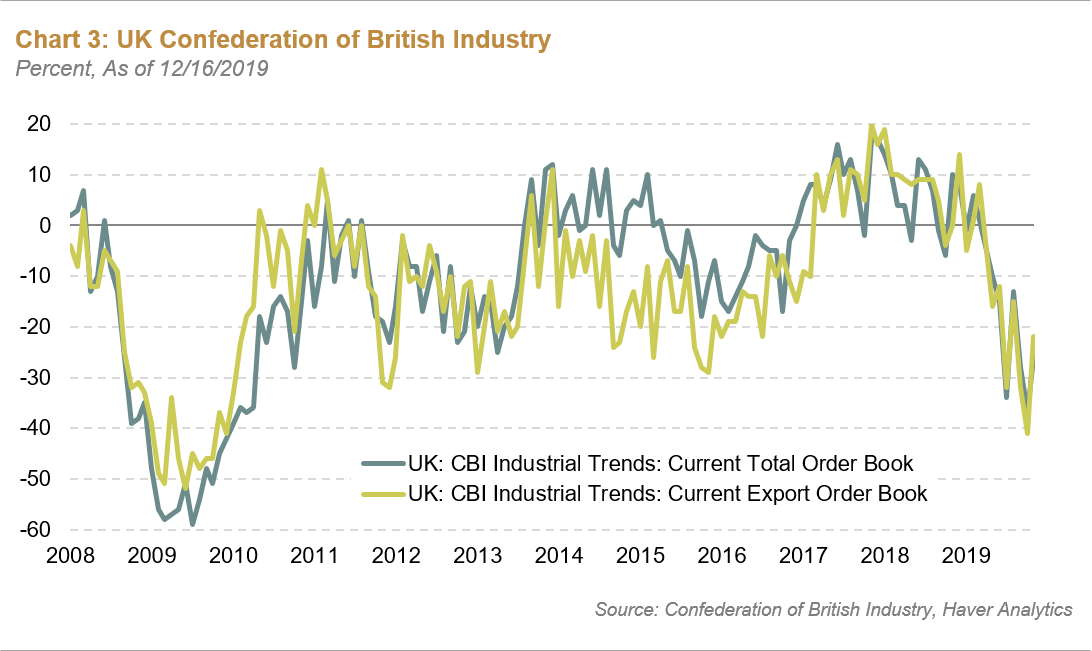

The economy is showing signs of the wear and tear over Brexit. Business investment has plunged, as businesses have been unwilling to implement long-term plans. Likewise, according to the Confederation of British Industry, both total and export orders plunged, but could be showing a slower deterioration. Both the lack of movement on Brexit and the generalized global economic slowdown have affected these trends. The prospect of moving forward on Brexit and eventually establishing the future trading relationship with the EU should improve business confidence. Whether or not that releases a torrent of investment remains to be seen, given the many still moving parts in Brexit. The economy should recover slowly, with fiscal policy adding to domestic demand and the Bank of England standing ready to ease policy, if necessary. The strength of sterling should dampen inflation and pave the way for a cut in the policy rate.

Conclusions

Investors breathed a collective sigh of relief with the UK's election outcome, at least by the market and currency reaction. The magnitude of PM Johnson's victory essentially gives him carte blanche to pursue his vision of the UK's future. Still questions remain, like whether or not Johnson and the Tories have re-drawn the UK electoral map or will the Labour switchers be a brief marriage of convenience on Brexit. Further, strong gains by nationalists in Scotland and Northern Ireland could complicate the political process in the UK. Nonetheless, the heavy lifting does start now. The expectation of a UK/EU trade deal by the end of 2020 is unrealistic and an extension request seems to be the likely course. But the close trading relationship between the UK and EU argues establishing the new rules of the trade game will benefit both. The enormity of the task means more time will be needed, since areas like agriculture, manufacturing, security, and services must be resolved. Yet, Brexit is now a certainty and even that will be a relief for businesses. This saga though is not over yet.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF