Introduction

The mighty U.S. dollar (USD) has left a myriad of currencies weak in its wake over a long period of strength. The euro is one such currency. It has depreciated nearly 9% over the past four quarters. Economic growth has slowed and a recession in some countries was a risk. Trade tensions escalated. Growth forecasts were lowered and the markets jettisoned the possibility of central bank interest rate normalization in 2019 and possibly even 2020. Despite the clouds, could the euro be set to appreciate?

Fundamental Forces

What forces could drive the euro?

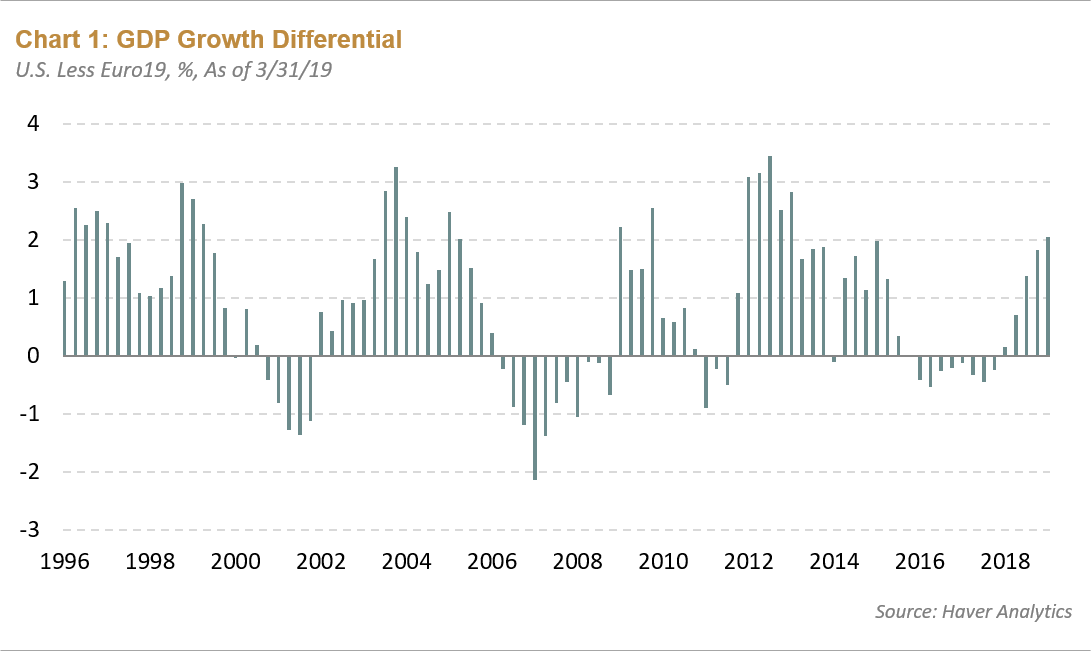

Growth differentials favor the dollar over the euro currently. We can see that in Chart 1 below, U.S. growth has throttled that of the eurozone recently. The growth differential favors the USD and, in fact, throughout the 30-year history of the euro, U.S. growth rates have eclipsed those of the 19 European Union (EU) member countries. U.S. growth should decelerate, especially as the fiscal thrust is reduced, which could possibly change the dynamics. Fiscal policy in the eurozone is expected to turn mildly positive.

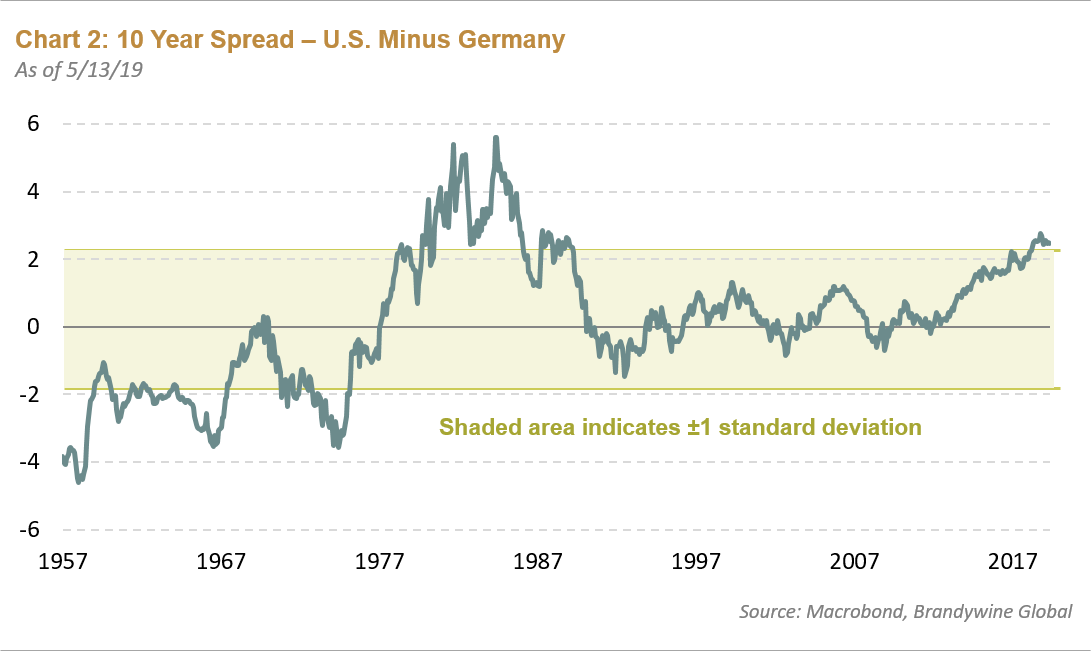

Higher domestic interest rates have been favorable for the U.S. Euro interest rates, as proxied by the German Bund, are once more negative. Chart 2 compares the U.S. 10-year note with a German Bund with the same maturity. Current rate spreads are as wide as they have been since the early 1980s, not surprisingly also a period of a strong USD. Just comparing nominal yields favors Treasuries over the Bund. Nevertheless, the cost of hedging for euro investors obviates the lure of a U.S. Treasury, causing the investor whose home currency is the euro to stay at home.

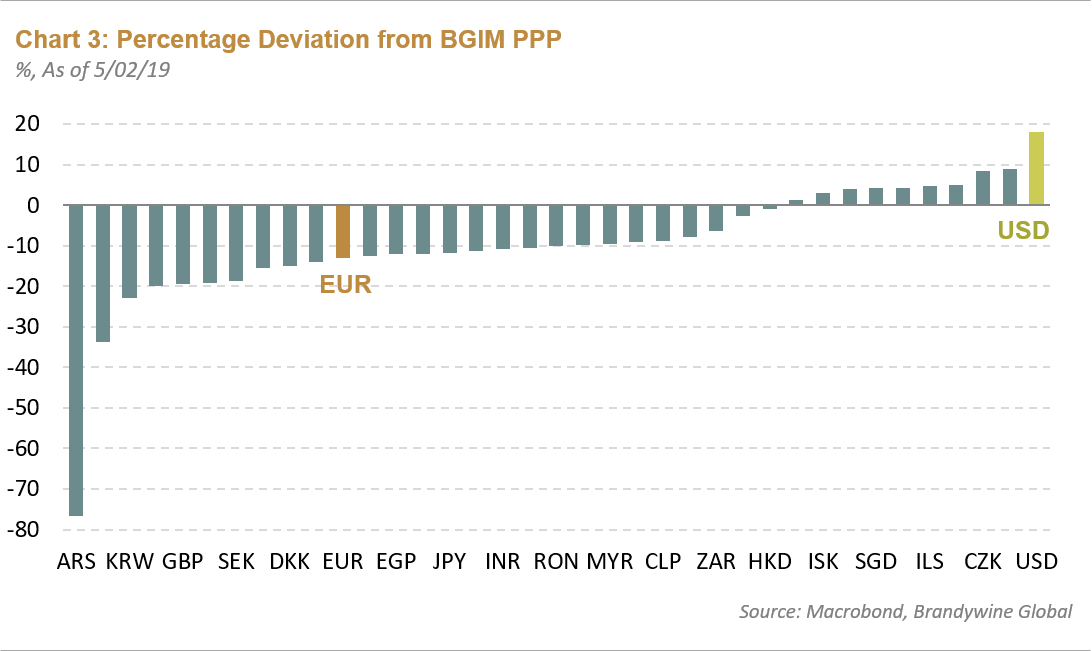

Valuation increasingly favors the euro over the dollar. Chart 3 calculates purchasing power parity (PPP) for the countries in our opportunity set. This metric basically measures inflation differentials across countries, so those that have a lower inflation rate relative to another country should see its currency appreciate against the country with the higher inflation rate. Two points should be made here:

- The euro is undervalued, with appreciation potential

- The USD is the most expensive currency in our universe

Therefore, some role reversal seems in order.

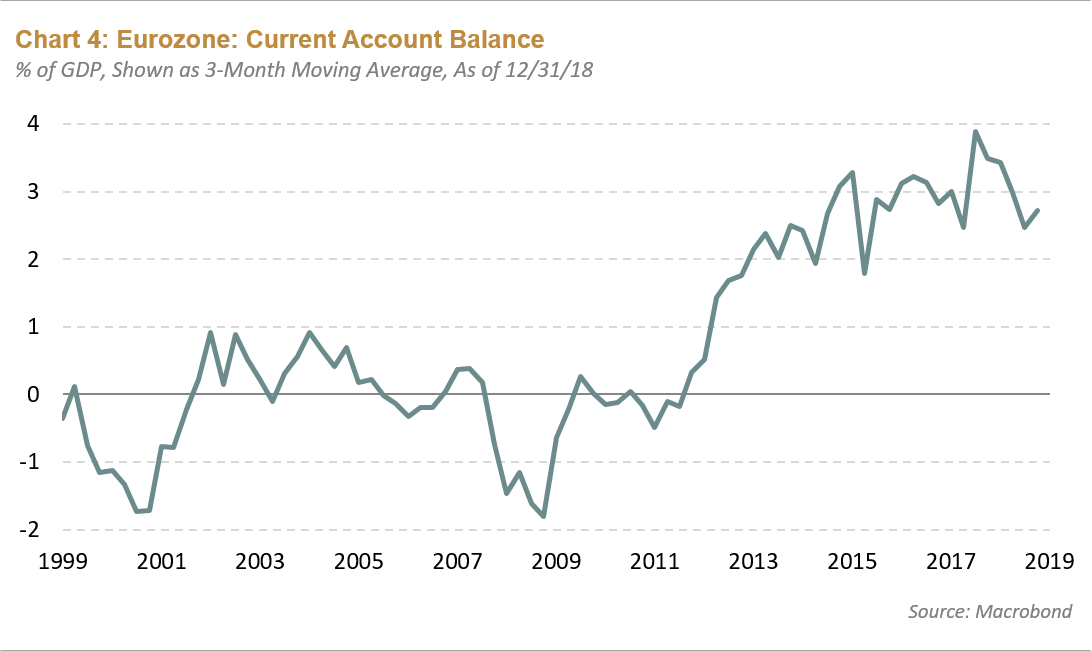

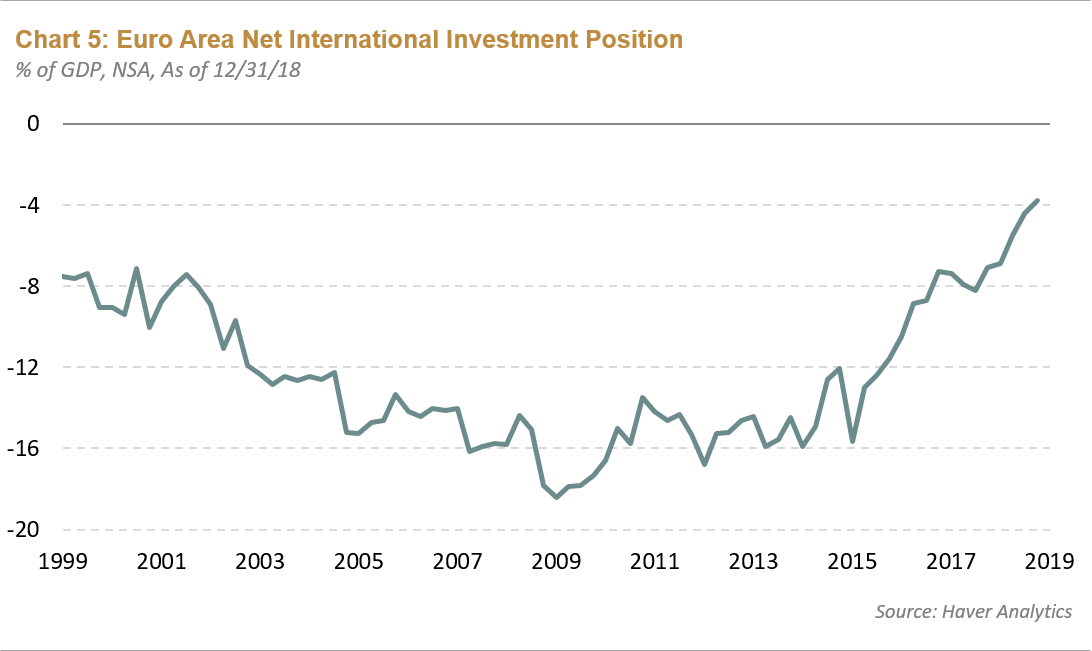

External forces could build support under the euro. The eurozone is presently running a current account surplus (Chart 4). The Euro area is saving more than it is investing. Its current account surpluses through time have resulted in an improving net international investment position (NIIP) (Chart 5), albeit a still negative position. Nonetheless, the accumulating current account surpluses will over time push the NIIP into positive territory. A primary income surplus should bolster the current account. The Euro area should become a supplier of capital to the world, as its assets exceed its liabilities and create demand for the euro. This could exert a long-term upward pull on the currency.

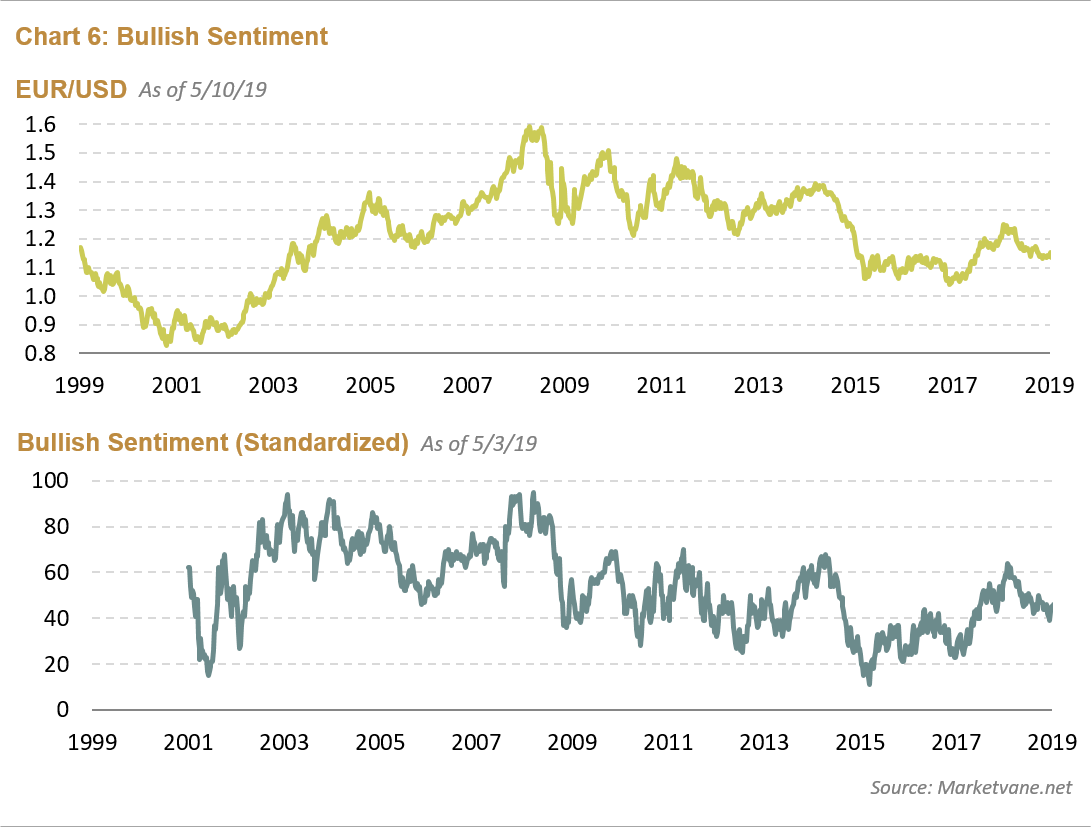

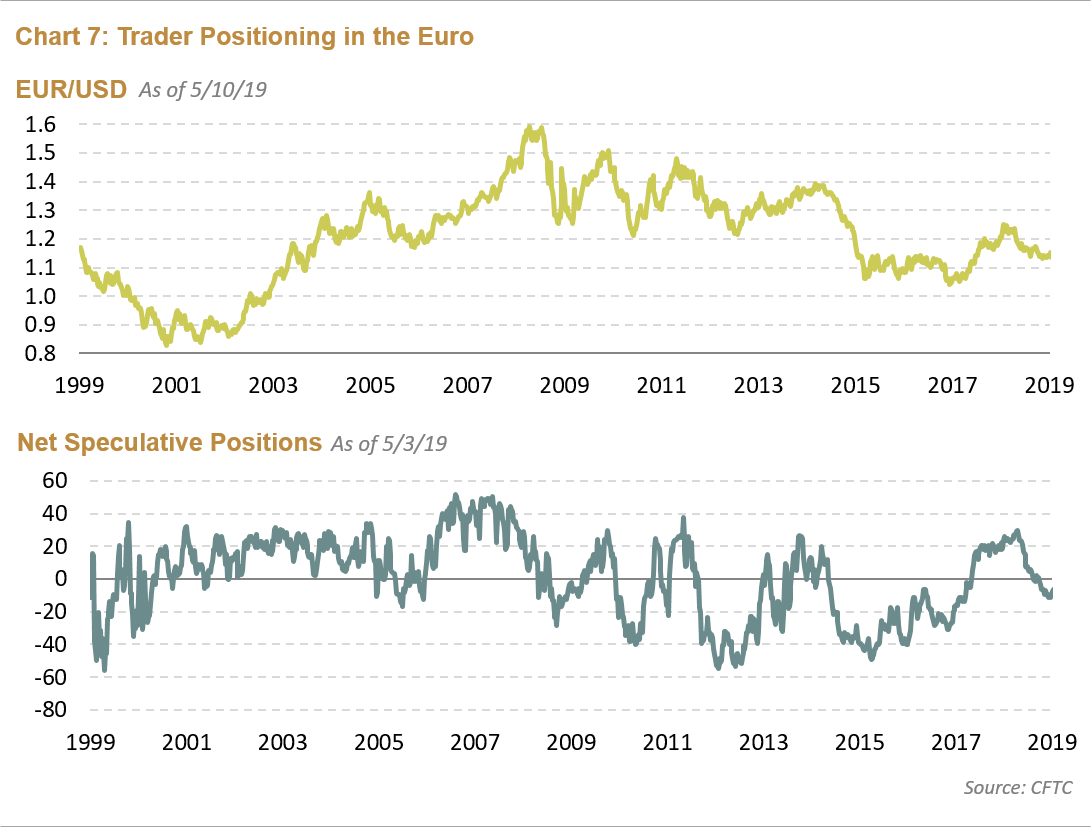

The euro may be unloved and unwanted by investors but this contrarian sentiment could be setting the currency up for a rally. Chart 6 and Chart 7 are typically taken to be contrary indicators of the direction of a currency. However, these indicators suggest a possible turn in the euro. The market’s sentiment is currently negative for the euro. That’s not a surprise given last year’s growth disappointment and the prospects of European Central Bank (ECB) rate hikes pushed further into the future. The other chart shows how traders have positioned their euro exposure. Traders are “short” the euro, meaning they are net sellers, adding an element of downward pressure. These two indicators could be harkening a possible reversal. Any move positively in the euro could help sentiment adjust and traders that are short would in many cases be forced to cover those shorts, giving the currency positive momentum. Catalysts for such a reversal could be better growth, inflation moving to target, or a less dovish central bank.

Conclusions

The euro, like many currencies, has been lapped by a strong USD. Forces, though, could be coalescing to change this also ran status. Some forces may be cyclical, while others are structural. The European economy could be set to pick up from last year’s disappointing growth. First quarter growth posted a 0.4% gain, with Germany expected to grow in line with the rest of the eurozone; that could mark a manufacturing improvement, subject, of course, to the China-U.S. trade negotiations and the threat of tariffs on German cars. Nonetheless, financial conditions in the eurozone remain accommodative. The interest rate differential could compress, as U.S. rates drop and eurozone rates increase should risk-off behavior dissipate. Additionally, the continuation of current account surpluses could create a demand for the euro, as the bloc, over time, becomes a supplier of credit—in other words, a net creditor. Finally, the amount of negative sentiment could just be building to a turning point for the euro.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF