Like Europe, Japan has been growing above trend and was up 1% during the second quarter, earning it the top spot among the Group of Seven developed economies for that period. This level of growth was anomalous considering that second quarter growth alone was close to Japan’s average annual growth since 2010. Even more anomalous was the nature of the expansion. Japan typically rides the ebb and flow of the global economic cycle via the trade channel, with exports driving marginal changes in its growth profile. But the second quarter gross domestic product (GDP) snapshot was a portrait of an economy firing on all cylinders, including final domestic demand.

So is this growth a flash in the pan or a whiff of something different coming out of Japan?

It is easy to be skeptical given the physical realities of Japan’s shrinking population. However, there are other considerations. Japan saw 28 million visitors from abroad in June (seasonally adjusted and at annual rates), a figure representing 22% of its population. This influx has increased over 150% in only three years, and the government is hoping and planning for much more tourism in the years ahead. Technically, money spent by tourists and visitors should be recorded as an export but could easily be misreported as domestic demand.

Additionally, nominal capital spending accelerated to over 6% in the second quarter, year over year. This figure is in line with the reality that firms need to invest in automation in order to overcome the shortage of labor created by a shrinking population.

Money growth and bank lending are expanding smartly, profit growth is up, price inflation for corporate goods is climbing, and employment is expanding at roughly a 1% growth rate due to an increased participation rate, notwithstanding the contraction in the population.

Even wage growth is beginning to stir. The job offers-to-applicants ratio has been above the previous cyclical peak since 2014. Different measures of employee compensation tell different stories, but nominal compensation per employee in Japan is rising at roughly a 1% annual rate, up 3.6% over the last three years. As my colleague, Richard Lawrence, discussed in his recent blog, Morgan Stanley publishes a wage trend measure that makes adjustments related to temporary workers and a host of other factors. It recently has broken out above 2%, suggesting that wage growth in Japan may be higher than previously thought.

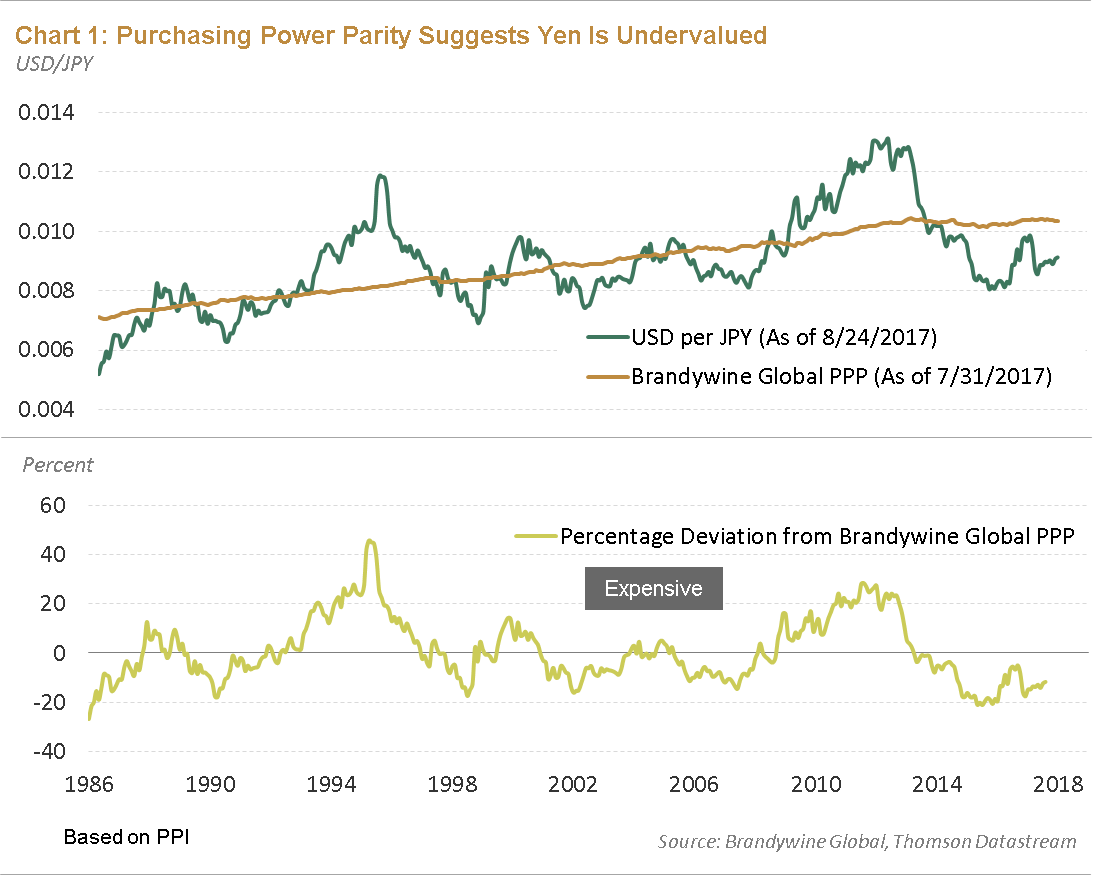

The currency market remains skeptical. The Commitment of Traders Report from the Commodity Futures Trading Commission (CFTC) shows that traders’ net speculative positions are short the yen, even after this year’s modest rally. Brandywine Global’s estimate of purchasing power parity (PPP) for the yen is below ¥100 (see Chart 1). The level of the real effective exchange rate in early 2015 was the lowest in 35 years; it has risen only slightly since then. Both measures reflect a discount in the yen to its longer-term fair value, a sign of skepticism or pessimism in either the economic outlook or currency or both.

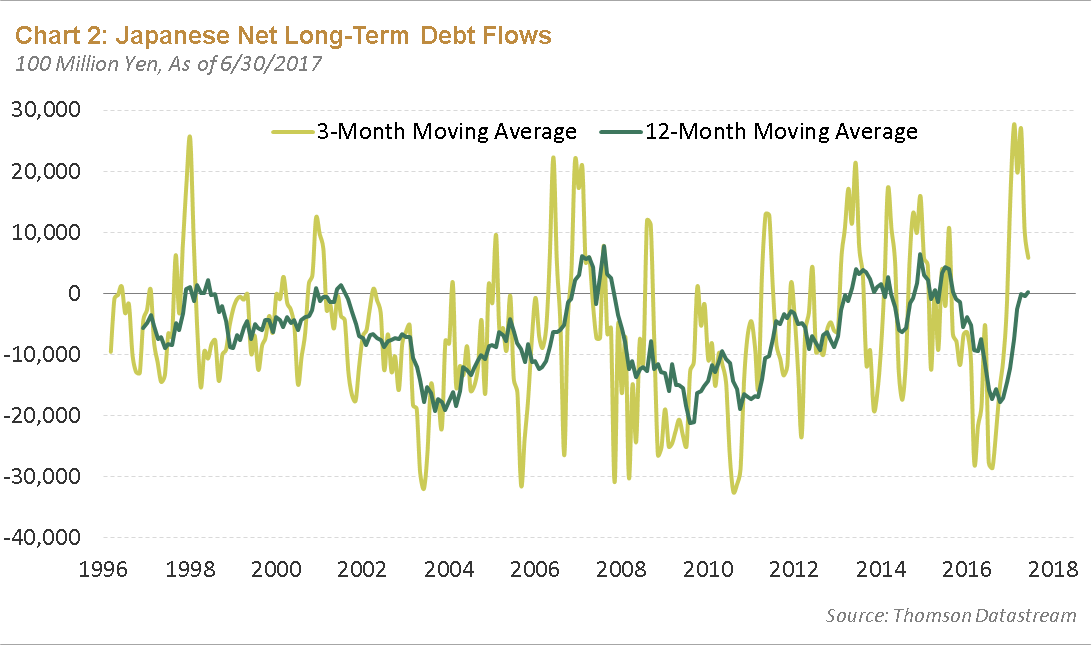

The current account also has rebounded back to nearly 4% of GDP and export growth is strong, normally positive developments for the currency. Even more supportive are some of the capital account details in Japan’s balance of payments. There have been no net outflows of portfolio capital in the last 12 months due mainly to a paucity of net fixed income flows, despite near zero bond yields and stories of Japanese retail investors looking for yield abroad (see Chart 2). The one capital account category recording strong outflows is “other investment” which is where carry trades can show up. It is possible that yen bearishness has encouraged investors in a “risk on” environment to treat the low-yielding yen as a funding currency for speculation.

Conclusion

It is easy to be negative on the yen, and its current price seems skewed towards a negative view. A shrinking population, the highest government debt-to-GDP ratio in the Organisation for Economic Cooperation and Development (OECD), and the most aggressive example of unorthodox monetary policy in the world hardly seem like the building blocks for a foundation of confidence in the country or its currency. The Bank of Japan is an investor in the equity market and its holdings of Japanese government bonds (JGBs) are approaching 100% of GDP, a figure that dwarfs comparable statistics for the Federal Reserve or European Central Bank. Sporadic but persistent episodes of North Korean missiles dropping out of the sky into the Sea of Japan do not help much either.

However, a lot of the negatives are in the price, at least for now, and investors might be ignoring some important positives. The economy could continue to make progress and sustain productivity through capital investment while the balance of payments could remain currency-supportive. There is no predetermined path for the yen that follows from the decline in the population; instead it is still a question of growth, inflation, and monetary policy. True, Japan’s stock of national debt is unsustainable. But the Bank of Japan (BOJ) has effectively neutralized nearly half of it through monetization—it likely will remain on the books of the central bank permanently—without any sign of instability. While the market seems preoccupied with the central bank’s fight to create inflation, the counter-factual might be more significant. The BOJ seems already to have successfully overcome deflation. All of these observations suggest that information risk for the yen could be tilted toward a positive surprise.

Groupthink is bad, especially at investment management firms. Brandywine Global therefore takes special care to ensure our corporate culture and investment processes support the articulation of diverse viewpoints. This blog is no different. The opinions expressed by our bloggers may sometimes challenge active positioning within one or more of our strategies. Each blogger represents one market view amongst many expressed at Brandywine Global. Although individual opinions will differ, our investment process and macro outlook will remain driven by a team approach.

Download PDF

Download PDF